Hello Indexheads,

Passivefool here

Welcome to the first edition of the Indexheads newsletter. We started the newsletter a little over a month ago and published an intro post. The response was amazing and frankly surprising given the narrow focus of this newsletter. We want to thank all of you amazing Indexheads for reading, subscribing, and joining us on this journey to spread the gospel of low-cost indexing.

Anish and I were discussing what should we talk about in the first edition and we noticed that quite a few people asked rather basic questions when we published the introductory blog post. So, in this first edition, we thought we’d talk a little bit about why index funds make sense. Since then, Michael Burry made a dumbass comment that passive investing was a bubble.

Surprisingly, this got a lot of play among Indian investors, and I received a few queries. Anyway, we’ll cover that in a separate post.

In the first edition, we thought, we’d start with the absolute basics. Although it might seem like people know what a mutual fund is and how it works, the fact of the matter is that there are just 1.96 crore unique mutual fund investors in India. Yep, only a tinyyyyy portion of India invests.

Source: HDFC quarterly results

To a vast majority of people, terms like index funds, benchmarks, active, passive etc are all alien. So, before we talk about the philosophy of indexing, a few basic terms.

Active funds

These are mutual funds where a fund manager tries to beat a chosen benchmark like Nifty 50, BSE 100, Nifty 500 etc. The manager achieves this by actively picking stocks that can deliver the best growth.

Index funds

Index funds track a benchmark and aim to match the returns of the benchmark. An index fund holds all the securities of an underlying index in the same proportion. The objective of the fund is just to deliver returns in line with the index and not to either outperform or underperform the index before costs.

Index/Benchmark

An index is a representation of a part of a market. You might have heard of Nifty 50, which is one of the most widely used benchmarks. The Nifty 50 is a large-cap index that consists of the 50 biggest companies in India. Similarly, there are various benchmarks which index various slices of the market.

Why do we need benchmarks?

Benchmarks serve a point of reference for comparisons. It’s just like you and I would compare our marks in school to feel good or bad about ourselves. It allows us to compare the performance of an investment against a point of reference.

Why index (invest passively)?

Forget what Warren Buffet, Jack Bogle, or any of the other “smart guys” have to say about indexing. I could talk about the zero-sum theory, efficient market hypothesis, and other fancy theories. But forget all that. When it comes to investing, there are only a few things you can control. You cannot control the direction of the markets, you cannot stop market crashes, and you prevent recessions, and you most certainly cannot stop Donald Trump saying dumb shit and launching nuclear missiles.

What you can do, however, is to keep your costs low and control your behaviour. Let’s talk about costs because they are one of the most important things you should know as an investor. Ironically, a vast majority of the investors today don’t care about costs or worse yet, they are oblivious about them.

When you invest in a mutual fund, you need to pay the AMC to manage your money. You pay this in the form of an expense ratio. So every day, when an AMC declares the NAV, a small fee is deducted. Now, the thing about an expense ratio is that it seems trivial. If you search for a fund on Moneycontrol or VR, here’s what you’ll see for example:

Now, you might think 2% is nothing. You’d be excused for thinking so; I used to think so when this was all new to me. Now, the thing about costs is that they compound over time. The longer you invest, the higher the impact of costs on your returns. Here’s how much you’d lose because of that seemingly tiny 2%, if you were investing Rs 5000 for 20 years and if your portfolio grew 8%. I used this handy little calculator built by Prof. Pattu (Freefincal).

If you invested in a fund that charged 2%, your investment would be worth ₹ 22,96,248. But if you had invested in a fund that charged 1%, assuming all things equal, your investment would be worth ₹ 26,07,083. That’s a difference of ₹ 3,10,835 or 12%. That 2% now doesn’t seem too small, does it?

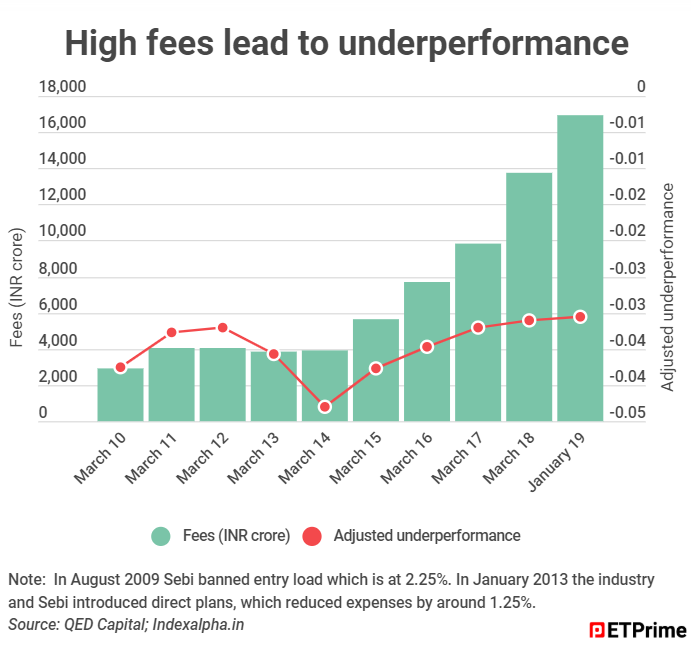

Here’s the impact of costs at the industry level

As the industry has grown in assets, so has the underperformance at the aggregate level.

Source: ET Prime

Yes, costs are a bitch! Hurts even to think about it, doesn’t it?

Now, that we know a little about the basic premise of investing, I’ll get to the point. Whenever there’s a conversation about index funds, the discussion inevitably starts with the performance of active vs passive and I think this is problematic. Don’t get me wrong, the performance of most active funds is horrible. But it is always better for an investor look at the active vs passive debate from the prism of costs rather than performance. Performance is anyways is impacted by costs.

Let’s look at the costs of funds in the large-cap category, where passive investing makes the most sense today. Here’s how the expense ratios of the regular plans of equity funds stack up. The median expense ratio of a regular active large-cap fund is 2.32%, while that of a regular passive fund is 0.17%. It’s muchhh cheaper in direct plans.

Source: Valueresearch

Always, remember, if you are investing in index funds, always choose direct plans. Only an idiot would invest in the regular plan of an index fund. If you don’t know the difference between regular and direct plans of mutual funds, check this post.

Ok, I see costs are veryyyy importantttt! How about the performance of index funds vs active funds?

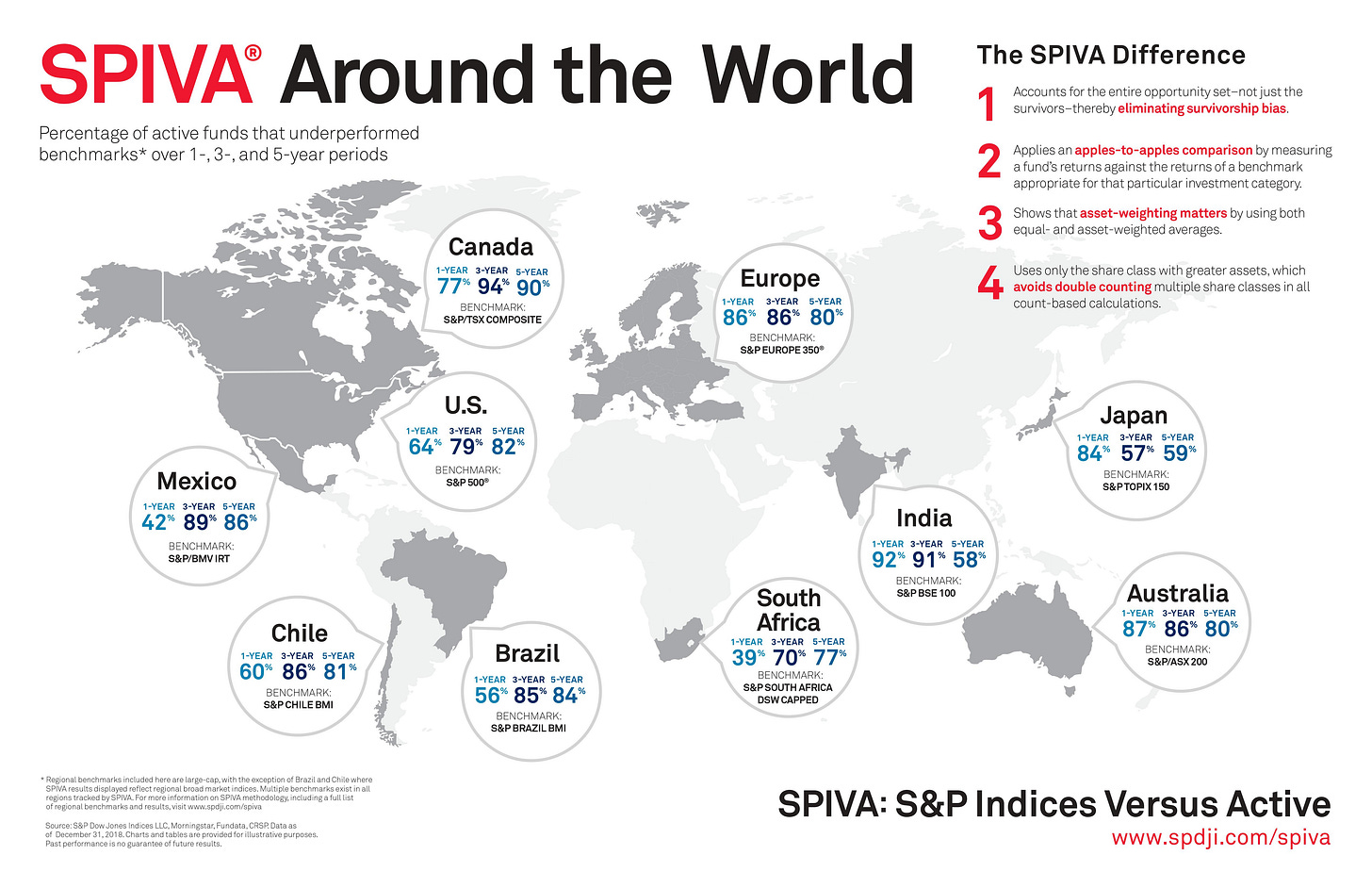

S&P, one of the largest index providers in the world publishes a bi-annual report called Indices Versus Active Funds (SPIVA). This report measures the performance of active funds against their benchmarks. Here’s a snapshot from the 2018 year-end report.

Across almost all the categories, your odds of picking an outperforming fund are worse than a coin toss.

Take a look at the large-cap category. In the last three years, 90% of all funds have underperformed the index. There have been a few regulatory changes that have precipitated this.

Mandatory benchmarking to total return indices

Like I’ve explained above, every mutual fund needs to have a benchmark. But most mutual funds up until 2018 were benchmarking schemes to price returns index (PRI) as opposed to the total returns index (TRI). Ok, what the hell are price and total returns indices you ask?

When you go to Moneycontrol and look at the value of say, Nifty 50 or any index for that matter, you are looking at the price returns of the index. A price returns index just captures the price increase and decrease of all the underlying stocks.

What’s wrong with that you ask? Well, stocks also declare dividends and PRI indices, don’t capture this. But the TRI indices capture dividends declared. If you are wondering how that makes a difference. TRI returns will almost always be higher because they include dividends. Here’s Nifty TRI vs Nifty PRI and notice the difference?

In 2018, SEBI mandated that all fund houses use TRI indices as benchmarks. Up until then, most funds were using PRI indices, fricking scamsters. They used to show the difference between PRI and TRI as performance. This vanished with the SEBI regulation.

Scheme recategorization

Later in 2018, SEBI also announced the recategorization of all mutual fund categories. As per the new categories, each mutual fund was allowed to have one fund per category except for index funds, fund of funds (FOFs), and thematic funds. Before this, fund houses were running multiple funds which were almost the same - just to gather assets.

None of the mutual funds took categorization seriously, they were just labels. A large-cap fund manager could buy midcaps and even smallcaps in some cases to generate that extra returns. Yes, fund managers used to do indulge in such shenanigans before these regulations.

Costs

The median expense ratio of a large-cap fund is 2.3% while that of an Index fund is 0.17%. Just to keep up with an index fund, a large-cap fund has to outperform by 2.13%. See how IMPORTANT costs are?

EPFO inflows

The Employees' Provident Fund Organisation (EPFO) in 2015 had decided in to invest 5% of its incremental inflows in equities. It later increased the limit to 15% in 2018. EPFO, according to Value Research, sees about Rs 1.2 lakh crores of inflows every year. 15% of annual flows, about Rs 18,000 crores are now flowing into equities.

EPFO has chosen the passive route to invest in equities through Nifty 50 and Sensex ETFs.

Efficiency

Large-cap stocks are the most widely tracked stocks. From international research houses to domestic ones, all major research entities track these stocks. So, the chances of some fund manager coming across a piece of unknown information that can give him an edge are slim to none.

Bottom line

Today, it’s a no brainer to use index funds to gain large-cap exposure. That is unless you want to be charitable by paying ~2% to an active fund. I mean, I am not sure if you’ll get some karma points or not, but hey, it’s your money if you want to throw it away. Don’t get me wrong, I am not saying that active funds will never outperform the indices. They may or they may not. But unless, you have a know a baba who can predict the future, trying to pick a large-cap fund that may outperform is a fool’s errand.

Ok, that’s about large-caps. What about mid and small caps?

The mid and smallcap spaces are still to an extent, the domain of stock pickers. Even in the last year when there was a bloodbath in mid and small-caps, most funds did better than the index in terms of the fall. Having said that, there seems to be some evidence that the performance of mid-cap funds seem to be converging

Here’s an infographic from this rather revealing article about mid-cap funds by Pravin. The difference between the top-funds and next-five funds has been consistently narrowing. Meaning, any random fund you pick, odds are that the returns will be similar to the other funds in the category.

When it comes to small-caps, for now, it’s better to stick with a decent active fund. Interestingly, here’s an interesting snippet from a recent Value Research interview of Aashish Somaiyaa, CEO of Motilal Mutual Fund.

What’s your view on the level of churn in these indices? Of the current 250 constituents of the Nifty Smallcap 250, 64 weren’t a part of the index in July last year. Passive is not all that passive?

That’s a lot of churn. I haven’t verified the fact but too much churn eats in the returns because there are costs associated with changing stocks in a fund.

Ok, fair enough, can I use mid and small-cap index funds?

Up until recently, we didn’t have index funds for mid and small-cap indices. Motilal Mutual Fund, in August 2019, launched index funds tracking the Nifty Midcap 150 Index and Nifty Smallcap 250 Index. We had a few ETFs, but they are illiquid still. For now at least, better to stick with good active funds, at least for mid and smallcaps.

I hope this gives you an idea about indexing.

Misconceptions & grouses

Now, I’d also like to like to clear some misconceptions about indexing and index funds and also answer some questions people asked us when we tweeted out the newsletter.

An Index always goes up.

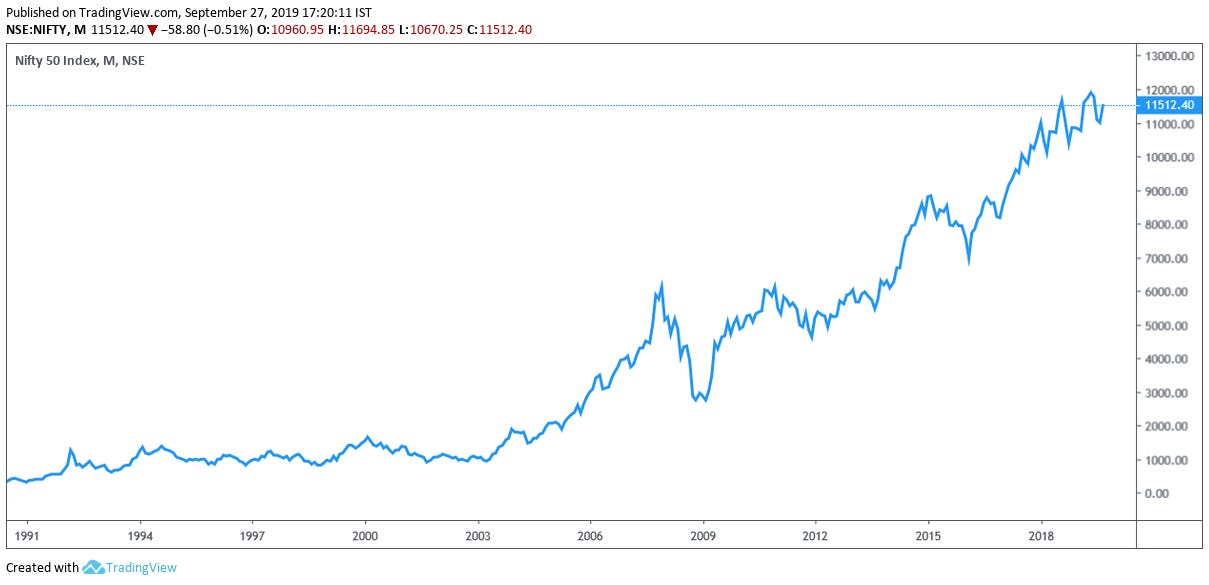

Saw this on Reddit and it just amazed me. I mean, sure, it looks like that because historically Indian markets have gone up.

But, markets can also go a long time without doing anything or crashing hard and fast in a short span of time. For example, in 2008, Nifty 50 crashed about 60% in a few months. And there can be long bear markets - Japan had a 20+year bear market from the 90s to late 2000s. Yes, try thinking about that without losing your mind and getting seduced by the safety of a fixed deposit.

Indexing only works in efficient markets

Ok, this argument has been coming up too frequently of-late. Sure, as markets get more efficient, the chances of active managers outperforming the benchmarks reduces. There’s no denying that and we have proof.

But regardless of market efficiency, you will get the average market return and at low-costs. It’s as simple as that, forget the efficiency of the markets.

Index funds are average!

Correct. No matter what happens, when you buy an index fund, you are guaranteed the average market return. In most parts of our lives, being average is a bad thing. But when it comes to investing, you should strive to be average. Just by being average, you will end up better than over 50% of all investors. How’s that for being average?Index funds are always cheaper

Broadly yes, but there are always exceptions. For example, the expense ratio of UTI Nifty 50 direct fund is 0.10% while Franklin Nifty Index fund charges 0.68%. Both funds are meant to track Nifty 50, and there is absolutely no difference between them.

Mailbag

Here are some questions from investors. We’ll try to have a mailbag edition every week where we answer questions from investors. If you have any, you tweet me and Anish.

Any links resources for me to understand more about indexing and index funds?

This will change the way you invest: S&P Index Versus Active Funds report by Avinash Luthria.

The case for low-cost index-fund investing - Vanguard

Jack Bogle on Index Funds, Vanguard, and Investing Advice

The Benefits of Using Index Funds - Ben Carlson

And Now for Something on Index Funds | Jason Zweig

The Arithmetic of Active Management - William F. Sharpe

Thank you. Please do share this, if you enjoyed reading.