International investing

The two most important functions in Investing are

Asset Allocation

Security Selection

Market Timing (wait—you cheated. You said two. Yeah, I did, but market timing is equally important, but for those who are doing it full time. For the rest, just focus on your day job)

Within Asset Allocation, there are options like Equity, Real Estate, Commodities, Currencies, and Bonds. Now, there is no perfect portfolio. But there are guidelines and rules of thumb for asset allocation, and we have written about them here.

Today we are going to talk about Asset Location within equity. No, it’s not a misspelling. Every AMC is now launching an international fund with more flavours than your local ice cream store. So does the location matter. How much should you invest overseas? There is a documented home country bias, which is obvious given our discomfort with unfamiliarity and uncertainty. However, now with the world more connected and all that shit, and the options being available in a more convenient manner than earlier (even though a Nasdaq fund has been available since 2010), the question that everyone has is how much do I allocate to international equity.

The question before that is, do you really need international equity, and hence does the location of your asset matter. If the world is more interconnected, isn’t it more logical that even equity markets and, for that matter, other asset classes would be more connected?

Diversification

Low correlation

Invest in tech cos (FB, Amazon, Google etc.).

The last one cracks me up. All the big US pop music stars would come to India once their career in the west was on the decline. Investing in these already emerged tech companies is like watching Bryan Adams and Madonna perform in their 60s. Their time is done. And if you have the ability to invest in new and emerging tech companies in the US, you should be in the US at a VC fund. I highly doubt you will be able to do that sitting in India.

Diversification

This one is not the same as portfolio or security diversification. This is more to do with the possibility of what if your country of residence becomes Japan or Venezuela, or Russia? Then you need to invest outside the country where you live. Below is a graphic from this article by Meb Faber, which I am going to refer to quite a bit. If we look at the last 40 years, 1980s to 2010s, equal weight is never the worst performing index.

In the 90s, Japan fell about 50% and then fell another 40%. The US outperformed Equal Weight (EW) in the 90s and 2010s but underperformed in the 80s and 2000s. So no visible pattern or trend here. If one is taking a passive exposure to global markets, then best to go with an EW or ACWI (All Country World) Index.

An ACWI index will periodically rebalance and allocate higher to the market that is doing well and underweight those underperforming, as you can see in the table below from Visual Capitalist. The allocation to the US went up from 43% to 58% over the last 10 years as it outperformed.

Over the last decade, the UK’s index weighting has halved. Brexit uncertainty caused British stocks to underperform relative to other markets. In addition, the UK’s public equity marketing has been shrinking, with the number of listed companies falling by 21% in just eight years. Japan saw its weighting decline by more than two percentage points. The country has faced a very slow recovery since the asset price bubble in 1989, and the stock market has yet to surpass its previous peak. On the other hand, China’s weighting in the MSCI ACWI IMI has increased over the last 10 years." A Geographic Breakdown of the MSCI ACWI IMI Index

Correlation of US Market with India

So let me make it simple. Look at the graph below. In times of crisis, the correlation goes to 1. As Rajan Raju puts it beautifully in his paper “International Diversification: much ado about nothing?”, “It’s a bit like your umbrella vanishing when it starts to pour and reappears, magically, when the rain stops!”

In short, there is no free lunch in equity investing globally if one is looking for low correlated instruments.

Investing in emerging tech companies

If you are looking to get access to investing in tech companies that are listed, most of them have already been discovered and emerged. There are better ways to get exposure to those companies. PPFAS Flexicap is one. And if you are looking to get into companies early in their life cycle, most of the value today is created pre-IPO by VC and PE funds. So that is not going to happen.

Strategic Asset Allocation

As the table below shows, if you are allocating 10-15% globally, that is hardly going to make a difference to your returns over the long run. Here we took three combinations and looked at the last 20 odd years—a decade where the US performed and then the previous one where the US didn’t perform.

Portfolio 1: Nifty - 60%, SPY - 20% and Nasdaq - 20%

Portfolio 2: Nifty - 80%, SPY - 10% and Nasdaq - 10%

Portfolio 3: Nifty - 80%, SPY - 5% and Nasdaq - 5%

We have deliberately not taken currency impact into account. Because it can go either way. Ask those who invested in the 2000s. Purely on an equity basis over the last 20 years, the portfolio with the highest allocation (40%) to SPY and Nasdaq had the lowest returns. With no major benefit in the Sharpe ratio.

Let us look at rolling returns. In the first half (on the left side), when US equities had a lost decade due to dotcom and GFC, the portfolio with the highest weightage to US markets consistently underperformed. This is despite the fact that we started the backtest in 2000, which is post-dot-com bust low. On the right side, post-stimulus and massive continuing doses of quantitative easing (QE), US heavy portfolio outperformed, but not by much.

For the period Jan 2000 to Dec 2009, the same portfolios above had a return of 7%, 10.3% and 11.9% vs a Nifty return of 13.4%. And from Jan 2010 onwards, the portfolios above had a return of 13.9%, 12.4% and 11.6% vs a Nifty return of 10.8%. As is evident, most of the outperformance in the US equity indices have come in the last decade, and there is a heavy dose of recency bias if one is just looking at the numbers of the last ten years.

Rupee Depreciation

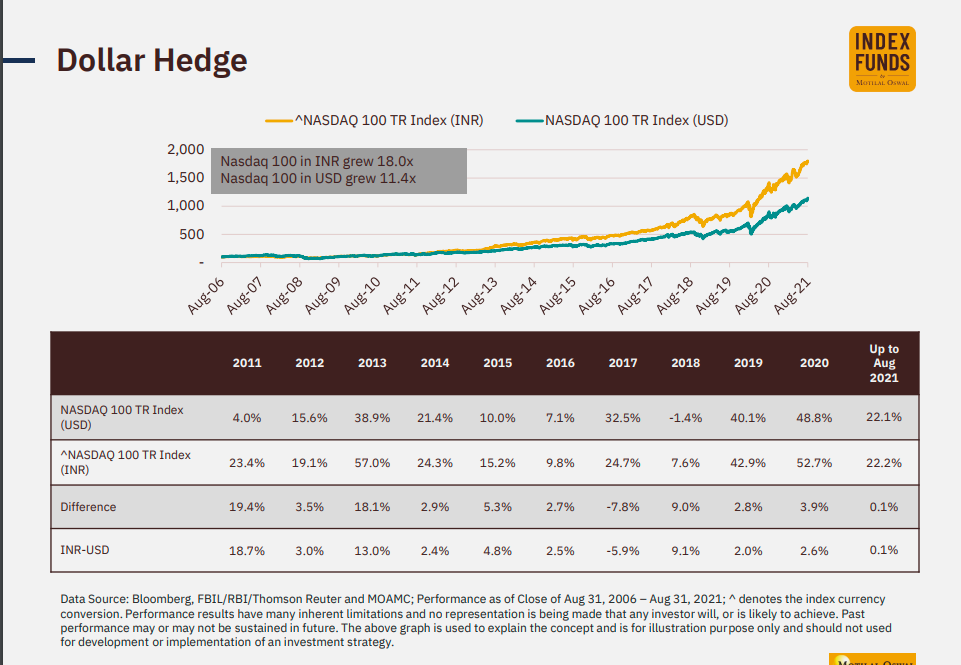

The Nasdaq has given a return of approx 17% in USD terms and 21% in INR terms over the past 15 years. In 2011, the rupee depreciated sharply by 18%, with one more sharp move in 2013 of 13%. These were the years when India was counted among the Fragile Five countries. And then came in RBI Guv, Raghuram Rajan who implemented outgoing Governor Subbarao’s policies and from Fragile Five, India moved into the Fab Four. In 2014, we got a stable govt post the terrible reign of UPA2 and since then and over the years the rupee has depreciated at an average rate of 2% p.a. Which is quite a bit. But there is a reason why the table below starts from 2011. Because before that, between 2006 and 2011, the INR had appreciated by 1% pa against the USD. Yes, that is possible.

So a bet on global equity investing in USD, essentially a bet on the USD and less on the equity instrument. And if your goals are in USD, then taking exposure in USD denominated asset makes sense. But don’t be under the impression that this was an equity bet.

Ok. If, after reading all the above, you still want to invest in a global or US fund, but as a Tactical Allocation. A fancy word for saying market timing. One can use Dual Momentum or Meb Faber’s GTAA models to time entries and exits. Or keep life simple and go with the ACWI index.

Completely off the topic of this thread if I don't want to actively search for stocks and let's say not confident ,what is the best way to invest in Indian equities and also my time horizon of deploying money is next 10 years and my investment horizon is 25 years

Which indian amc provides an etf or fund of fund that would give me exposure to acwi index