I thought of writing about the absurdity of this premise when this story went viral. But then a lot of brilliant people debunked this notion of “passive bubble”, and I thought this would slowly fade away but I was wrong. Honestly, I’m surprised that this article is getting so much attention, even after a month.

When ordinary people say dumb things, they get punched in the face. But when smart people say dumb things, they become prophecies.

This is one of those instances. Michael Burry needs no introduction. In case you need one, then shame on you. But anyway, if you've seen the movie The Big Short, Michael Burry was played by Christian Bale. Remember this scene? 😉

Michael Burry was one of a select group of people who warned about the subprime mortgage crisis in the US. He bet against mortgage-backed securities (MBS) and made a ton of money. Michael Lewis immortalised him in the Book, The Big Short, which was later adapted into a movie.

I love Christian Bale, and that makes writing this post all the harder because I'm gonna diss Michael Burry. Don’t get me wrong, Michael Burry is one of the smartest people on the planet. I am not even as smart as a single hair follicle of his, but you don’t need a PhD or a Nobel prize to poke holes in this argument. Just plain common sense will do. Mind you, I' am not going to say anything new in this post that hasn’t already been said by people a billion times smarter than me because attacks against index funds, as you will discover, are nothing new. In fact, the humble index fund has been subject to attacks since its inception.

There are very few things that have been unmitigated good in the world of investing. Index funds have been one of those rare things. In fact, most products are designed to fleece money off investors. Here’s a startling number to quantify that from S&P:

As indexing has grown, the benefits to investors – in terms of underperformance avoided and fees saved – have been substantial. The bars in the chart below show the growth of assets tracking the S&P 500, S&P MidCap 400, and S&P SmallCap 600. As of December 2018, those assets totaled nearly $3.9 trillion. The green line represents our estimate of the cumulative savings in management fees over the past 23 years; the savings accumulate to $287 billion.

That’s just from the funds that track those S&P indices. The collective savings will be an order of magnitude higher if looked at in the aggregate.

Apocalyptic predictions about index funds are nothing new, more on that later. But here’s what Burry said:

Burry, who made a fortune betting against CDOs before the crisis, said index fund inflows are now distorting prices for stocks and bonds in much the same way that CDO purchases did for subprime mortgages more than a decade ago. The flows will reverse at some point, he said, and “it will be ugly” when they do.

“This is very much like the bubble in synthetic asset-backed CDOs before the Great Financial Crisis in that price-setting in that market was not done by fundamental security-level analysis, but by massive capital flows based on Nobel-approved models of risk that proved to be untrue.”

Here’s what a CDO means:

CDOs, or collateralized debt obligations, are financial tools that banks use to repackage individual loans into a product sold to investors on the secondary market. These packages consist of auto loans, credit card debt, mortgages or corporate debt. They are called collateralized because the promised repayments of the loans are the collateral that gives the CDOs their value.

Now, compare a CDO - a complex financial instrument to an index fund, which is just a plain basket of stocks. This is just plain moronic.

An excerpt from Nir Kaisaar’s brilliant article:

It’s a frivolous claim because index funds are merely a vehicle, not an investment per se. It’s like calling brokerage accounts or safe deposit boxes or wallets a bubble — it’s not the container that matters, but what’s inside it. Index funds track a wide range of global investments, including stocks, bonds, real estate, commodities and currencies. Surely not all of them are bubbles.

Before we go further and talk about the supposed distortion of prices, it is very important to take pause and visualise the size of this so-called “passive bubble” which I shall henceforth also refer to as “Bubblegate.” Most often than not, charts showing the fund flows from active into passive are used when fear-mongering. It works brilliantly, and I'd do the same if was crying wolf about passive investing.

Source: ICI 2019 factbook

But here’s the reality:

What’s more, there’s plenty of money moving out of closet index funds which charge several times that of an index fund into low-cost index funds. That’s a win for the investors. Here’s Ben Carlson who wrote a masterpiece of a post debunking Bubblegate.

Professional money managers have been closely tracking their benchmarks for decades now. That’s because those indexes are their benchmarks. Very few actively managed funds deviate much from those benchmarks because being different eventually leads to underperformance, which can lead these managers to get fired.

Career risk may be one of the greatest inefficiencies people never talk about but it’s there. And because career risk has always existed, closet indexing has been around for some time.

This is true even in India. Go look at the portfolio any large-cap fund and they will almost be identical to the index. Why in the hell would you pay 2% for a closet index fund, when you can get a low-cost index fund for 0.05%? Unless you have too much money and want to give some away.

Source: ICI 2019 factbook

And there you go, it’s a bubble! 🙄 Sell all your index funds and run for the hills.

Now, if index funds make up such a tiny slice of the overall market, how in the hell are they distorting prices. And as Larry Swedroe in his brilliant article, puts it, if index funds are distorting prices (which they are not), active managers should be cheering.

What’s really ironic about the criticisms aimed by active investors is that if indexing’s popularity were actually distorting prices, active managers should be cheering, not ranting against its use, because it would provide them easy pickings, allowing them to outperform. (Note that if money flowing into passive funds distorts prices, it could still make it difficult for active managers while it is occurring because distortions could persist as long as the flow continued. Eventually, though, the opportunity would manifest itself.) Here we turn to our trusty videotape to demonstrate that the exact opposite has been occurring—the rise of indexing has coincided with a dramatic fall in the percentage of active managers outperforming on a risk-adjusted basis.

Now that I think of it, it’s also maybe worthwhile thinking about the meaning of the word “bubble” before I rage on.

Here’s the definition of a bubble:

Used to refer to a significant, usually rapid, increase in asset prices that is soon followed by a collapse in prices and typically arises from speculation or enthusiasm rather than intrinsic increases in value.

I wonder how people call passive investing a bubble with a straight face. Here’s how a real bubble looks like:

This is the chart of NASDAQ during the dotcom bubble.

Burry also worries about liquidity and price discovery:

The simple theses and the models that get people into sectors, factors, indexes, or ETFs and mutual funds mimicking those strategies -- these do not require the security-level analysis that is required for true price discovery.

Price discovery becomes an issue when index funds make up maybe 80-100% of the market. When they make up such a tiny portion of the market, I am unable to comprehend how price discovery is an issue. There are enough stock pickers in adult diapers, quants, PhDs, Nobel laureates, drones, spies, and satellites looking for mispricings in the markets, exploiting them and setting the prices. As long as your maid and Uber driver are talking about investing in stocks, price discovery is golden!

Eric Balchunas had tweeted this. The price GE kept crashing even as the flows increased into the stock. How’s that for price discovery?

Also, there’s this angle:

Here’s Clifford Assness:

We’re not one of the people who are worried that the world is about to end because we have gone from around 20 percent to 40 percent passive,” said Asness, whose Greenwich, Connecticut-based firm oversees $208 billion. “I think there are too many of us being active to begin with.

Burry also worries about illiquidity in smaller stocks. The risk that fund managers will be forced sell in case index fund investors starts redeeming in the case of a market downturn. Isn’t that the case for active funds too?

“In the Russell 2000 Index, for instance, the vast majority of stocks are lower volume, lower value-traded stocks. Today I counted 1,049 stocks that traded less than $5 million in value during the day. That is over half, and almost half of those -- 456 stocks -- traded less than $1 million during the day. Yet through indexation and passive investing, hundreds of billions are linked to stocks like this. The S&P 500 is no different -- the index contains the world’s largest stocks, but still, 266 stocks -- over half -- traded under $150 million today. That sounds like a lot, but trillions of dollars in assets globally are indexed to these stocks. The theater keeps getting more crowded, but the exit door is the same as it always was. All this gets worse as you get into even less liquid equity and bond markets globally.”

Moreover, index fund investors account for a tiny portion of the overall trading in the market. And a vast majority of index funds investors, who coincidentally use Vanguard funds are more of buy and hold till death types. Again, here’s another chart from Eric Balchunas. At the depth of the financial crisis in 2008, Vanguard saw inflows every single month of the year. Eric rightly characterises that as Navy SEAL like discipline.

That’s just crazy. If you are first time investor or a millennial investing for the first you probably won’t be aware of the sheer panic in the global financial markets during 2008. Here’s a chart of the major US indices at the depth of the financial crisis. Not just the US indices, even Nifty 50 was down by over 55%.

2008-09 was a time when the global financial system was almost on its knees, and I am not exaggerating. Markets across the globe were shellacked. Just between late 2007 and 2009, nearly $8 trillion in value was wiped out in the US markets. Now imagine the collective losses across the globe. The collective brain trust of the planet went into crisis mode because they didn't see the crisis coming. Some of the most deeply held beliefs about markets and regulations were shattered during this period. There was just pure despondency and panic around the world. This was a time when many people didn’t have the certainty of a job or a home if they woke up the next day.

Now try imagining investing during this period. Trust me when I say that it takes an enormous amount of discipline and fortitude.

To further illustrate this point, here’s another stat from Vanguard:

In aggregate, trading among Vanguard households is low. In 2018, only 16% of Vanguard households traded in their accounts, a rate relatively unchanged over the 2011–2018 period of this study.

But, but, he’s Michael Burry, and he’s so damn smart. He can’t be wrong, can he?

Whenever people ask me for a target of a stock, I always tell them, anybody who predicts things is either lying or an idiot. Why do people like predicting things? It’s a question worth pondering. Post “Bubblegate”, Joe Weisenthal wrote a piece aptly titled “Why We Love to Call Everything a Bubble.” Here’s a particularly savage excerpt from the article:

But why is making those calls so popular? Well, for one thing it allows you to feel sophisticated. You can furrow your brow, shake your head sagely, talk about how “history always repeats itself,” and then cite something you once read in Charles Mackay’s Extraordinary Popular Delusions and the Madness of Crowds.

Nobody on the planet has ever had a perfect record of predicting things. Financial planner Allan Roth also wrote a brilliant piece on why this bubble talk is nonsense. In the article, he writes about geniuses and their track record of predictions:

I also give credit to Gary Shilling, who made 13 gloomy financial predictions for 2008, with every one being right. That proved to be a tough act to follow, however, as, after he was discovered and widely followed, all of his 13 gloomy 2009 predictions were wrong.

Meredith Whitney also made a brilliant gloomy call in 2007, and then followed up with a horrible prediction in 2010 stating there would be hundreds of billions of dollars of municipal bond defaults over the next 12 months, which, of course, never happened.

And of course, the list of people who got predictions right, became celebrities, and then got everything wrong is endless. Charlie Munger, one of the greatest and wittiest investors of all time, had coined a syndrome which is apt in this situation called The Shoe Button Complex. Anish pointed this out.

Munger’s grandfather had managed to corner the market on shoe buttons back around 1900. The grandfather exercised a virtual monopoly over their production and sale. Emboldened by his business acumen, the old man grew to believe that he not only knew more than anyone about shoe buttons but that he knew more than anyone about anything — and he preached and proclaimed at length on such. Munger and Buffett named the syndrome the Shoe Button Complex, and they encountered it frequently in their dealings with successful business practitioners.

Look, I am not saying Burry fits in this category, I don’t know. All I am saying is that there are enough examples of predictions by geniuses gone wrong.

It also seems like the right time to quote Jack Bogle, the patron saint of humble index fund investors:

Source: Eric Balchunas

Crying wolf since 1975

People have been attacking index funds literally from the start. When Jack Bogle launched the first retail index fund, Leuthold Group, a research firm circulated this poster on Wall Street. Jack Bogle, who sadly is no longer with us, had defiantly hung this poster in his office.

Here’s another excerpt from a brilliant article by Larry Swedroe:

At the time, competitors uniformly derided it, even calling it “un-American” and “Bogle’s folly.” Now-retired Fidelity Investments Chairman Edward Johnson was quoted as saying he couldn’t “believe that the great mass of investors are going to be satisfied with receiving just average returns.” One of the great ironies is that Fidelity is now one of the leading providers of index funds. It was also the first fund family to offer a zero-expense-ratio index-based ETF.

Here’s what the director of research at Chase Investors had to say in 1975, the year Vanguard was founded.

To be fair to Burry, he isn’t the only high-profile name to pointlessly fret about the humble index fund. Some of the biggest hedge fund titans have said stupid things about index funds.

Active management is the real bubble!

Have you ever come across an article which says active management is a bubble? And why not? There are trillions of dollars in useless, costly, poorly managed funds that even fail to beat a simple benchmark and passive index funds which give you low-cost broad-market exposure and are a tiny slice of the overall market are a bubble? What the hell!

In the immediate aftermath of the Bubblegate, Josh Brown of Ritholtz Wealth published a piece aptly titled “The Real Bubble Has Always Been in Active Management” which eviscerated this whole argument. Two of my favourite passages from the article:

The real bubble is in actively managed funds. But we’re nowhere near that bubble’s peak, which was in the mid to late 1990’s. It’s been slowly deflating since the Great Financial Crisis – the moment the Boomer generation truly fell out of love with investing as a pastime or a recreational activity permanently. There were no more star stock managers from that moment forward, as almost all of them blew up along with the indexes and averages. The investor class then said to itself, subconsciously, “Why bother, I’ll just own the indexes and averages.”

The popularity of passive investing isn’t new at all, it’s a throwback to the days of people focusing on their own work and careers, not trying to pick managers and become part-time market speculators. You can never have a bubble in humility, apathy and passivity, which had always been the status quo up until the ’87-’07 period and is the more natural posture for investors to adopt for the future.

Most often not, the guys who are complaining are active managers because index funds are stealing their lunch. Billions are flowing out every month from these costly funds, and active managers are losing their jobs and fat margins. The only reason for the lack of a spectacular blowout and consolidation in the US asset management industry has been this rip-roaring historic bull run.

Otherwise, plenty of managers would have lost their jobs, and there probably would be more consolidation. This bull run has masked the underperformance and has led to a rise in the AUM of these fund complexes from gains in market value. There are hardly any organic flows into active funds. The next bear market will unleash the mother of all shakeouts among active fund managers in the US.

Let’s take the case of India. I’m preempting this “index funds are a bubble” argument should it ever rear its ugly head in India and it will for sure. Today, Index funds make the most sense in the large-cap category. Here’s their outperformance vs a composite index of Nifty 50 and Nifty Next 50. This analysis was by the good folk at Capitalmind.

Alpha has all but disappeared barring a couple of funds and you are sorely mistaken if you think you can pick them. I had written about a few possible reasons for the disappearing alpha among large-cap funds in the previous issue.

How big are index funds in India?

When this story broke, a few Indian investors asked if they should be concerned. Honestly, I was surprised. Anyway, these are really really early days for indexing in India. Index funds and ETF make up just 5.8% of the total AUM. Having said, that the times they are a-changin. Today, it would take a special fund manager to find alpha in the large-cap space and this is borne out in the SPIVA data. In the last three years, 90% of all large-cap funds have underperformed the BSE 100 index.

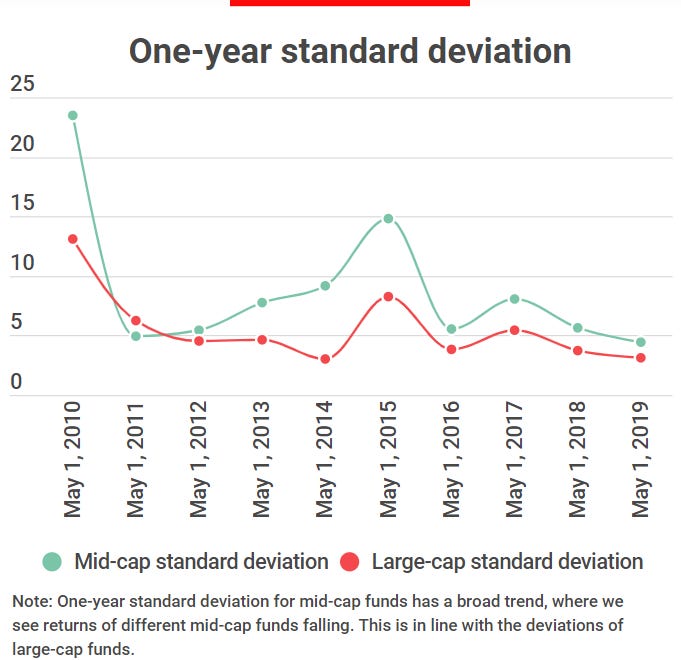

Even in the mid-cap fund space, performance seems to be converging across funds. Meaning, theres very little distinguishing one fund from the other.

Here’s an excerpt from this brilliant article by Pravin Palande.

The difference between the top-five funds and the next-five funds for the three-year and five-year period is negligible. This shows that the environment of managing mid-cap funds has now become efficient and figuring out which fund will give the best return is actually a waste of time. “The entire mid-cap space is restricted. The number of stocks to invest has remained the same. Hardly any new stocks with liquidity have entered the space. So, returns are looking similar. It is like lots of smart investors fishing in the same sea,” says Prashant Krishna, head- compliance, Capitalmind, an investment firm.

Out of the total industry AUM of Rs 25.6 lakh crores, the AUM of Index funds and ETFs was Rs 1.48 lakh crores. Out of this, the AUM of ETFs was Rs 1.42 lakh crores and Rs 6,219 crores was in index funds. The vast majority of AUM in ETFs is from The Employees' Provident Fund Organisation (EPFO). SBI Nifty 50 ETF alone in which the EPFO invests has an AUM of about Rs 57,500 crores making it the largest mutual fund in India. The 3 biggest ETFs have about Rs 90,500 crores in assets, all used by the EPFO.

Out of the Rs 6219 crores in index funds, retail investors just held about Rs 1600 crores. In total index funds only account for 0.24% of the total AUM.

Again, if somebody says that index funds will hurt price discovery, remember, we just have 1.96 crore unique investors in India. The Indian mutual fund industry has a lot to grow before index funds start hurting anything. So beware of this horseshit of an argument if anybody floats it.

There are far more important things in life to worry about, index funds aren’t one them.

🙏 Thank you for reading through my rant. You can keep the conversation going on the Indexheads Facebook group.

The goal of Indexheads is to spread the virtues of low-cost investing. We publish this newsletter just to create awareness about the merits of index funds. If you liked reading this issue, do you think it’s worth sharing? If yes, click 👇 the share button.

Further reading:

Debunking the Silly “Passive is a Bubble” Myth

Stock Pickers Are Imagining an Index Bubble

The Real Bubble Has Always Been in Active Management