Fool here:

Ever since we started this newsletter, we've been meaning to cover the debt part of investing. It seems like more people are tripping up with debt funds than equities off late or maybe it’s all the noise. But it took a new podcast launch for us to write about debt and let me tell, it's bloody worth the wait.

This week Anish caught up with Rajiv Shastri. Rajiv is an economist, debt market specialist, and former CEO of Essel Mutual Fund and an authority on all things debt markets. In this utterly captivating conversation, they discuss:

The structural issues with Indian debt markets

The problem with the promise of same-day liquidity in the open-ended debt mutual fund structure and possible solutions

The issue with credit risk funds and if it is worth taking credit risk in India

How to allocate money in the debt portion of the portfolio

Bharat Bond ETF - apprehensions and current thoughts

Rajiv’s views on the Indian economy and why he extra bearish and more…

My thoughts

As I was editing this, I had to listen to the whole conversation multiple times. Let me tell you, it was just absolutely brilliant for someone like me who is fascinated by debt markets. I’m not going to spoil the podcast by revealing too much but I highly, highly recommend you listen to the full episode. You’ll thank me later.

This podcast however got me thinking about how retail investors build their debt portfolios. When you buy an equity fund or a stock, it’s kinda relatively speaking easier to understand. If the price or the NAV goes up, you make money, if not you lose. But bonds and debt mutual funds can be confusing to understand when you’re starting out.

They aren’t intuitive at first blush. If interest rates fall, you make money, if they rise you lose, higher the duration, higher the sensitivity to interest rate changes, and so on. Then there are your Macaulay durations, your yield to maturities, calls, puts, floating bonds, sinking bonds, swimming bonds, what have you. I remember I was bloody frustrated and intimidated when I first tried to understand what the hell a bond was and how it worked. Of course, once you have a basic understanding of these fundamental concepts, debt is in my view, easier to understand, because a debt instrument has a defined pay-off.

But I keep seeing investors day in, day out taking short cuts to avoid understanding the fundamentals when it comes to building their debt part of the portfolios. The most common ones are:

Verbal farts

Friends, Mutual Fund TV shows, buy/sell lists, and other recommendations. As a segue, this leads to an interesting point - we love being told. To put another way, we take more comfort in other people’s recommendations because we overestimate their capabilities. If XYZ is on TV, that means he must be smart, which means his debt fund recommendations must be brilliant and safe. This is how the gullible retail crowd including me typically thinks.

We saw this blow up spectacularly with Franklin's debt funds. Even yesterday, people pointed out on Twitter that a supposed expert on a mutual fund TV show on one of these business channels was recommending a few of the Fraklin funds that blew up and now he’s apparently gone silent on Twitter. This sounds like a joke, but people, unfortunately, invest this way. Then there’s the scourge of buy/sell recommendations on blogs, financial media sites, etc which are just disgusting. These recommendations have no accountability or logic. These blogs, platforms, sites hawk funds that offer the highest commissions - it’s as simple as that. They get paid, you end up losing your hard-earned money!

Star blindness

Of the various things responsible for ruining retail investors, star ratings are right up there. If you use star ratings to select an equity fund, you’ll probably end up with a fund that gives you benchmark like returns - it’s an idiotic way to choose a fund, but you probably won’t end up losing your money in the long run at least. But using star ratings when choosing a debt is absolutely stupid and here’s why. One of the advantages of debt is that it’s relatively easy to understand the risk-reward relationship. The only way a debt fund can deliver higher returns is by taking higher risks. Let me explain this visually.

This image is what’s called a yield curve. In simple terms, it depicts the yields (returns) of various types of bonds across various maturities. Now notice how Government bonds (Gsecs) offer the lowest yields. That’s because the govt doesn’t default (yet) and is considered the safest borrower, so it can borrow at a lower rate. AAA-rated companies are the best companies, but there’s still a tiny chance of them going bust (this is called credit risk or default risk), so they have to pay a premium over G-secs. AA-rated companies are riskier then AAA, and so on, you get the idea, right? The riskier the companies, the higher the interest rates they have to pay to borrow.

Here’s the credit rating scale of various rating agencies:

Coming back to star ratings, they are based on past returns, plain and simple. And how can a debt fund achieve good returns? By holding lower-rated AA+/- bonds or lower. Meaning, lower the quality of bonds, higher the returns (probable), and hence higher the star ratings. If you are picking a 5-star debt fund, you’re probably getting a terrible fund. Chances of the underlying bonds defaulting are high, and so are the chances of you losing your hard-earned money.

Here are some examples of why start ratings are pointless and useless:

Chasing returns

DEBT IN YOUR PORTFOLIO IS FOR STABILITY, NOt FOR FUCKING CHASING RETURNS. THAT’S WHY YOU HAVE EQUITY!

This just constantly surprises me even after all these years. People keep doing this even in liquid funds. For 0.5% of additional returns, people are willing to gamble with their hard-earned life savings, this level of greed is just shocking. Ironically, liquid funds are used for parking emergency funds which are to be used when a virus is threatening the survival of the human race and you lose your job.

We saw how spectacularly wrong this can go with Franklin. The Franklin Ultra Short Bond Fund which is again used for short term goals was one of the biggest funds in the Ultra Short category. Now, the money is locked-in right at a time when people are losing their jobs, and their livelihoods are at stake and need the money the most. It's just gut-wrenching to see tweets from people who badly need these monies. But at the risk of sounding insensitive, investors are as much to blame as Franklin because those high past returns were out there for everyone to see. In debt, when you play with fire in your underpants, your bum is bound to get burnt!

I’m always reminded of this quote when talking about reaching for yield:

Even in other categories, funds have blown up when they tried to reach for that extra ~1% return over category peers, and investors have gotten hurt time and again. The objective of debt in your portfolio is to provide stability while equity does the heavy lifting of delivering inflation-beating returns. But what some of the retail investors end up doing is the opposite. They get scared of equity volatility and redeem their funds at the absolute wrong time while they take undue risks with debt funds, NCDs, AT1 bonds, and other risky debt instruments. Don't, please don't do this. Choose a debt fund that holds quality securities and isn't adventurous in its approach.

Debt in your portfolio is supposed to let you sleep at night while equity keeps you awake. If both equity and debt keep you awake, you will die of sleep deprivation and lose your money along with it. Damn, that got dark, real fast. But yes, you’ll die! Don’t!

Taking risk isn’t like eating a rusk

If you’ve been following me on Twitter, you’d have seen me relentlessly mocking credit risk funds by making horrendous jokes.

The reason is that the category is a joke. If you are new to MFs, credit risk funds have to invest 65% of the AUM in bonds below AAA. So they invest in AA, A-rated bonds, and so on. Which means they take a higher risk to generate higher returns. But this may not work out well always. There are very few quality companies in India, to begin with but you’ll lend to lower quality companies and make money? Wah! Jokes uh?

Here are the yearly returns of all credit risk funds. Look at the past returns and look at the future returns and by my count, more than 12 out of 20 funds had credit events.

The worst part is that this bloody category underperforms a liquid fund! Here’s the analysis by Rushabh:

And even the AMCs that have managed to avoid credit events (defaults, downgrades), the difference between their corporate bond funds and their credit risk fund is just about ~1%. And credit risk funds are way costlier than corporate bond funds which invest in relatively safer bonds. So you pay a higher expense ratio, take a higher risk of losing money to match the performance of a corporate bond fund which is relatively safer and cheaper! How the hell does that make sense!

Even in the podcast, Rajiv says that taking credit risk is pointless because there’s no reward for taking it. Actually, scratch that, your reward is you losing your money! To summarize, a credit risk fund is just a shitty corporate bond fund with a higher expense ratio, higher risk, and lower returns! Advisors/distributors will give you all sorts of ass-backwards logic to invest in these funds and let me assure you it’s not worth it. There is no scenario in my view where these shitty funds should part of the portfolios of retail investors.

Juicy yields (YTM)

This is another common mistake people commit. While it’s fine to assume YTM is a measure of return, it’s actually a better measure of risk. Again, understanding debt in lots of ways is quite simple. Higher the quality of the borrower, lower the interest he pays. Why would anybody willingly pay higher interest when they have the ability to repay loans? On the other hand, if someone is financially weak, he has to pay a higher interest rate to borrow. The reason being the lender is taking on extra risk compared to a safe borrower, and he needs to be compensated.

Coming back to mutual funds, the only reason a fund will have higher YTM is is taking higher risks by holding lower-rated bonds. And the second thing to keep in mind is that things can change real fast. All debt funds hold bonds that are liquid and illiquid. Now, if there is a situation where a fund faces severe redemption pressure for whatever reason, it sells the liquid bonds and pays back the investors. This means over a period of time it will be left with the less liquid bonds, and the ratings of these bonds typically tend to lower than AAA, which means they have higher yields. So, if a fund has a higher YTM, it may also be because people are fleeing the fund and it is just holding bad quality papers. Make sure to monitor the debt fund you’re holding, if there’s a sharp and sudden fall in the AUM, it’s usually a red flag.

Don’t be Gilty

The Franklin episode, coupled with COVID-19 seems to have caused some risk-off behavior among investors. And when there’s panic among retail investors, they end up doing dumb things. And this time, there seems to be a sudden interest in Gilt funds. The funds only hold government securities and carry no credit risk (yet). People seem to be assuming that just because there’s no credit risk, there are no other risks.

Here are the 1-year flows into Gilt, Constant Maturity Gilt, and Credit Risk funds. The spike in March seems fishy. I’ve been asked by investors if they can redeem their liquid funds and invest in credit risk funds. Gilt funds aren’t for parking money!

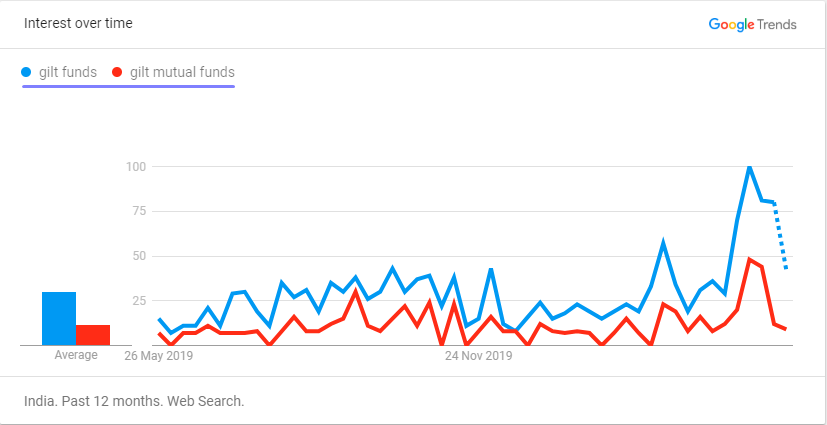

Even the Google search data points to the same.

Now, just because Gilt funds don’t have credit doesn’t mean they are riskless. They have duration or interest risk, for the sake of brevity, I can’t go into the details but this thread gives you a nice brief summary of the risks.

But here’s the gist - Gilt funds typically hold long-maturity government bonds. In bonds, longer the maturity of a bond, the higher the sensitivity to interest changes. And bonds do well in a falling rate environment. Since Aug 2018, interest rates have fallen from 6.5% to 4%, and Gilt funds have delivered phenomenal returns.

This, along with the risk-off environment, has drawn investors. But there’s only so much rates can fall. And in a rising environment, gilt funds can even underperform liquid funds, and investors will be disappointed for sure.

Using Gilt funds just because they have no credit risk is stupidity. They can be quite volatile in the short run and aren’t meant for parking money or for shorter goals. Any goal less than 10-years, using Gilt funds is a terribly stupid idea. I’ll go so far as to say, you can completely avoid Gilt funds. But you’ll have to take that call after you carefully analyze the pros and cons and not because an idiot like me is writing about it.

Also read: Gilt mutual funds will not protect your money! Recognize risks before investing!

What’s in a name?

Nothing! I’ve never been a fan of fund manager cults. I’m not saying that a fund manager doesn’t matter, of course, he does. But investors have a tendency of attaching too much importance to names, and over a period of time, people start assuming that the fund manager is a genius and he cannot possibly go wrong. In equity at least, if a fund manager takes some wrong calls, the fund may eventually recover. But in debt, wrong calls usually means your investment being permanently wiped out.

The Franklin episode was a textbook example of fund manager cults gone wrong. There was a near-universal belief that Santosh Kamath was a wizard of debt, and he couldn’t possibly make mistakes. And boy oh boy was that belief shattered spectacularly. The latest fund manager who has been steadily garnering accolades is Suyash Choudhary, the head of fixed income at IDFC. Make no mistake, IDFC has been conservative in its approach to debt and they’ve brilliantly managed to sidestep all the credit events since IL&FS imploded. But that doesn’t mean they can’t go wrong in the future. Your investment decisions cannot be based solely on a name. A name isn’t a strategy!

PS, that wasn’t a comment on the quality of the IDFC debt funds. They might be running some quality funds for all I know and I just used it as an example.

Alphabet blindness

Another common short cut investors tend to take is choosing funds with a large degree of AAA-rated exposure. Nothing wrong with this, as long as you realize that just because your fund only holds AAA-rated bonds, it doesn’t mean it can’t get into trouble. IL&FS went from AAA in August 2018 to D as of September 2018. In fact, on Septemeber 8th alone, it went from AA+ to BB - that’s a downgrade of 9 notches. DHFL before it went belly up had a AAA rating, so did Reliance Home Finance.

During a profound economic shock like COVID-19, things can get real ugly real fast. The ratings of 847 companies were downgraded in the last quarter. And then there’s also the question of the ineptitude of the rating agencies itself. Remember, the companies which need to obtain a rating when issuing bonds/debt pay the rating agencies. This is a massive conflict of interest right at the heart of the activity.

I’m not saying ratings don’t matter, but they can be flawed and can change in a moment notice, so don’t give them undue importance and don’t choose a fund solely because a fund holds top-rated bonds.

Size sickness

Another, call it a rule of thumb investors, including me rely on is to pick funds that have large AUMs. Again, nothing wrong with this metric either but this cannot be a sole determinant of the quality of a fund. A fund can have a large AUM because it aggressively pays distributors to push the funds. This can go wrong spectacularly too. The Franklin Ultra Short Bond fund which is being shut down was the second-biggest fund in the Ultra Short category.

A few other pointers

The best investment you can make is in understanding the basics of debt, the risks, and how they work. It might be intimidating at first, I know it was to me. But once you have a basic grasp of the basics, you can avoid a lot of mishaps and build yourself a debt portfolio that has a low chance of going up in flames when you check your portfolio one fine morning.

New fund offers (NFOs) are a strict no. Not just for debt, even for equity, there are very few situations where an NFO makes sense. It’s not like the Indian mutual fund industry comes up with a lot of NFOs that are unique and make sense to investors. There will always be funds that have existing track records.

Parting thoughts

This is by no means a guide to invest in debt. These are just my thoughts on investing in debt, and I might have gotten a lot of things wrong and missed a lot of things. Don’t treat this as investment advice, JUST FUCKING DON’T! There are no bloody shortcuts, investing is a bloodsport! Things will get ugly as they are meant to be.

The objective of this post is to get you thinking about the risks and dispel any complacent notions you have about debt funds. They are risky, and there is no such thing called a riskless or zero risk debt fund - every fund, every instrument carries varying degrees of risk. The right way to invest in debt is knowing the risks beforehand, understanding them, and doing what you are comfortable with while constantly learning and evaluating your portfolio and what you know.

Resources

If you want to learn about the basics of debt funds this Freefincal ebook is as good as a place as any, and it’s free too and also browse through the Freefincal archives

Debt mutual fund basics by Swapnil

The PIMCO education series is also a good resource to understand the basics

Introduction to Financial Markets

Financial Engineering and Risk Management Part I - Advanced

Stockviz - there are some really good posts in the archives

Corey Hoffstein’s Newfound blog also has some complex and advanced posts on bonds and fixed income

Dude, awesome podcast on debt. Thank you!

Also, one tip on interviewing skills - try not to interrupt the interviewer. There were lots of opportunities to mine gold / streams of thought which were possibly lost.

Awesome Post. loved it.