What are Balanced Funds?

A balanced fund is a mutual fund that contains a stock component, a bond component and sometimes a money market component in a single portfolio according to Investopedia. Generally, these funds stick to a relatively fixed mix of stocks and bonds. Their holdings are balanced between equity and debt with their objective between growth and income. Hence, their name "balanced." These are ideal for first equity investors, as well those looking to meet their long term goals like retirement, child's education etc., but also those who do not want to expose themselves entirely to equity risk.

Let us look at an interesting example of how Balanced Funds have created wealth historically. This is only an example and not a recommendation.

Balanced Funds - The HDFC Prudence Way

A study by HDFC Mutual Fund in 2014 showed that Rs. 10,000 invested in the HDFC Prudence Fund in 1994 (now renamed HDFC Balanced Fund) had grown to Rs. 4,50,000 by 2014. From 1994-2014, the world saw many "once in a lifetime" crises and events. Pokhran nuclear tests, SARS outbreak in 2003, Dotcom Bust, 2008 Global financial crisis, UPA era scams, to name a few. However, those who remained steadfast or perhaps had forgotten about their investment prospered in the long run.

Source: www.hdfcfund.com

However, the remarkable fact in that study was was that only ~2,500 investors were able to achieve or harvest these returns. This suggests an enormous amount of "behavior gap" by investors even if by chance or design, they had invested in the correct fund. The table below will give you an idea of how short holding periods are even for mutual fund investors. Only 3% of investors remained invested after 10 years.

Source: www.hdfcfund.com

In the next section let us look at how to think about building and managing your own "balanced fund" but with Index Funds.

Asset Allocation

Ben Graham said the first decision one must make when it comes to investing, is about asset allocation. How much should you allocate to stocks, bonds, real estate, gold, etc.? This is a very important strategic choice that every individual must make depending on the following two factors. In-fact this is true for institutional investors also. A landmark 1986 study confirmed Graham's view. The study found that asset allocation accounted for 94% of the differences in total returns achieved by institutionally managed funds.

In-fact Graham also talks about Asset Allocation in his 1949 classic, The Intelligent Investor:

“We have suggested as fundamental guiding rule that the investor should never have less than 25 per cent or more than 75 percent of his funds in common stocks, with a consequent inverse range of between 75 percent and 25 percent in bonds. There is an implication here that the standard division here should be an equal one, or 50-50, between the two major investment mediums.”

Furthermore, a truly conservative investor will be satisfied with the gains shown on half his portfolio in a rising market, while in a severe decline he may derive much solace (a la Rouchefoucald[1]) from reflecting how much better off he is than many of his venturesome friends.

There are two fundamental factors which determine asset allocation.

Ability to take risk

Ability to tolerate risk

Ability to take risk depends on one's financial position. Ability to tolerate risk is a matter of preference and emotional makeup. Bogle recommends the following mix as per the stage of life:

Younger investors in the accumulation phase of their lives can look at 80/20 stock/bond mix. Older investors can be slightly conservative with a 70/30 stock/bond mix.

Investors starting the post-retirement distribution phase can consider a 60/40 stock-bond mix and later move to a 50/50 stock/bond ratio

Bogle himself at the age of 88, had a 50/50 stock/bond portfolio and used to say that he would be equally happy AND sad, whenever the market went up or down. It is all about meeting your goals with minimum regret.

In his 1993 book, "Bogle on Mutual funds", after discussing a number of asset allocation strategies, Bogle raised the possibility that "less is more". A simple (Index) balanced fund 60 per cent in broad-based equity Index Fund and 40 per cent in Index Bond Fund would offer extraordinary diversification, operate at rock bottom cost and would offer the functional equivalent of having the investor's portfolio overseen by an investment advisory firm.

The Balanced 60/40 Portfolio

After that lengthy preamble let us look at the performance of 60/40 stock/bond portfolio which comprises NIFTY Index Fund and a liquid fund.

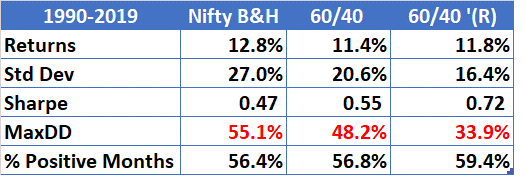

The table above shows returns from Nifty Buy and Hold from 1990 to 2019. The second column looks at a 60/40 lump-sum portfolio that starts at the same time. This portfolio is not rebalanced. The third column shows the same 60/40 portfolio, which rebalanced YEARLY only if the weights have drifted by more than 5%. If the 60/40 ratio has moved to 70/30, then it sells equity and buys debt. If the ratio has moved to 55/45, then it sells debt and buys equity.

The returns of the 60/40 unbalanced portfolio are lower by 1% almost annually. It also, however, cuts down the risk measured in terms of standard deviation by almost 15% and if the portfolio is rebalanced then by a massive 40%. Rebalancing is a contentious issue and can be subject to parameter risk.

Now let us look at 3-year rolling returns and standard deviations so that we can take care of the starting point bias, which the above analysis may be subject to. The graph below shows that returns dispersion between Nifty B&H, an Index 60/40 portfolio and Index 60/40 portfolio, which is rebalanced every year subject to the weights drifting by more than 5%. The point that stands out is that in the last ten years, the spread between the returns has narrowed.

So have the standard deviation spreads between B&H and the 60/40 portfolios narrowed. But the positioning doesn't deviate as much as returns deviate. The 60/40 rebalanced portfolio continues to have the lowest risk, followed by the unbalanced 60/40 portfolio, followed by Nifty B&H.

You get more return per unit of risk in a rebalanced 60/40 portfolio is TLDR version if you haven't read the whole article and just glanced at the tables and graphs.

Should one rebalance?

There is no easy answer here. Fortunately, Pascal answers it for me with a different analogy. Pascal argues that a rational person should live as though God exists and seek to believe in God. If God does not actually exist, such a person will have only a finite loss (some pleasures, luxury, etc.), whereas he stands to receive infinite gains (as represented by eternity in Heaven) and avoid infinite losses (an eternity in Hell).

So, Pascal's Wager[2] it is for me. I would go with rebalancing assuming that in 30-40 year investing time period, there will be a couple of 40-50%+ drawdowns which I will not be able to sustain. If you believe you can endure such periods, please refer to the Rouchefoucald maxim above.

Prof Jeremy Seigel, professor of finance at the University of Pennsylvania's Wharton School, recently stated that the 60/40 portfolio will not cut it anymore and 75/25 is the new 60/40. You can read it here. Rick Ferri, a well known Boglehead and RIA, however, disagrees with him and says "However, increasing to 75-25 as Siegel suggests could cause a happy 60-40 investor to capitulate during a bear market, which would cause more harm than good."

But that remains to be seen. We believe in India, a 60/40 portfolio is an excellent starting point for a majority of investors. If after 5-10 years, having seen a cycle or two, they can think about increasing the equity weight.

Balanced Funds Landscape

However, if you are not a DIY investor, and want to outsource the asset allocation and rebalancing there are many balanced funds now called Hybrid Funds, which will do the asset allocation and rebalancing on your behalf. The advantage is that the behavior gap gets bridged and there are no taxes on rebalancing. The disadvantage is the higher costs (you can make your own balanced fund at 15-20 bps whereas the average balanced fund will cost you 100 bps even if you invest in a direct plan) and asset allocation decision lies with the fund manager. We looked at the Aggressive Hybrid Category (direct plans) where the fund manager can allocate up to 80% to equities. There is a fair amount of dispersion even in 3-year annualized returns across 50 funds as shown in the graph below. Therefore picking the correct fund here will also be a challenge.

This brings me to the next decision. How to pick a fund? Picking the top-performing fund of the season. Spoiler alert: It doesn't work. Because of mean reversion, a top-performing fund, reverts and falls in the next few years. Below is a table from the same HDFC Fund study I mentioned above:

Source: www.hdfcfund.com

The solution is to go for a 2nd quartile fund which delivers steady returns or build your own 60/40 portfolio, with an index fund and a liquid fund. I wonder why there aren't any balanced funds, which only invest in Index and Liquid funds. I guess fees have something to do with it.

Two Key Decisions

To summarize, there are essentially two key decisions that as an investor, one must make about asset allocation:

Asset Allocation: The allocation between stocks and bonds. This depends on your goal, life stage, risk ability and risk tolerance.

Rebalancing: Maintain a fixed ratio between stocks and bonds or one that varies with market returns. Bogle believes that the fixed ratio or periodically rebalanced portfolio is a prudent decision for most investors as it limits risk, even though the unbalanced portfolio may provide higher returns in the long run.

It's not too complicated to invest in an index and a liquid fund and keep rebalancing it. The challenge is to keep doing it year after year, with all the noise around you. A systematic rules-based system is essential for this. In a future article, we will go into more detail on picking balanced funds, index funds, liquid funds, rebalancing and other related issues.

References

[1] Reference to the maxim, "We all have strength enough to endure the misfortunes of others."

[2] Pascal's wager is an argument in philosophy presented by the seventeenth-century French philosopher, mathematician and physicist, Blaise Pascal (1623–1662). It posits that humans bet with their lives that God either exists or does not.

🙏 Thank you for reading this issue of Indexheads. You can keep the conversation going on the Indexheads Facebook group.

The goal of Indexheads is to spread the virtues of low-cost investing. We publish this newsletter just to create awareness about the merits of index funds. If you liked reading this issue, can we ask you to share this around? If yes, please click 👇 the share button.

And we’d also like to thank every single one of readers for all the love and support. PS, here’s a tweet that made our day :)