Fool here.

I know I’m very early, but happy new year all you doomed humans. After all the insane action in 2020, this is going to be an interesting year to see if the craziness continues. So I thought I’d write my thoughts on what the year ahead might look like and help you navigate these upside-down markets. Here’s my market outlook for 2021:

Heading into a brave new normal in 2021, I expect the major central banks to continue injecting liquidity into the global economy. With the stock of negative-yielding debt once again spiking to upwards of $17 trillion, permanent capital allocators like pensions and wealth funds will be searching for yield, and this is a positive for equities.

On the economic front, I expect a synchronized global upswing and 2021 and a V-shaped economic recovery. In all likelihood, 2021 be a repeat of 2020, during which pretty much every asset class went up. I'm pencilling in a 20%-25% earnings growth across the board globally.

Rebound in inflation will be the biggest risk worth looking out for. Rising inequality, protectionism, US-China relations will be the key macro risks to watch for.

All this sounds convincing, doesn't it? But I can assure all this is just flavoured bullshit and I might as well be talking out of my ass. It's a new year, and that means you'll see a deluge of investment outlook videos, PPTs, PDFs, excel sheets, podcasts and webinars. Some will be rosy, some will be scary, some will be smoky, but all of these things will be largely useless.

These predictions and forecasts are a bit like throwing a lot of shit at the wall; something is bound to stick.

"Prediction is very difficult, especially if it's about the future."

--Nils Bohr

And moreover, I don’t understand the point of one-year predictions and outlooks. In the grand scheme of things, one year is just white noise. If you are a long-term investor, nothing worth bothering about happens in a year in the markets. As mind-numbingly cliched and overgeneralized it is, the boring stuff tends to make all the difference:

Increasing your investments in line with your salary

Rebalancing your portfolio

Not buying shiny garbage funds

Not listening to charlatans and crooks looking to sell shady financial products

Behaving!

“If stock market experts were so expert, they would be buying stock, not selling advice.”

--Norman Ralph Augustine

But, since I’ve click baited you and probably pissed you off, I’ll make some predictions that will be true no matter what happens - 100% guaranteed, mother promise.

Costs will always matter!

We had written about the “Cost Matters Hypothesis” at length last year. And what we wrote back then will be true in 2021 as well. While investors give a disproportionate amount of attention to things they can’t control like market conditions, daily index movements, what “experts” say on TV, they care very little about things that make all the difference. Things like costs and behaviour. I keep saying, auto deducting mutual fund expense ratios is one of the greatest innovations ever. Since investors don’t realize that they are paying heavily, they don’t care about the value they get in return. And the product sellers are just milking investors for whatever they can.

The case for indexing isn't based on the efficient market hypothesis. It's based on the simple arithmetic of the cost matters hypothesis. In many areas of the market, there will be a loser for every winner so, on average, investors will get the return of that market less fees. - Jack Bogle

Let’s put the quote into context. For any given period, 60-80% of all actively managed mutual funds underperform their benchmarks. This is particularly pronounced in the large-cap space, and things have been getting difficult in the mid-cap space as well.

One of the biggest reasons for this underperformance is costs. Today, the category average expense ratio of direct plans of large-cap mutual funds is ~1.2% and ~2.2% for the regular plans. The category average expense ratio of direct plans of index funds is ~0.28% and ~0.60 for regular plans. So, an actively managed large-cap fund has to generate about 1% extra just to keep up with an index fund. It sounds simple, but as the numbers illustrate, in the last 5 years, 80% of the large-cap funds have failed to beat their benchmarks.

Active funds will be sold on all sorts of nonsensical stories. But at the end of the day, most of them will fail to beat a simple index fund. That’s because they charge too much and trade too much. While mutual funds preach buy and hold, most of them are just trading inside their funds. You can check the turnover ratios in the factsheets. Index funds work because they charge less and have very minimal turnover.

Today, Rs 3,15,847 crores of money is in actively managed large and multi-cap funds (these are predominantly large-cap oriented). Just based on a back of the envelope calculation, assuming an average expense ratio of 1.5%, investors are paying between Rs 4000 - Rs 5000 crores as fees to largely get Nifty 50 performance they can get for 0.10%!

Not just in MFs, even when you are trading, picking stocks, costs will always matter, this is an iron law of investing.

If you don’t behave, you are buggered!

One of the best things to have happened in modern finance in the past 2 decades is the realization that humans are not rational utility-maximizing creatures. We apparently don’t consider all the available information and make good decisions. Huh, who would’ve thought that was obvious, eh?

This led to the birth behavioural economics, and it’s offshoot behavioural finance. The founding fathers of modern Behavioral economics and finance like Daniel Kahneman, Richard Thaler, Dan Ariely, Meir Statman, among others have become household names. Books like Thinking, Fast and Slow, Nudge, Predictably Irrational etc. have become bestsellers.

But like any good thing, the financial services industry has co-opted it. And not only did the suits co-opt behavioural investing, but they’ve also bastardized it to sell all sorts of nonsense.

Every single piece of communication and fund document is littered with references to some bias or the other. This has quickly descended into Behavior Shaming. The insinuation being investors are somehow flawed or broken, and it’s the sacred duty of the biasmongers (I coined it) to fix them. It’s just a tactic to make investors feel inadequate so that the product pushers can sell some garbage. 90% of all mainstream behavioral economics and behavioral investing content that you hear and read is bullshit. It’s just silly nonsense masquerading as serious insight.

Just be sure I’m not misunderstood, there’s some amazing work being research and published. But the bullshit always trumps substance. You now have behavioral coaches and certification programs. Every adviser off late touts himself as a behavioural coach. I have very very negative mixed feelings about this. Investors might just end up paying “advisors” for some pointless nonsense.

Look, you’ll see posts with 3000 fricking biases, but they have zero value. And by that I mean just reading things and knowing you are biased is useless. Knowing you are biased and dealing with them are two different things. One of the best books I started reading recently was The Behavioral Investor by Daniel Crosby. One of the key messages in the book is that all our biases were evolutionary responses designed for us to survive.

So, there's fundamentally nothing wrong with you and me. The behaviour we exhibit is perfectly normal. We were built for a time long ago when survival and reproduction were our top priorities. But the world has changed from the times when we had to hide as soon as we heard rustling in the bushes. The traits that we picked up to survive make investing hard, which makes it important that we are aware of them.

You can read all the books on behavior and start a personal quest to become an emotionless robot, but that's not going to happen. We'll always have our quirks, as they are meant to be. But that doesn't take away the fact that your ego and biases are bad when investing.

The odds of you becoming a Buddha are slim, so that leaves you with the next best thing. Figure out what quirks or biases make investing hard and figure out a way to get out of your own way.

For example, most people think that in order to build a good habit like exercising, quit smoking or invest regularly, you need to have a strong will and push yourself. Sounds logical, doesn’t it? But it turns out, that’s not the case. I came across this insight as I was writing this post. As much as we’d like to think that the 1000s of decisions we make in a given day are carefully thought out, that’s not the case. We mostly rely on defaults, things that we usually do without even thinking twice.

Think about some of your oldest habits, both good and bad. You do those things without even thinking about it, pretty much on autopilot. Wendy Wood, the Professor of psychology and business at the University of Southern California and the author of Good Habits, Bad Habits: The Science of Making Positive Changes That Stick has been researching this for most of her life. She found that building good habits isn’t about a strong will or self-control but rather the environment, context and the cues make all the difference.

We are all dependent on the context in which we live. We form habits based on what’s easy and rewarding, what’s easy for us to do repeatedly and what’s rewarding in our context in the places where we live. - Wendy Wood/ Behavioral Scientist

And it takes time to build habits, and they are as much a result of the environment and cues than just pushing ourselves. And the trick to building a good habit according to her work is to ensure you are in the right environment and to reward yourself immediately as you work towards building a habit.

Successful habit learning depends not only on repetition but also on the presence of stable context cues. Context cues can include times of day, locations, prior actions in a sequence, or even the presence of other people (see Table 1). Illustrating the importance of stable cues, almost 90% of regular exercisers in one study had a location or time cue to exercise, and exercising was more automatic for those who were cued by a particular location, such as running on the beach. Other research shows that older adults are more compliant with their drug regimens when pill taking is done in a particular context in their home (for example, in the bathroom) or integrated into a daily activity routine.

- Healthy through habit: Interventions for initiating & maintaining health behavior change

So, to put that in my perspective, the first thing I do after my salary hits my account is to transfer money to my investment account. The salary hitting my account is a cue that reminds me to transfer funds to my bank account linked to my SIPs. I’ve done it so many times that this has become a habit of sorts and I do this without a second thought. I’m sure most of us would be used to it as well. As you keep doing a thing over and over again, it becomes a sticky habit.

Similarly, breaking habits is again, not about will power or self-control. It’s about disrupting the cues that trigger bad behaviour or changing your environment that triggers it. An example of Wendy Wood’s donut eating bad habit:

What does work to break a habit, it seems, is changing the environment we’re in, which can disrupt those cues. I could bring apples into the office so I have something ready to snack on when it gets to lunchtime and I might be thinking I should go get some donuts from the vending machine. If I have something else at the ready that will compete with my thoughts about donuts, and then I’ll be better off. A new environment will be a better way to try to shift my behavior than just exerting willpower.

In the investing context, it could be the temptation to sell your investments during bear markets, buy useless funds etc. For example, in March, given the market crash and the apocalyptic headlines, most investors would’ve been tempted to sell, I know I was. So, the best way to not make the mistake would’ve been to switch of CNBC, not read those useless financial headlines and instead focus on worthwhile things like working, spending time with family, Netflix etc. Just like not being around smokers makes it easy to quit smoking than being around them.

We also suffer from action bias (I hate the word), the tendency to crave action, that's bad when investing. So what do you do? While your core portfolio remains untouched and unfiddled (coined it), you can probably put 2-5% of your money in a separate account to day trade, buy options, buy bitcoin and go crazy, just to scratch that itch for action, a release if you will.

Similarly, inertia is a very powerful enemy of investors. This could manifest in multiple ways like not investing at all and leaving money in a savings account with 3% interest or sticking to defaults like recommended funds on platforms and so on. And inertia is a very powerful enemy of investors and left unchecked, it can cause serious damage. How do you deal with inertia? One idea could be to automate investing as much as possible. It could be something as simple as a SIP. Not just a SIP, you can also now automatically increase your SIPs by a preset percentage every year so that your investments increase along with your salary and inflation.

My pet theory and I don’t have a lot of evidence at this point, Its that a lot of mainstream behavioural finance sounds nice on paper but it largely useless. By mainstream I mean, your financial media, behavioural coaches and gurus, bloggers - myself included and so on.

But doesn’t mean out biases don’t make investing difficult. We’re all unique, and it pays to know some of these biases and figure out hacks to deal with them. The way to know is not by reading random nonsense published in mainstream financial media. I’d suggest reading classic books and peer-reviewed academic research.

Look, there’s no bloody way any of us can live life constantly in debug mode by analysing every single action if it’s affected by your biases. You’re not a goddamn machine.

But making sure your stupidity doesn’t affect your retirement, that’s the bottom line and that in itself a long journey. The irony of all this bullshit being written about biases and such is that they can actually make things worse. Backfire effect is another bias (🤮) - it’s our tendency to hold on to our beliefs even when presented with evidence that our beliefs might be wrong. It’s a bit like those gruesome images of black lungs on cigarette packs, and they do very little to stop people from smoking.

And to me, much of behavioral science is about figuring out how stupid we are and tricking ourselves into not being stupid by building enduring habits. And if you repeat these tricks for a long time, they’ll stick and become second nature.

There a lot of people who believe behavioral investing is a pseudoscience, and some others doubt it’s applicability. But like I said, that doesn’t change the fact that we can be our worst enemies when it comes to investing. In my view, the key is to trick ourselves into not being stupid.

NFOs are largely pointless

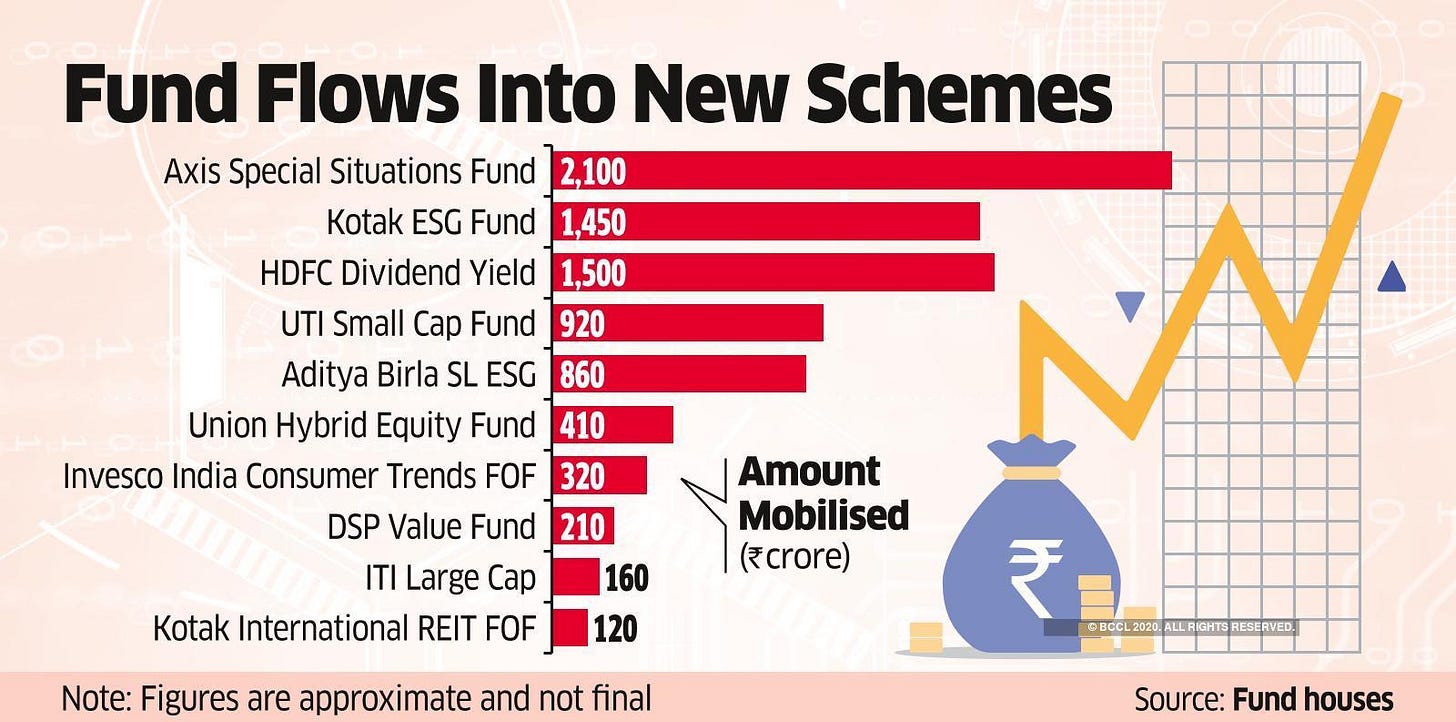

It’s silly season right now. Ever since the markets recovered post the COVID crash, AMCs have made a beeline to launch and file new funds like there’s no tomorrow. There must have been 40+ new fund launches last year, and they aren’t stopping so far this year.

Why the sudden rush? Well, a raging bull market is the best time to sell garbage. And add to this that fact that equity mutual fund flows have negative for the past 6 months straight. Maybe AMCs need some shiny new funds to attract investors.

We are in 2021, but even today, NFOs are sold with the pitch that the new units only cots Rs 10 and they can go up infinitely. Some investors even think of NFOs as IPOs where they can make gains on listing 😭 Just in case you're new to NFOs; they are not equal to IPOs, you don't make any listing gains. NFO is a new fund that takes your money and buys the stocks it wants to hold. An IPO, on the other hand, is a new company listing on the stock exchanges for the very first time.

In the last 5-6 months, of the 40+ funds that have been launched, except for maybe a couple of funds, none of the funds are unique. They are just being launched by AMCs to fill their categories. There are far older funds with established track records.

Source: Economic Times

There were also several international and ESG themed funds - these funds are unequivocally 97.35% useless. But some of these funds have raised the most money because they were launched by bank-owned AMCs like ICICI Pru, Axis and Kotak. They seem to have used the bank distribution to just mis-sell the hell out of these funds.

Let me keep this short. 9.99 out of 10 times there are exactly 0.0000 reasons to invest in NFOs. There will always be far better alternatives with established performance records for you to choose from. NFOs will always be a winning proposition only for the AMCs. I understand the urge to add some new shiny fund to your portfolio, but you’d be willingly messing up your portfolio in all likelihood. Stay away for NFOs and stop making the AMCs rich.

Very rarely do NFOs make sense, the likes of Motilal Nasdaq 100 ETF/FOF, ICICI Alpha LowVol, Nippon/Motilal Midcap 150 index funds/ETFs, Bharat Bond ETF are some examples I can think of.

Macro tourism

This is a particularly widespread disease among investors. It's the tendency of investors to read some Zerohedge, Bloomberg articles or listen to some “famous” fund managers and make investing decisions. If there was a hall of fame for the stupid things investors do, this would be the first in it.

And you can see this on full display on Twitter and among your friends if you look closely. It’s scary how people make important investment decisions based on some simplistic narratives. There have been several well known public examples in the past decade or so. During the COVID market crash this year, plenty of investors sold equities. The reason was that these people believed that because all major economies were shut and companies had closed operations, the GDP and revenues of the companies will fall, and hence the stock market would fall further.

What happened was quite the opposite. The market bounced back as quickly as it crashed. People who went to cash during the crash have missed all or a good chunk of the subsequent recovery. The worst part is that this will significantly affect their long term goals like retirement etc.

What people didn’t realize back then and don’t realize even today is that there is very weak to a negative correlation between the stock market and the GDP of a country. The other trade that has been in vogue in the US since 2008 is that the modern financial system as we know it will end because the central banks have printed trillions of dollars and they will cause doomsday one fine day. The best thing to do is to sit on cash or buy gold. People who bought gold anytime post the market crash in 2008 have badly underperformed equities. People who went cash on the other hand, well, they have negative returns after inflation.

At any given point of time, given the media environment we live in, there is no shortage of world-ending headlines and stories. Unwitting investors time and again succumb to these asinine and simplistic narratives and make investing decisions. The problem with basing investing decisions is that there will be 100 of variables at play and there’s a complex interplay between them and most people don’t have the ability or the data to understand all that.

Not just retail investors, even macro hedge funds that trade based on macroeconomic factors have been among the worst-performing strategies since 2008. Now consider the fact that these are the smartest fund managers with millions in research budgets and an army of PhDs with smart underwear. You think you can read Zerodhedge and get things, right?

For every George Soros, Druckenmiller or Julian Robertson, you have 1000s of managers who’ve failed, that’s how hard this shit is. Listen to them, but don’t blindly ape everything they do. The playground they play in and the one you play in are vastly different.

Let me just clarify a few things. I am not saying you don’t need to pay attention to macroeconomic factors, of course, you have to. But you also have to realize that it is an incredibly complex discipline and takes an insane amount of effort to get a handle on how the economic machine works. But you can be dead certain that making investment decisions based on half baked knowledge may end with you being homeless in your retirement.

PE blindness

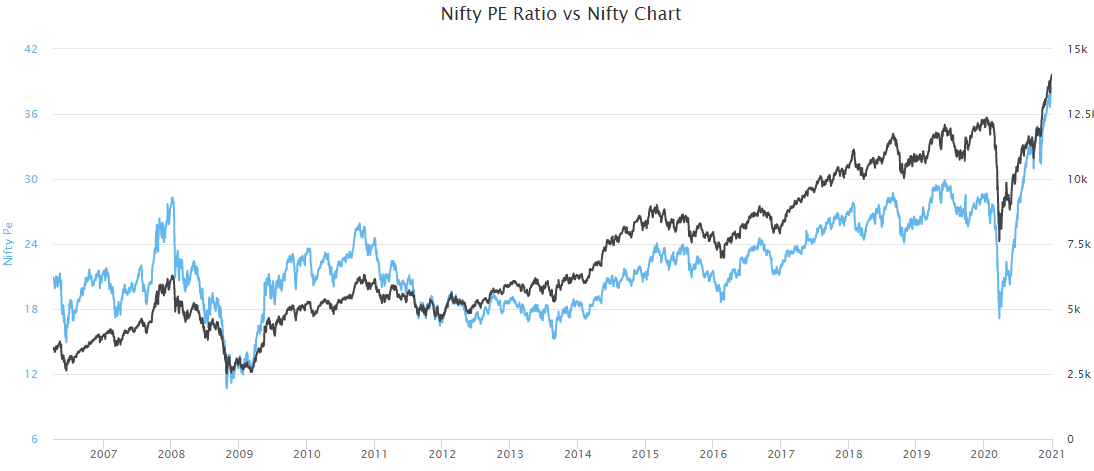

I’m probably going to get murdered for this, but making investment decisions based solely on PE is stupid. Today the Nifty 50 PE is around 38, typically anything over 20 is considered expensive.

Source: Equityfriend

And investors use this PE in a variety of ways from going completely to cash to reducing equity exposure. Now if someone was timing the markets just based on PE and nothing else, he’d be in cash since 2014 when the PE crossed 20. Yes, there are these extreme investors.

And most investors don’t even understand the difference between standalone PE and consolidated PE and end up making a kneejerk decision just because Nifty PE is high. They don’t realize that PE on its own doesn’t convey everything and the markets can also remain in “overvalued” zone for a long time due to a variety of reasons which they don’t comprehend.

I get using PE as one metric when analysing market valuations, but a disproportionate number of investors I see are still in the mindset of Nifty PE above 20 = go to cash. It’s the same with US investors timing the markets using the Shiller CAPE ratio, which mostly would’ve ended in disaster.

Hunting for yield = disaster!

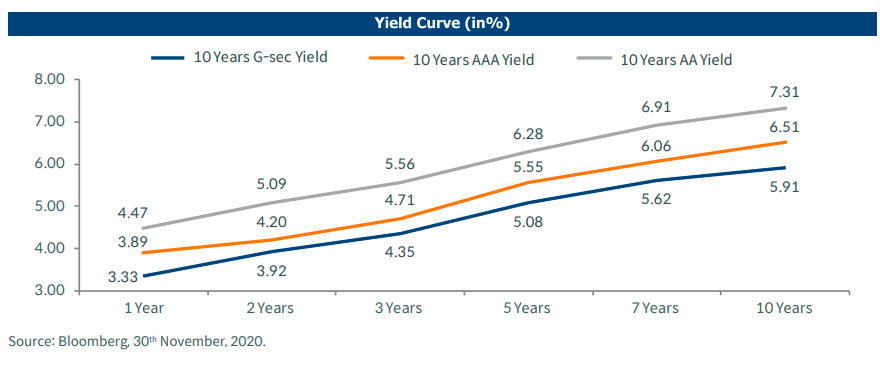

These are very bad times for savers heading into retirement and retirees. Given the series of rate cuts, the yield on a 10-year govt bond has fallen from around 8% in 2018 to 5.9% currently.

Source: Mirae

Here's how the yield curve looks like. This image basically tells you how much you'll get paid for various maturities and risks. Even if you take a very high degree of risk with a 10 year AA bond, you're only getting around 7-8%. On liquid funds, the returns have fallen from about 6.5% to 3.5%. FDs are averaging about 5% today. For comparison, you get 7% interest if you put your money In IDFC savings account.

Given this low return environment, people might look for higher returns, and that cannot come without higher risk. This is usually the time when bank RMs sell credit risk funds, hybrid funds, AT1 bonds and other structured products as alternatives to FDs. And we've seen this story a 200 times before with Yes Bank bonds, dividend plans of balanced funds, credit risk funds, Franklin debt funds among others.

As a saver, there are no easy answers to low returns. But hunting for yield, It never ends well.

Your bank RM is your best friend 🤗

After your mother and father, the only other person who genuinely cares about you is your bank relationship manager. He wants you to be rich. Which is why he always sells you the best financial products with the highest returns. Please don't take this seriously; I'm kidding.

One of the problems in India, even accounting for our small investors base is we nearly don't have enough advisers and distributors. For the 2 crore mutual fund investors, we have about a few hundred RIAs and probably just probably about 10000-15000 advisors. And most of these people get paid a % of the AUM as commissions, which means they have a strong incentive to go after people with more money.

And that leaves common poor people like me with bank RMs or insurance salesman as the only sources for financial advice. And these people are the worst when it comes to selling absolutely horrible financial products wholly unsuited for you and me.

The only real thing that matter to most of these people are the commissions they can make. In a lot of cases, insurance salesmen make 40% to 80%+ of the first-year premiums as commissions.

As for banks RMs, they'll sell sand to a sheikh. Bank RMs usually have sales targets and are incentivized to sell financial products. The only qualification they look for is if the buyer has money. They don't bother with pointless distractions like whether the product they are selling is suitable for the investor or not.

In the last 4-5 years, they've been responsible for some of the most reprehensible mis-selling episodes.

They were among the biggest sellers of balanced funds as guaranteed income products.

They pretty much sold all the credit risk funds that blew up starting with BOI AXA to Franklin.

Those Yes Bank AT1 bonds which became zero

And the list goes on. And what makes things worse is that most often than not, retirees are the favourite targets. And given that these retires tend to be relationship-oriented, bank RMs take perfect advantage of that trust to sell all sorts of toxic sludge.

Never ever buy anything from a bank. Banks are just meant for banking activities and nothing else.

Thematic seduction 💋

In the past few years, there have been a slew of thematic and sectoral fund launches like pharma and healthcare, consumption, manufacturing, commodities, digital, IT, banking and so on.

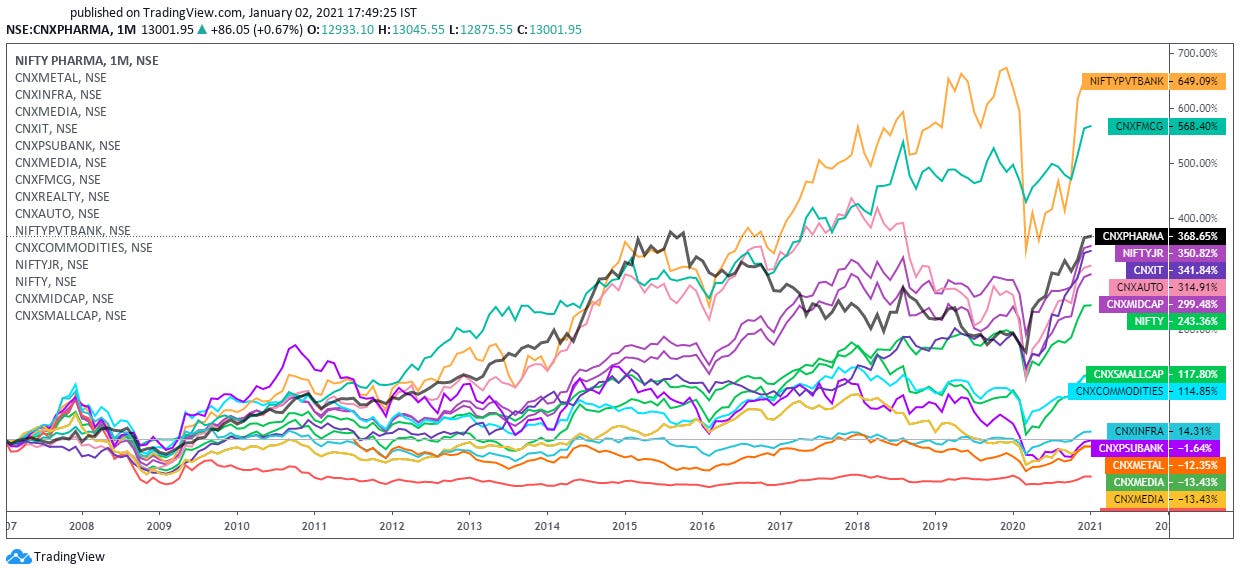

The thing about sectoral or thematic funds is that they are hit or a miss. If you get it right, you can make some really good money. But if you get it wrong, you’ll underperform savings bank returns. Buying and holding them like a diversified equity fund is a really really bad idea. Just take a look at the performance some of these sectoral/thematic indices.

The 5-year returns of the various thematic and sectoral funds ranged from -1.79% to 20.67%. You can drive an aeroplane through that dispersion. For comparison, Nifty 50% returned 13.0% for the same period. It’s a short period, but these funds are new.

Thematic and sector funds are story funds - they are always sold based on stories.

Take the example of a popular technology focussed mutual fund. The people of the AMCs don’t go a sentence without talking about artificial intelligence or machine learning. But I’ve never heard them mention the risks of thematic funds. Why? Because they have fat juicy margins.

The thing about stories is that they pretty much always end badly if you can’t ride the story by getting in and getting out. Take the example of the India growth story on the back which infrastructure and PSU funds were sold; it’s one of the worst-performing themes.

And the other thing about these themes is that they tend to concentrated bets and hence they fall far more than diversified funds. This makes holding on to them very hard to reap those rewards. They are what I call behaviorally incompatible.

Just so we are clear, I am not saying don’t invest in them. These themes need to be timed properly, YES MARKET TIMING, the very thing most people tell you not to try. If you don’t time these themes, you’ll be left holding the bag for a long time. If you don’t know when to get in and get out, the odds are high that you’ll regret it. If you can’t time them, having a higher allocation to these themes is a recipe for disaster. A mistake I see investors frequently make.

And the other thing is these funds fetch some handsome margins for AMCs. Which means when a theme is hot, you’ll see them push these fund aggressively. I’m sure you must have seen some ads for Pharma funds, global funds and IT funds off late.

Whenever there’s a sales pitch, always look at the incentives :)

So, make sure you know what you are getting into. If you don’t have the stomach for the saas-bahu level drama and the twists and turns, low-cost broad market index funds can be your best friends.

And most often than not, AMCs launch these thematic funds when a theme or sector had done well, at peak bull runs. Which most often than not means disappointing returns in the future. The time at which an AMC launches a thematic fund speaks volumes about their priorities and their customer focus.

Star managers are like shooting stars

One of the more pointless things people do is invest in funds because some “star fund managers” are managing funds. If a manager is on a hot streak, he starts getting media attention and the inevitable profiles, magazine covers and the Warren Buffett comparisons follow.

These managers then achieve a mythical status and are often painted as oracles and wizards. They become overnight experts on everything from economics, taxation, politics, public policy, and other investors. They are all-seeing and all-knowing. This leads to more inflows than they can manage as investors rush in and with very few exceptions, the performance and the stars along with it fade away. There is enough research to show that performance is rarely persistent.

History is littered with once hot star managers lie Santosh Kamath of Franklin more recently, Neil Woodford, Bill Miller, Bill Gross and 1000 others. And hotness is a musical chair.

The thing about star managers is that it is very hard to decompose skill and luck. Take the case of Prashant Jain for example, who is in the news because his funds, among the largest mutual funds in India, have been underperforming for nearly a decade now. Before this, he was beating Nifty black and blue. Now the question is, was it luck or skill and will he make a comeback?

Anybody who says they know is either lying or deluded or trying to sell you something. And more importantly, trying to pick “star managers” is incredibly hard. There is enough evidence to show that even the smartest and well-resourced investment consultants, pensions, and financial advisors suck miserably at it.

More importantly, a “star fund manager” is not an investment strategy. Managers come, they make their fat bonuses and go. But that doesn't translate into returns for you.

Being attracted to individual success stories also leaves investors vulnerable. Whilst we know that Rafael Nadal’s success is largely a result of application and skill; there is too much randomness in financial markets for us to unequivocally know that a streak is not just a run of good fortune. Even if a fund manager is skilful, the power of the narrative around them often leads us to make imprudent decisions. It is never a sensible idea to make investment decisions based on our admiration of an individual or our desire to participate in their story.

The lesson for investors is to be aware of the strong lure of streaking star fund managers, who catch the eye but so often burn out. We need to spend less time thinking about any given ‘exceptional’ individual, and instead concentrate on our own objectives and the overall outcomes we want to achieve.

- Behavioral Investment

And of course, some people based on random dumb luck do get it right, but that’s not replicable or quantifiable. Believing in “star managers” is just like believing in cults, it’s never going to end well.

I'd just like to thank you for ever actually having the time to share your unbiased, well-formed and obviously well read analytical yet highly entertaining and delightful views and opinions with us commoners. Please treat this comment as the sincerest of blessings and regards from my end. And needles to mention, keep up the relentless attack on these so called harbingers of the financial spehere and their almost and/or utter disregard for the layman. More power to you :)

Happy new year sirr and a big thank you 😊 🙏 for making people understand who are making amc rich by buying mutual funds