Core and Satellite Approach to Investing

The Hitchhiker's Guide to the Galaxy for investors. Issue #20

Anish here:

Core and Satellite approach to investing sounds like something out of The Hitchhiker's Guide to the Galaxy for investors. But it is not rocket science. Let us try and answer the question, “what do most of us want out of investing”? Do we enjoy the process of investing, or is it a means to reach our financial goals? For most of us, it is the latter. But along the way, we start playing some other game. For most investors, a streamlined, low-cost, and utilitarian portfolio is the way to go. The implicit goal of most individuals investing is to get to a corpus which leads them to independence.

The power of money is the freedom that it affords to the holder.

Before we deep dive into Core and Satellite, let us take a step back and look at a holistic wealth allocation framework from the point of view of risk buckets. We will then place Core and Satellite Investing within this framework and show you how to use it for asset allocation.

Wealth Allocation Framework

Ashvin Chabra, head of Jim Simons’ family office and the Father of Goal-based investing, wrote a seminal paper on the overall asset allocation framework and how to view other assets like home, primary business, seed investment in startups etc. Chabra calls this the “Wealth Allocation Framework” which is underpinned by risk allocation or allocating an asset in three different risk buckets based on personal risk assessment. And this exercise should preclude the selection of assets and fund managers. The big point here is that there is no free lunch - Assets that provide safety from market falls will not have high return potential and vice versa. The three risk buckets are

Personal Risk - will have assets that limit the loss of wealth but will probably yield below-market returns. E.g. cash, annuities, insurance, primary home and human capital

Market Risk - will have assets that provide risk-adjusted market returns in line with modern portfolio theory. Mostly all conventional equity investments will fall under this category. Fixed income investments that carry interest rate and credit risk also belong here.

Aspirational Risk - will have assets that will yield above market but will carry a much higher risk of capital loss. E.g. venture capital, early-stage “angel investments”, family-owned business (if they form a significant portion of networth). In addition to this ESOPs, hedge funds, leveraged real estate would also fall under this risk buck.

(Source: Ashvin B. Chhabra)

Asset Allocation

Having defined the risk buckets, let us focus on the middle one, i.e. market risk in more detail.

Not everyone is able to make their investing plan simple and stick to it over the long run. Having understood risk bucketing broadly let us look asset allocation in the context of “Market Risk” or the middle bucket above using a Core and Satellite approach to constructing a portfolio. Later we will see how to manage that portfolio depending on the goal that one has in mind.

Ben Graham said the first decision once must make when it comes to investing, is about Asset Allocation. Graham also talks about Asset Allocation in his 1949 classic, The Intelligent Investor:

“We have suggested as fundamental guiding rule that the investor should never have less than 25 per cent or more than 75 percent of his funds in common stocks, with a consequent inverse range of between 75 percent and 25 percent in bonds. There is an implication here that the standard division here should be an equal one, or 50-50, between the two major investment mediums.”

Core AND Satellite is an investing strategy which entails creating an efficient portfolio, i.e. maximizing your return potential for a given level of risk.

Core strategies provide exposure to asset classes like equity and debt. This is done via instruments that are broadly representative of the market, managed passively and low cost. Passive instruments tend to outperform in efficient markets or market segments like large caps in India. The top 100 stocks are well researched, and all the information and analysis are available to all at the same time. Hence it is very tough for large-cap actively managed funds to outperform low-cost passively managed large-cap index funds.

Satellite strategies have the potential to deliver higher returns from skilled active management. These may be used to try and add an additional kicker to your low-cost core. In India, most believe that there is still alpha or outperformance in midcaps and small caps because there are information asymmetry and scope for active managers to outperform by superior analysis and research. Factor funds are a good way to add active beta to your portfolio. Rule-based factor funds have a better chance of outperformance than discretionary active funds if the strategy is constructed scientifically and implemented consistently.

Using a Core and Satellite approach, investors who believe in low-cost passive instruments like index funds can benefit by allocating the majority of the investment portfolio to “Core” passive instruments and scratch the active itch for higher returns by having a “Satellite” allocation.

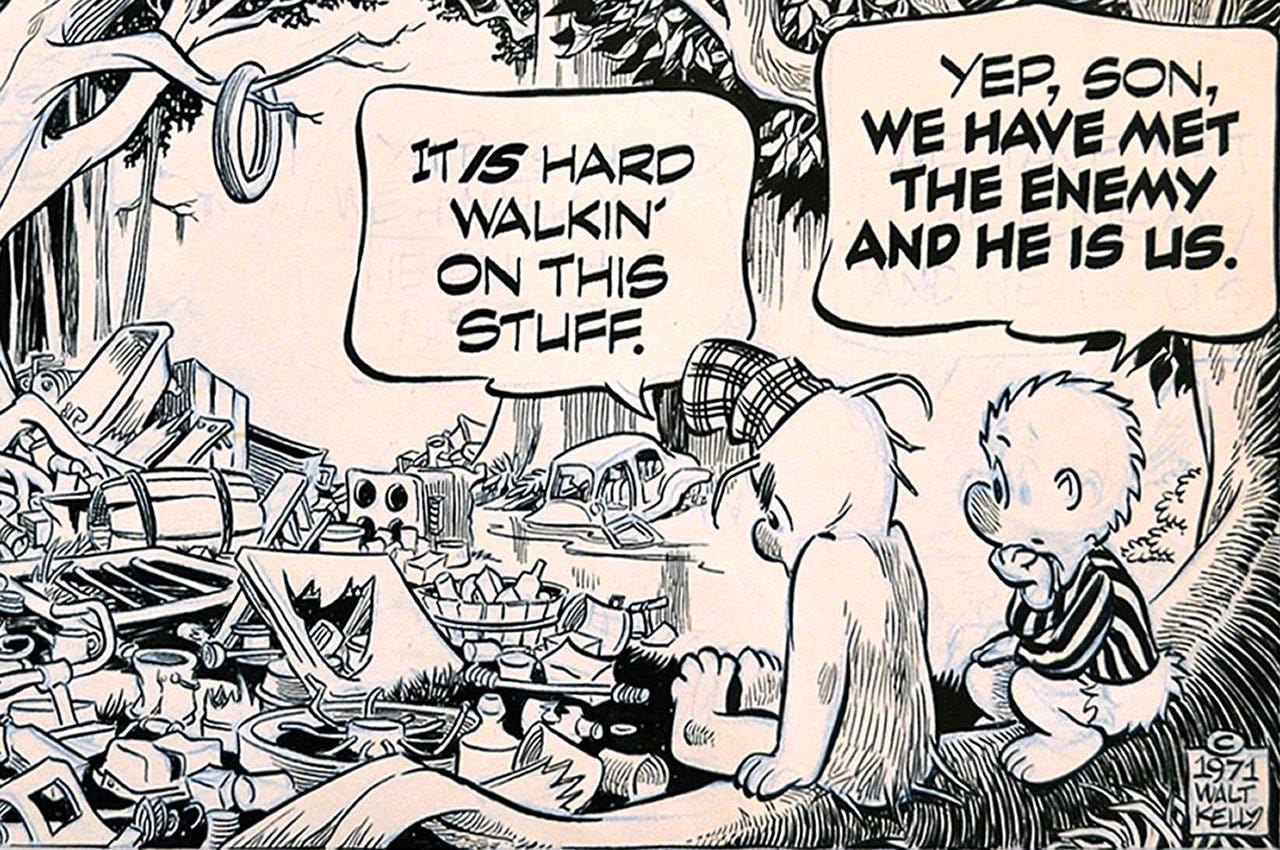

Behavioral Advantage: We may intellectually understand the merits of low-cost passive index investing, but we still want to own something that may give us the chance to outperform. Once this need is taken care of, it helps us to stick to our core passive portfolio over the long run. It basically helps you to get out of your own way.

For most investors, a passively managed core with an actively managed satellite approach will help them reach most of their investing life goals.

Passive core of low-cost diversification

Active satellite of cost-effective concentration.

The allocation between core and satellite should be done after a detailed risk profiling on various factors like Investment Goal, Horizon, Age, Risk, Income, Dependents etc.

As we reach closer to the goal one can take a glide path approach and start rebalancing the portfolio to reduce risk and preserve corpus accumulated.

Declining Equity Glide Path - A declining equity glide path is where you gradually reduce your allocation to equities as you get closer to your goal

Static Equity Glide Path - A static equity glide path would have a static allocation, such as 60% to equities and 40% to bonds

“Personal” in Personal Finance - Meet P. Kumar

Everyone’s life circumstances, risk ability, risk tolerance and experiences are different. Which is why sometimes we miss the “personal” in personal finance. Let us take an example here of a P. Kumar, a 28-year-old married techie working at a large Indian software firm in Bengaluru. His current CTC is Rs. 20 Lacs which he expects will grow at the rate of inflation over the next 30 years. He also is entitled to ESOPs in his company which is listed on the NSE. He is looking to build a retirement corpus which he will need when he reaches 55-60 yrs.

Kumar will however perhaps face his first hurdle when he reaches the age of 35 - 40 yrs. Either he would have moved up the ranks and become a team leader or he would have chosen to become a domain expert. In either case, this is an age where many tech firms cull out high-cost employees when time are bad.

The article above went on to state that “expensive roles such as senior project managers with 8-12 years of experience and not associated with any outcome-based roles are vulnerable.” So if Kumar and others of his ilk were to face a crisis like the pandemic in 2020 while they were in that age bracket they would be vulnerable to a layoff. So this is a minefield a financial planner for a techie should keep in mind while planning even his long term goals.

Now how would one broadly use the wealth allocation framework we introduced above to help Kumar?

Personal Risk: EPF, PPF, ancestral home, insurance and human capital

Market Risk: Retirement Fund invested in 60:30 ratio in Index Equity Fund and Debt Funds as a “Core” investment. This is rebalanced after review on an annual basis. A “Satellite” allocation of 10% is made to two direct mutual funds in the mid and small-cap segment.

Aspirational Risk: ESOPs allotted which will vest over 5 years. When cashed and reinvested it can be re allocated in the risk buckets above. We have deliberately not gone in too much details of the numbers as we wanted to focus on the qualitative aspects of planning.

The same plan may be different for a practicing CA or lawyer. For a medical doctor again it may be different as most start earning relatively later than other professions. It again maybe different for those in the media and show business. They have relatively lumpy income streams and therefore a different plan needs to be put in place for them.

Conclusion

We have seen above how the wealth allocation framework can be used to classify one’s investment assets. The “Core and Satellite” strategy can then be used to plan future investments depending on the investor’s goals. The graphic below summarizes the Core and Satellite strategy

[1] How I Invest My Money by Joshua Brown and Brian Portnoy

[2] Beyond Markowitz: A Comprehensive Wealth Allocation Framework for Individual Investors