Fool here

Hope you guys are locked away from the world and safe. We have a really interesting issue today. Over the past few years, the awareness about the existence of exchange traded funds (ETFs) has steadily increased, thanks to Sarkari ETFs like the CPSE ETF and Bharat 22 ETF. I’m a huge fan of ETFs and I think they are one of the most consequential financial innovations in the last century. Across the globe, ETFs have democratized low-cost access to stocks, bonds, gold, real estate and other asset classes in a transparent wrapper.

Although ETFs have grown by leaps and bounds in the developed markets like the US, they are still relatively unknown in India. We have about 70-80 odd listed ETFs, but except for about 10-15 ETFs, many don’t trade much at all. And there are also a lot of misconceptions about how ETFs work. Since we started this newsletter, plenty of people have asked us to write about the difference between ETFs and index funds and how to choose between them. Although it’s a good topic to cover, I think it would be pointless without understanding how exactly an ETF works compared to a mutual fund. I reached out to Anubhav he graciously agreed to write a detailed piece for the newsletter, much to my surprise 😃

Anubhav was involved in the creation of ETFs including the Motilal Oswal Nasdaq 100 ETF and probably knows more about the inner workings of an ETF more than anybody else I know of. Hopefully, this is just one of the many more pieces on all things ETFs. If you are absolutely new to ETFs or investing, this might seem a little intimidating, I know I was when I first tried to understand an ETF. But if you carefully and slowly read this piece, you’ll know more about ETFs then the next 100 people. So, read on and post any questions you have in the comments. I’d also like to thank Anubhav for doing this.

Anubhav Srivastava is a partner at Infinity Alternatives with over two decades in the financial services industry. Previously he was heading the Passive business at a leading asset manager and has, over the years, developed expertise in ETFs, modelling, risk management, and analytics leading to new benchmarks in innovative investment products. He was responsible for the widely successful MOSt Shares NASDAQ-100 ETF. He occasionally advises regulators on systemic risk management, in addition to regular commentary on the larger investment and ETF space.

Anubhav holds an MSc in Quantitative Finance and an MBA from IIM- A.

ETF Introduction

Since the 1995 launch of the first exchange traded fund (ETF) based on the S&P 500 Index and a Nasdaq-100 based ETF in 1999, ETFs are a financial innovation which accounts for a large chunk of volumes in global stock markets.

ETF’s may represent a basket of stocks which replicate or enhance an index such as the Nifty, BSE Midcap or the Nasdaq-100 Index. Along with diversification benefits at low cost, ETF’s may offer trading flexibility of a stock (short selling, buying on margin and purchasing single units) depending on local market regulation.

A Mutual Fund

Like a Mutual fund, all ETF’s are open-ended funds, which continuously issue/redeem units and declare a Net Asset Value (NAV) of the underlying portfolio on a periodic basis. And like a mutual fund, an ETF is managed by an Asset Management Company whose activities have the fund’s trustee’s oversight as well as supervision by the stock market regulators.

A share

But…an ETF is exactly like a share on the stock exchange. Market entities are buyers, sellers, and there are intermediaries (brokers) and an exchange where the trades take place. Unlike a share, however, fresh tradable shares of the ETF (units) can be continuously created (or redeemed) on-demand (subject to minimum volumes).

Advantage ETF

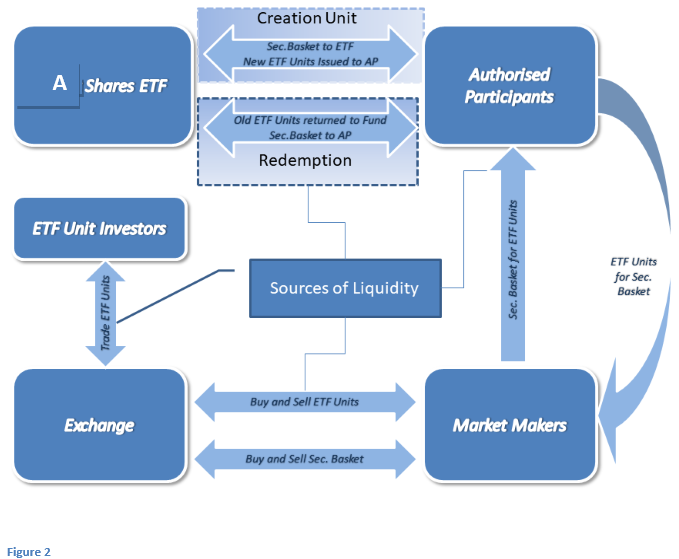

ETF’s indicative NAV (iNAV) is continuously calculated and published. While the iNAV reflects the value of the underlying stock, the price of the ETF unit reflects market’s interest based on the participant’s view of the underlying basket, providing transparency, intra-day liquidity and thereby better price discovery. E.g. difference between the NAV and the traded price, it may present an arbitrage opportunity which could lead to creation units or redemption of existing units (Figure 2).

Mechanics of ETF’s

Initial Issuance: The New Fund Offering

At the inception of the fund, the Asset Management Company seeds the fund by issuing units to both investors and Authorised Participants (APs).

Once the ETF is listed on an exchange, the interaction between the AMC, the market and market participants changes somewhat:

On listing, the issued ETF units trade on the exchange much like the shares of any other company. However, there is one significant difference, the units of the ETF can be purchased and sold on the exchange as well as with the Asset Management Company Issuing the ETF units. The latter process is akin to the subscription and redemption transaction of a Mutual Fund – however, the amounts that can be redeemed for kind (the ETF may also redeem for cash by selling, in the stock market, the basket equivalent to the redemption) are usually large amounts.

It is important to understand that in In India, no distinction is made between investors and APs and anyone can create and redeem units directly with the Asset Management Company in Creation Unit lots. This is set to change with restrictions being placed of APs and Market Makers of the recently issued PSU Fixed Maturity ETF.

Sources and Measures of Liquidity

ETF liquidity is a much-studied subject but is most often misunderstood, even though it is straight forward. However, there are two aspects which are worth mentioning, one is the sources of liquidity, and the other is the measure of liquidity.

The Myth

The first myth to dispel is that an ETF’s liquidity is its average trading volume on the stock exchange. A common assumption is that an ETF’s liquidity is determined by its trading volume, but that isn’t necessarily so. The trading volume is more of an indicator of a fund’s popularity and how much it traded in the past – not how liquid it is.

A better gauge of liquidity is to look at the hypothetical number of shares that can be traded. An underlying stock in the ETF with low trading volumes will adversely affect the liquidity irrespective of the actual traded volumes of the ETF units i.e. an in-demand ETF could be often traded and still have low liquidity as that low individual stock liquidity will limit basket creation/redemption. Conversely, a thinly traded ETF can be very liquid as the underlying stocks may be very liquid. Therefore, it can be said that the true measure of ETF liquidity is the liquidity in the underlying basket.

Liquidity Illustration

ETF Liquidity is not the average trading volume of the ETF Unit.

Let’s say that we wanted to invest in an ETF that traded over 1 million share volume per day. At first glance, we would consider it a highly liquid ETF. However, let’s assume that this ETF included five very liquid large cap stocks and one very illiquid small cap. If suddenly a large investor wanted to buy in and the ETF basket called for many shares to be created one day, the small cap stock may not trade at high enough volume to be included. This could prevent additional units of the ETF from being created in its original basket form. This example serves to illustrate a scenario where the volume traded of the ETF itself is not an issue; rather it is the thinly traded nature of the underlying stock that poses the problem.

Sources

Therefore, going back to the mechanics of the ETF - liquidity (or the ability to buy or sell) - has two sources: the creation and redemption by authorized participants and the market-making activities of broker-dealers given that all ETF units can be bought/sold (created/redeemed) from all of these three sources, notwithstanding the dark-pool that exists at the market maker/broker-dealer level. The creation, redemption of ETF units (in kind) is largely dependent on market demand for that specific exposure or temporary arbitrage opportunity (either a premium or discount).

Primary Source of ETF Liquidity is Liquidity of Constituent Stocks. Additionally, Creation and Redemption of ETF Units by authorised participants; Market Making Activities of Broker-Dealers: Darker Pools; and ETF demand affect liquidity.

An Example: A large brokerage house receives a bulk order from a client for ETF units. The brokerage, now acting as an Authorised Participant, buys the underlying basket instead of going to the market for those ETF shares. This is converted into ETF shares by the AMC, thereby infusing many shares additionally into the market.

On the reverse requirement, the same Authorised Participant could redeem the units and take delivery of the underlying basket and then smart route it to the market, thus providing an additional avenue for selling the ETF unit.

This activity has the additional advantage of aligning the price, and the NAV of the ETF as the premium/discount to the NAV is clearly visible to all market participants.

How would a financial advisor avoid paying large bid-ask spreads and advance their use of ETF’s without getting hindered with the apparent trading volumes? Using limit orders or accessing “upstairs” liquidity providers for large trades can lead to better execution.

Index Funds

Index funds have predated ETFs by several years and have been successfully running for some time. One of the reasons ETFs gained popularity as investors needed a way to trade the index without any leverage or notional exposures.

Index funds are fundamentally mutual funds where the manager’s role (much like an ETF) is to replicate an Index.

The manager takes each constituent’s representative percentages and rounds up/down to get a ready portfolio which rebalances and changes according to the fund managers wishes as well as the actions effected by the index provider.

Alternatively, the issuer (asset management company) may decide to wrap an ETF which in turn invests in the relevant index (basket of shares).

Price and currency (FX) risk in an Index fund is born by existing investors while an exiting investor can be given an exit through the cash carried by the index fund. in an index fund investors are impacted by actions of other investors in the fund. Index fund basics

However, there are a few significant challenges to running an Index fund – namely, there has to be continuous subscription and redemption for all investors. Any large movement (large number of investors or a smaller number of large investors) into the fund will impact all existing investors - conversely, in an ETF, all costs related to creation or redemption are borne by the investor creating or redeeming units.

Example: A US exposure Index Fund faces a redemption in India and pays out the monies based on standard redemption timelines – on current valuations (FX and Stock Values). The manager now needs to replenish cash by selling securities (stock) which will settle on a T+5 basis which entails equity market and FX risk, which is now borne by remaining investors.

As an Index fund must honour all redemption/subscription requests, it may carry larger amounts of cash to provide redemptions at NAV and carrying this liquidity will lead to higher tracking error.

For index funds which wrap other ETFs, the overlying fund adds an additional layer of cost. Also, as it’s investing in a traded security, the NAV of the Index Fund will be affected by any ETF premium or discount.

Conclusion

Investing in an Exchange Traded Fund, unlike a share, provides liquidity by secondary market trading as well as through the unit creation/redemption process. The former is measured by trading volumes, and the latter is virtually unlimited for creation and limited to the AUM for redemption. All these activities have the effect of matching demand and supply, thereby catering to all sizes of investor orders. Trading volumes, therefore, have little bearing on the liquidity of an ETF. So, are ETFs the go-to instrument? Well mostly. If however, there are small investors who do not have access to trading accounts or are unfamiliar with stock markets and are ok with higher cots/tracking errors, then Index funds are for them, ideally only as a basket of Index funds.

Parting thoughts

ETFs (or Index Funds should you be constrained to buy those) are merely building blocks. Selection of an ETF v/s an Index Fund is merely a step in the asset allocation process (i.e. deciding which Instrument to use). Before that, it is even more important to determine individual risk appetite, strategy execution, and thereafter managing the aforesaid portfolio. Fortunately, there are algorithmic platforms available where an investor can choose and execute such a portfolio of ETFs/Index funds. But, should the flesh and bone, emotion-driven, ‘human’ advisor go the way of the ‘active manager’?

Great effort. My one question is , if etf liquidity is determined primarily by the basket of underlying stocks a Nifty Next 50 etf must be liquid enough regardless which etf right? Some of NN50 etfs are barely traded as per data.But the basket of NN50 stocks are highly liquid. Please clarify

Great Article. Please clarify tax implications of ETF vis-a-vis index funds.