Oh Yes...to a happy ending

But will he and his savings bank account live happily ever after? Issue #9

The Yes Bank saga has taught a lot of people some painful and costly lessons. In spite of being the smartest people in the known universe, we humans have an amazing knack of consistently doing some incredibly dumb things. And yes, we need to make mistakes, because that’s how we are built to learn. But most often than not, we don’t. And when we don’t we learn some costly lessons instead of some possibly free ones. This post isn’t specifically about indexing but speaks to something even more important - our behaviour.

Rushing this special guest piece by a friend of mine, a Mr Boiling Frog, who writes of his friend and the costly lessons he learnt from the Yes Bank debacle. Read on 👇

On the day when Yes Bank was placed under a moratorium, we heard a lot of “No’s”. There was an “Oh No!” from the trader who saw the stock price volatility. Then there was “Fuck! No” from the journalist who knew that there was a problem with the bank since 2017 but still continued to bank with a positive Yes with the bank he hated the most. Then there was the “Wtf! Noo” from a company which continued to bank with Yes since the time the bank promised some delicious under the table perks 😉 only to keep his account even after the bank was named in the AQR (Asset Quality Review) two years ago.

But this is not the end. There was also the “BC! No” from the depositor and the “Gayi Bhains Paani Main! NO” from the SME guy who had a payment of Rs 5 lakh that very next day.

All these guys are smart people. They watched the news. They understood the risks and more importantly they all had heard the stories about Yes Bank since the day Urjit Patel decided to go NPA hunting and nail the sorry asses of each and every banker that came his way.

Still, most of these guys did not feel the need to change their bank. I happen to speak to this journalist whom I’ve known for a while now. He is just this average hack who was aware that something was terribly wrong with Yes Bank and one day the bank would blow up. He felt that Yes bank was taking too much risk and after getting the $1 billion capital infusion. The bank had become arrogant and was lending helter-skelter so that its existing NPAs would look smaller. The greed out there! This guy was clear that this bank would go down for sure and yet he did bank with Yes. To be fair, he did move most of the money, but all his bills and EMIs were through Yes.

Why would he do that? He told me that the whole idea of changing a bank is tedious. And considering the fact that people are generally averse to anything that deals with systems and processes, changing bank was a NO..hell No! “They should have beneficiary account portability,” he said, just like a SIM card. I own a Vodafone mobile, and I can seamlessly move to Jio without any issues. So why can’t I move my beneficiaries and bill payments seamlessly? Since I refused to do this painful task, I’m in deep trouble”, he added. I could not understand the issue. Why the fuck was he trying to solve the three-body problem when all he had to do was move to another bank?

He is not the only one; even the lord was not spared. The gods themselves banked with Yes Bank. Jagganath Temple has deposits worth Rs 545 crore with the bank. Now think about this. The gods were not spared. And today the Odisha government wants the centre to intervene and help them get the Rs 545 crore back. Why would you deposit so much money with a crisis-hit bank?

Why did corporates still bank with Yes Bank even after learning of the issues which were in the public domain?

Then I came across this guy who woke up early on Friday and went to the Yes Bank branch in BKC to get the Rs 50,000. His company had its treasury account with Yes Bank. And I was like why? Why the fuck would you want to do that to your company? He told me that it has to do with the six degrees of separation.

I was like “What?” He said, don’t you know the six degrees of separation? Rana Kapoor was the most connected banker in the corporate world. He was transactional, and he knew everybody. These connections were conscious because Rana worked with all kinds of corporates to whom he could lend at higher interest rates. He would initially lend less but not participate in a consortium as he knew that he would not get creamy deals with the promoters. In a consortium, he could not do deal-making. But as the size of his bank grew, his ability to take risks also grew. Yet, wherever he could lend on his own, he continued to do it. He was able to do this because of his connections. Similarly, he could also make the same corporate entities bank with him. So when he finally left the bank, a whole lot of corporate depositors left the bank, but many stayed. This corporate guy says that it has to do with the connections that Rana made and the sales and marketing team maintained. They saw to it that even after his exit, wherever possible they retained the small corporates.

Six degrees of separation

In six degree of separation, every person is connected to every other person through six relationships. So if you are looking at the six degrees of separation of Rana Kapoor or better yet, what is the six degrees of separation of Rana from say, Ruchir Sharma, the chief global strategist at Morgan Stanley? There is a chance that the number could be 1 or 2 because both of them went to the same college. Similarly, Rana’s separation from the biggest of the big businessman in the country was at the most 1 or 2 numbers, which is an incredibly high score. Rana built these relationships throughout his banking life. According to our guy, even when Rana had left the company, most of these businessmen stayed with Yes Bank because the relationship managers were there, that was the connect. Rana had built the system of connections which remained intact even after he left and even when the bank had gone down under.

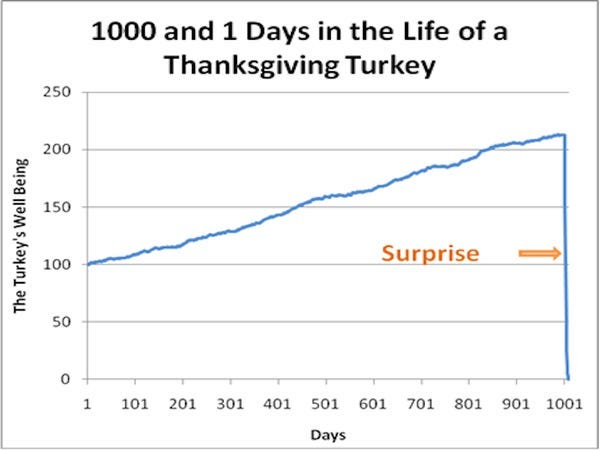

In a way, a similar thing applied to the journalist. While he knew that the bank had many problems and he explains that he was too lazy to move his beneficiaries to another bank, the real reason was that he connected to the bank through the six degrees of separation. He had met Rana, and he knows all his allied staff. He was in touch with the PR and other managers in the bank for many years. But more importantly, his overall direct relationship with the bank was positive. And thus his cognizance failed. As Taleb says, “A turkey is fed for 1000 days by the butcher, which confirms to the turkey that the butcher loves it. On the 1001st day, the turkey gets a surprise.”

But while the six degrees of separation works very well, there is another important thing that really gives us an understanding about ourselves and our relationship with money.

“Investing is not the study of finance. It’s the study of how people behave with money. And behaviour is hard to teach, even to really smart people.” - Morgan Housel

If you look at the behaviour of all these people mentioned above, you will notice that while they are smart and savvy, they are not prompt. Their closeness to the bank and its employees gives them a sense of security that they let their guard down and actually do not take any prompt action to avoid possible disasters.

This happens to investors a lot. Their behaviour towards money has nothing to do with their intelligence, awareness or the amount of information they have. They have developed a habit towards money which is directly a result of their personality. A high strung worked up person would behave promptly with money but may not take the right decision. A well-informed person has the ability to take the right decision but is lax and acting on the information is never a priority. Both issues create a problem.

Maximising actions and minimising emotions is the key to the problem of the journalist or for that matter, the corporate who feels that his bank will never go down. Both these characters need to build a system that breaks the six degrees of separation and act on the information they have, without emotions.

I asked this corporate guy if he would trust another bank the way he did trust Yes Bank in future.

“It is not about trust. It is simply whom you or your boss is dealing with the bank. I might know that it is a sinking ship. But when I’m comfortably numb, I don’t even know if I’m afloat or going down”, he said.

This is the “boiling frog syndrome” that we humans suffer from. Imagine we put a frog in a pot full of water and start heating the water. As the water temperature increases, the frog adjusts its body temperature as a result. Just when the water is about to reach its boiling point, the frog can no longer adjust itself. At this point, the frog decides to jump. It tries to jump, but it is incapable of doing so, as it has used up all of its strength adjusting its body temperature. Very soon, the frog dies. What killed the frog was its own inability to decide when to jump and when not to.

I understood. WTF. This was fucking crazy. But somewhere I had heard the term called relationship banking and also the behavioural aspects of our relationship towards money. It clicked. I finally said YES to Rana. I got it. There was a relationship, but no happy endings.

🙏🙏 Thank you for reading this issue of Indexheads. You can keep the conversation going on the Indexheads Facebook group.

The goal of Indexheads is to spread the virtues of low-cost investing. We publish this newsletter just to create awareness about the merits of index funds. If you liked reading this issue, can we ask you to share this around? If yes, please do share this amongst your tribe.

We’d also love to hear your thoughts ideas and suggestion on what more we could write and do to spread the world about index investing in India. Please leave a comment below. It’s your loyal readership that keeps this newsletter going.