We were supposed to publish a different post, but I am kind of glad that we didn't. Ideally, this post should have been the first thing we ever wrote, in hindsight. But the start of a new year is an even better time, I guess.

If you were looking for real-life heroes, people who have done extraordinary things that impact the masses, the investment management world would be the last place you'd look. I'd go so far as to say that you wouldn't even consider looking there.

Think about it; the world of investing isn't kind to heroes. In fact, it turns even the most good-hearted people into villains. The investment management industry is filled to the brim with rent-seekers. People whose sole job is to take as much as possible from the average investor, while giving very little back, if anything at all.

Rent-seeking definition

The act or process of using one's assets and resources to increase one's share of existing wealth without creating new wealth.

A couple of days ago, I was searching the archives of some of the podcasts I’ve subscribed for something to listen to. I found an old 2007 conversation of John Clifton Bogle also fondly known as Jack Bogle among the archives of EconTalk by Russ Roberts. I immediately started feeling a little nostalgic and emotional because Jack Bogle is one of my personal heroes. I started listening to it, and I immediately wanted to write about the message Jack spent his entire life preaching. It has been uttered a million times but there are still billions more who need to hear it.

Jack Bogle, if you aren't aware, is the founder of the Vanguard Group and the creator of the world’s first retail index fund. If you look across the history of the investment management profession, you'd be hard-pressed to find somebody who has done more for the average individual investor than Jack. In an industry filled with charlatans and liars, Jack Bogle came to be referred to mockingly at first, but rightly so as saint Jack.

The story of Jack is that of undaunted perseverance in the face of what would seem like insurmountable odds to average humans. Jack spent over 50 years fighting to deliver a good deal to the little guy. Jack is a revolutionary in the truest sense of the word. The revolution he started - the Index revolution has delivered incredible financial outcomes to millions of average working and middle-class men and women across the world.

As I started listening to the podcast, I figured what better way to start this new year than write about the story of Jack and the message he relentlessly spread with a missionary zeal till the day he passed. I don't look up to a lot of people in the financial world, because I believe the vast majority of people are full of shit and disingenuous. I can count the number of people who genuinely care about investors and walk the talk on one hand.

But Jack Bogle was one of those rare people who fought his entire life to ensure that the average investor gets a good deal. He followed what he preached and was a man of irreproachable integrity, honesty, and humility. I think this quote perfectly sums up Jack:

While some mutual fund founders chose to make billions, [Jack] he chose to make a difference. - Boglehead’s Guide To Investing

The investing lessons you could take away from what Jack wrote and spoke are endless. But I think there even greater lessons to learn from the way Jack lived his life. Here's the incredible short story of my hero Jack Bogle.

Today, Vanguard is one of the world's largest asset managers with close to $6 trillion under assets. But the story of how Jack started Vanguard and the first index fund is now the stuff of legend.

The bad times

After graduating from Princeton University, Walter Morgan, founder and CEO of the Wellington Management Company, hired Jack as his clerk. But Jack quickly rose through the ranks. By 1955 he was the assistant to the president, by 1962, the executive VP and Jack became the president and CEO of Wellington in 1967.

There was a massive bull in the 1960s and investors flocked to the markets in droves. This era was later referred to as the go-go era. Think of it as being a 100 times worse than the 2014 mid and small-cap rally, when everything, quality and junk alike went up. This was an era when investors were chasing shiny objects

Inflation-adjusted chart of the S&P 500

The flagship fund of the Wellington Group was a conservative balanced fund, and the performance of the fund started slipping. Here's an excerpt from Big Mistakes by Michael Batnick:

Performance first started to fall behind as Bogle's responsibilities grew. From 1963 to1966, the flagship Wellington Fund gained just 5.1% annually, well below the 9.3%return of the average balanced fund. As the environment started to heat up and the conservative nature of Wall Street was transformed by the first generation of new blood to enter since the 1920s, management decided it needed to do something to keep up with the changing times. “Lured by the siren song of the Go Go years, I too mindlessly jumped on the bandwagon.”

Jack had to something and he engineered a merger with Thorndike, Doran, Paine & Lewis Inc. an up and coming firm based in Boston headed by four new hotshots of the same names. They were managing a go-go (read a fancy flash in the pan fund) fund called the Ivest fund. In the process of the merger, Jack had let go of majority voting control of the board. The new managers held 40% compared to Jack's 28%, and all seemed well until it didn't. The go-go era came to a painful end as the markets cracked badly starting 1969.

This lousy phase culminated in 1974 when Jack, as he would later say was “fired with enthusiasm” from the Wellington Management Company. But given the structure of the mutual funds, he was still the Chairman of the board of Wellington Funds. The members of this board voted to retain Jack. It was decided that the management and the distribution of funds would remain with Wellington Management. At the same time, Wellington Funds would be responsible for the administration of funds, shareholder record-keeping, sending out letters etc. but would not be able to manage funds ever again.

Now think about this moment for a second. Jack's career in the mutual fund industry seems like it is almost over. But like many times before and many times after, Jack was stubborn to a fault. In a situation where any sane person would have given up, Jack had found a way. Wellington Funds later became Vanguard, a new group with a mutual structure. The company was owned by its funds which were in turn owned by investors. The company was only answerable to its investors. The goals of the firm and that of the investors were perfectly aligned. This was the closest an investment management company could get to being a non-profit entity.

Jack later convinced the Board of Wellington Management to let him launch an “unmanaged fund”, and as luck would have it, the board agreed. Remember, Jack and Vanguard weren't allowed to manage funds ever again. But since the Index fund wasn't managed in the strictest sense of the word, Jack managed to convince the board.

Although Jack had thought about Indexing when he wrote his senior Princeton thesis in 1951, the lightbulb moment for Jack Bogle was the now legendary article titled "Challenge to Judgment" by the legendary economist Dr Paul Samuelson. In the article he wrote:

A respect for evidence compels me to incline toward the hypothesis that most portfolio decision makers should go out of business- take up plumbing, teach Greek, or help produce the annual GNP by serving as coporate executives…Some large foundation should set up an in-house portfolio that tracks the S&P 500 index- if only for the purpose of setting up a naive model against which their in-house gunslingers can measure their prowess.

The ball, as I have already noted, is in the court of those who doubt the random walk hypothesis. They can dispose of the uncomfortable brute fact in the only way that any fact is disposed of – by producing brute evidence to the contrary.

This was the final push Jack needed and this was the moment when the world's first retail index fund was born. From being at a point where nothing was going right and it seemed like his career was over, Jack, just by virtue of his sheer superhuman perseverance found a way to turn things around.

Doing the right thing, always, no matter what!

The challenges didn't quite end there. If convincing the board to launch the index fund was in itself a big challenge, convincing Wall Street to buy into the concept of an index fund, an alien concept at the time was a whole another. So in 1976 Vanguard finally launched the first index fund. The underwriters of the First Index Investment Trust (Vanguard S&P500 Index Fund) were confident of raising $150 million. But after three months, they could only raise $11.3 million, 93% less than what was projected. Adversity was waiting for Jack with open arms.

The launch was an utter failure. Now think about this moment, an average person would have given up at this juncture. Vanguard led by Jack hadn't even raised enough money to buy all the shares part of the S&P 500 index. Instead of returning the money, as luck would have it, Jack chose not to give up and go ahead with the launch of the fund. Since they couldn't buy all the stocks part of the index, Jack and others employed a sampling methodology. They basically picked a few stocks from each sector that broadly resembled the index and so the world's first index funds was now a reality. One of the other crazier things was that the fund was being managed by a young woman who was working part time for Jack, while her full time job was in her husband’s furniture store.

The problems quite didn't end there for Jack. Vanguard by then had decided to go “no-load” meaning no commissions. Frontend loads, of 7.5% to 8.5% were common. Jack proposed to internalize the distribution costs to the fund expenses, but a Wellington Fund shareholder opposed this proposal causing further problems. Meaning Vanguard couldn't spend to distribute from the fund assets, even though other managers were reaping insane amounts of profits. This overhang wasn't solved until 1981 when the SEC finally ruled in favour of Vanguard.

On top of that, given the bear market of the 1970s, the funds were bleeding assets.

All the Vanguard funds saw 83 months of consecutive outflows starting May of 1971 and ending in January of 1978.

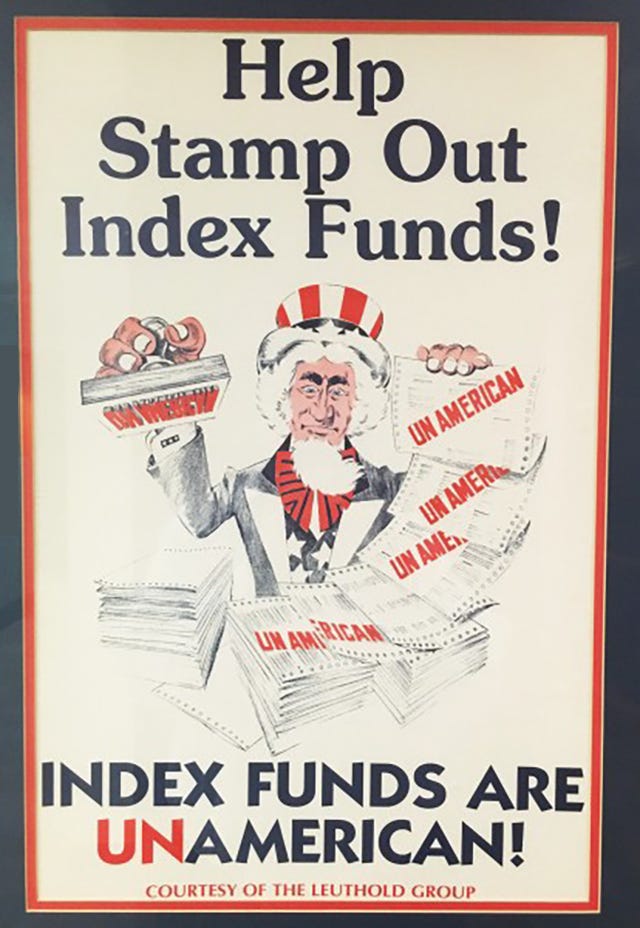

The attacks

Add this, the mutual fund industry started attacking the index fund right from the get-go. Leuthold Group, a research firm circulated this poster on Wall Street calling the index fund “un-American”. Jack, to his credit, had hung this poster defiantly in his office. The fund was also labelled as Bogle's folly.

Edward Johnson, the Chairman of the Fidelity Group, one of the biggest asset managers even at that time, said:

“I can’t believe that the great mass of investors are [sic] going to be satisfied with just receiving average returns. The name of the game is to be the best.”

Competitors:

“Who wants to be operated on by an average surgeon?”

We are going on record now because of the wave of publicity about index funds that, by their charter need to do no better than the average. As professionals, we reject the thought of settling or the averages. Whatever road other fund managers take we are going to strive for excellence.

But Jack was resolute, he knew that this was the right thing for investors and the numbers even at that time were on his side. The fund wouldn’t hit the $1 billion mark until 1988, over a decade later. But the revolution was underway!

Trickle, then a deluge

It took a while for the revolution to take hold firmly. Even as late as the 1990s, Vanguard just had about $56 billion in assets. It would take another 15 years for Vanguard to almost hit the $1 trillion mark. But the 2008 crisis is what opened the floodgate of inflows into Vanguard funds. The financial crisis, as I had written in a previous issue, was a watershed moment. Investors and advisors alike realized that they weren't getting the performance that they were paying out of their ears and noses.

The power of compounding without the tyranny of costs

Jack would later meet the counsel and the underwriters of the first index fund in 2011 to celebrate the 35th anniversary of the index fund. This is what the counsel to the underwriters shared at the meeting:

I wanted to help out the underwriting, and bought 1,000 shares of the First Trust Index at the offering price of $25 per share, which included a 6% sales charge. I've reinvested all my dividends in full, paying the taxes separately. Before coming to this dinner, I looked at my most recent fund statement. Here's what it shows. I now own 4,493 shares and at today's net asset value of $250.99 per share, their current asset value is $1,127,704."

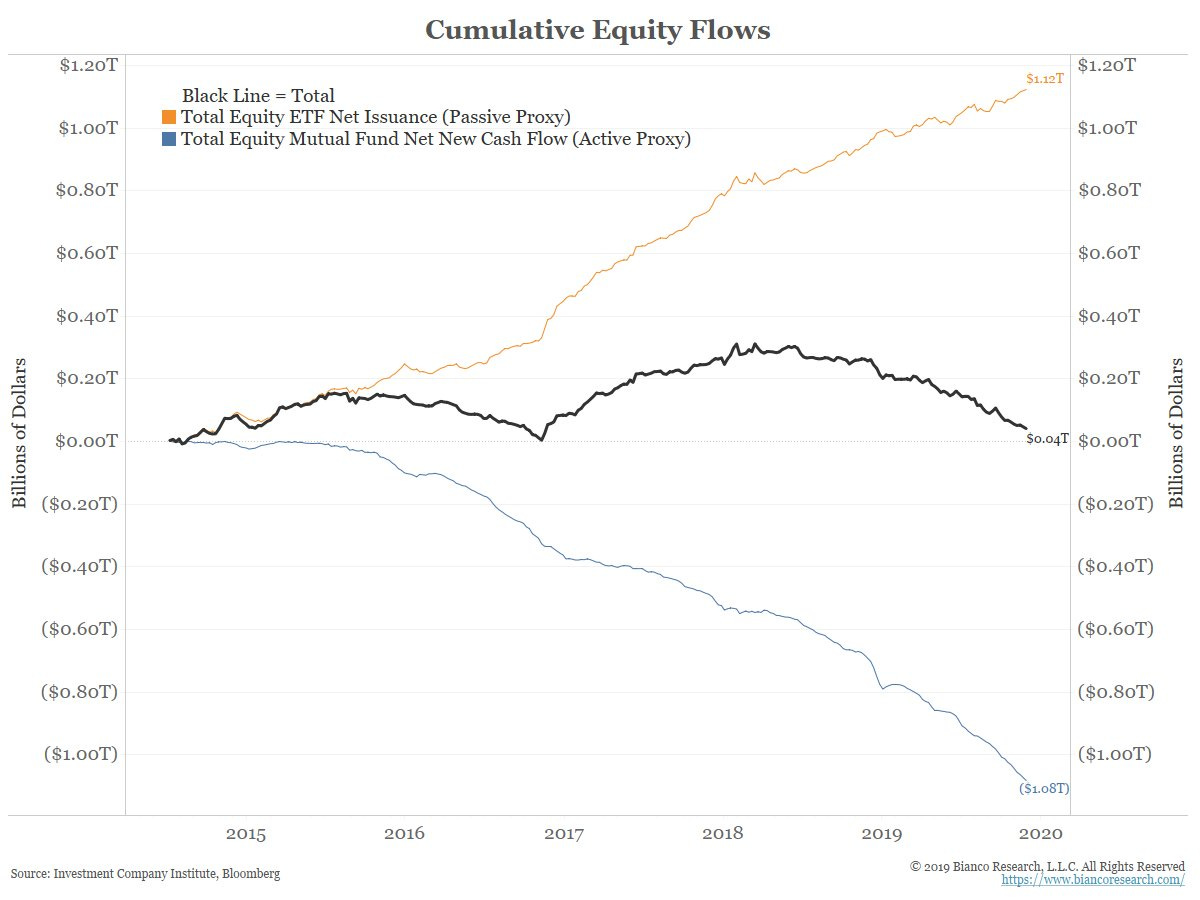

Bogle’s folly - the revolution takes hold

Source: Bianco Research

Over a trillion dollar shift from high cost active to low-cost broad market index funds.

The undercover philanthropist

Right from day 1 of Vanguard, Jack believed in keeping costs low. While most people frame the active vs passive debate in terms of performance, for Jack, it was never that, but it was low-cost vs high cost. Performance is anyways a result of that. As Jack often used to remark:

In investing, you get what you don't pay for

Given that Vanguard is a true mutual company, i.e. owned by its funds and in turn investors, the profits that it generates is passed on to the investors in the form of lower expense ratios. And Vanguard has been consistently slashing expense ratios and putting more in the pockets of investors since it's inception.

The genius of Jack was not just in putting more money into the pockets of Vanguard investors, but also forcing the entire industry to do the same. Albeit, they did it kicking and screaming, but he didn't care. All through his life, Jack railed against Wall Street's penchant for ripping off the little guy. He was rightly called the Sheriff and the conscience of Wall Street.

To the little guy

Source: Barrons

As a result of the dramatic decline in expense ratios, it is estimated that Vanguard is responsible for saving investors over $500 billion in fees. That's just an astounding number. To put that into context, the total AUM of the entire Indian mutual fund industry is about $320 billion.

In the immortal words of Hamilton Nolan:

Che Guevara looks good in a beret, and Eldridge Cleaver had his moments, but today let us all take a moment to honor Real Motherfucking Hero of the People: John motherfucking Bogle, who has kept hundreds of billions of dollars out of the pockets of Wall Street greedheads.

Half a trillion dollars that would have gone to Wall Street motherfuckers for no good reason has instead gone to Joe and Jane Average investors and retirees, thanks to John Bogle.

Morgan Housel aptly called Jack Bogle “the biggest undercover philanthropist of all time.”

From folly to fear

From the being labelled as Bogle's folly to being called a bubble, the humble little index fund has come a long way.

The true measure of a man

True Jack created the index fund, made investing almost free and accessible to everyone. But one thing that made Jack truly special was how grounded, humble, and accessible he remained till his last breath. A cursory search and you can find some amazing and powerful personal stories. Jack indelibly changed the lives of investors, advisors, hedge fund managers, and anybody who even once interacted with him. I found Rick Ferri’s recollection of how Jack changed his life particularly powerful.

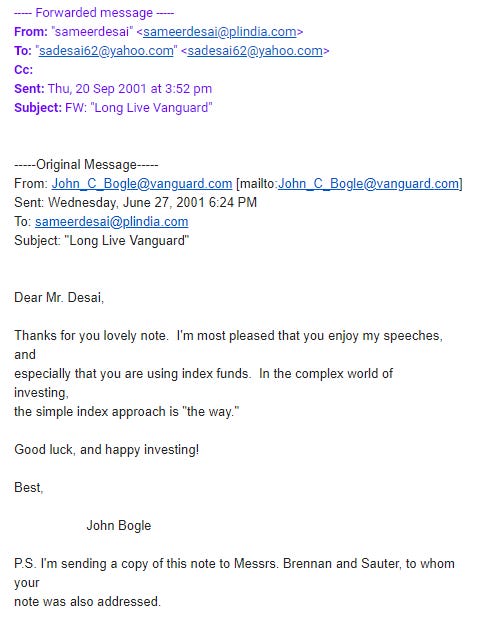

Jack used to write handwritten letters even in the age of the smartphone to individual investors. Later on, he adopted email. This humility of Jack has been a recurring theme across conversations I've heard about people describing Jack. Even Sameer Desai, a friend of the newsletter had received an email from Jack. Here's a screenshot, Sameer gladly agreed to share:

Jack retired from Vanguard in 1995. Jack had a heart condition, and by this time, he had already suffered multiple heart attacks. In 1996 he received a heart transplant at a ripe age of 67. After retiring from Vanguard, he became an evangelist for the humble index fund. He continually kept talking and writing about the same thing over and over again. Nothing could stop jack, not even illness. The Bogleheads is a community of people inspired by Jack dedicated to spreading the gospel of low-cost Indexing. They hold an annual conference every year. Jack spoke there regularly, and in one of the year's Jack couldn’t make it because he was sick. But that didn't stop him, he still spoke from the hospital.

In an industry that thrives on wrapping bullshit in the garb of complexity, Jack's message was brutally simple:

Keep your costs low by investing in low-cost broad market index funds

Ignore Mr Market's noises and keep investing

Don't peek

Stay the course!

He remained humble and forthright till his last breath. Think about it, with all the fame and constant praises, weaker men would have figured out ways to make money off it. But Jack remained the ever-humble missionary constantly preaching the gospel of low-cost investing.

Here are a couple of really amazing anecdotes from Allan Roth and Burton Malkiel:

Alan Roth, founder of Wealth Logic

I first met John Bogle about 16 years ago after I wrote him a letter thanking him for his work and telling him how much I’d like to meet him. A week later, I received a handwritten card telling me that he was going to be in my area in the next month and would be “pleased to set up a meeting.”

I arrived early at the Denver Sheraton, my heart pounding in anticipation. When he walked into the hotel’s restaurant and sat down, I noticed he looked a bit angry. “Mr. Bogle, is something wrong?” I asked. He told me he had just lost a dollar in the hotel vending machine and that he was going to the front desk to get that dollar back after our meeting.

Burton Malkiel, economist, CIO of Wealthfront, and the author of A Random Walk Down Wall Street:

Jack told me—perhaps with some embellishment—about a time he had to stay at New York’s Plaza Hotel to attend a meeting. When his turn in the check-in line came, he informed the desk clerk that he wanted the cheapest room possible. The clerk suggested an economy single at $250, but Jack insisted that was way too high. After Jack rejected other alternatives, the exasperated clerk indicated that there was a windowless former broom closet next to the elevator shaft for $89. Jack quickly said, “I’ll take it.” As the clerk was looking for the key, Jack turned to a man waiting behind him and apologized for holding up the line. The man, who turned out to be a Vanguard shareholder, said, “Oh, that’s perfectly OK. You’re Mr. Bogle, aren’t you? Cheap! Right?”

Jack was also witty and funny. In 1995 he was scheduled to speak at the Morningstar conference but couldn’t because he was due to get a heart transplant. He was back at the same conference in 1996 and opened saying he was supposed to speak there last year but had a change of heart.

The greatest tribute

When Jack unfairly passed at the beginning of the year. There was an outpouring of tributes and remembrances. Everybody from the titans of investing world to the average retiree sang Jack's praises and shared their favourite recollections.

Rick Ferri, Investment consultant, hourly adviser:

You cannot measure the quality of a man by the size of his bank account, but in John Bogle’s case, you can measure it by the size of your bank account. No one on this planet has done more to increase the lot of individual investors in the last 50 years than John C. Bogle

A tribute from perhaps the greatest active investor of all time.

Warren Buffet sang Jack's praises at the Berkshire annual shareholders meeting.

In the 2016 annual Berkshire Hathaway letter, Warren Buffet wrote:

If a statue is ever erected to honor the person who has done the most for American investors, the handsdown choice should be Jack Bogle. For decades, Jack has urged investors to invest in ultra-low-cost index funds. In his crusade, he amassed only a tiny percentage of the wealth that has typically flowed to managers who have promised their investors large rewards while delivering them nothing – or, as in our bet, less than nothing – of added value.

In his early years, Jack was frequently mocked by the investment-management industry. Today, however, he has the satisfaction of knowing that he helped millions of investors realize far better returns on their savings than they otherwise would have earned. He is a hero to them and to me.

Clifford Asness, CEO, AQR Capital Management

Though we knew it was imminent, the day we lost Jack, nevertheless, still felt shocking. While perhaps unlikely, given our age and investing style differences (everyone knows an indexer and a quant active manager can’t be friends, right?) we had become quite close over the years. He was such a force for good, and had such vitality, it’s difficult to imagine the world without him. He was one of the last heroes and one of the last old school gentlemen. And up to the very last he was working! He was writing his business memoir (and a history of Vanguard) and commenting widely and, of course, honestly and bravely, on the burning investing issues of the day. Put simply, no single person has ever done more for investors while asking less for himself. Nobody comes within a mile. We won’t see his like again.

Larry Fink, founder Blackrock

But, I think the greatest tribute to Jack fucking Bogle is the cottage industry that has developed itself dedicated to attacking the humble low-cost index fund. Why? Because the humble index fund has threatened the livelihoods of charlatans and crooks who had for decades engaged in legalized thievery. Ironically, some of the smartest and accomplished investors, hedge fund managers have also been blaming index funds for all sorts of things.

Think about this for a second. What is an index fund? And by that I mean the true index fund - market cap-weighted, low-cost broad-market index fund? It's a fund which buys all the stocks proportionally that are part of the index. For example, the S&P 500 or the Nifty 50. They just hold all the stocks in the same weights as an index - simple, nothing more, nothing less. There are no exotic structures or black box methodologies, or secret sauces. A simple index fund just buys all the damn stocks in the market.

As an aside, the term “Index Fund” has lost its meaning. Today, any product which replicates an index is called an index fund. You can create an index of Indian CEOs who like to wear pink and create a fund for that and call it an index fund.

But this simple fund has been ruthlessly, and relentless been attacked from day one. People have called it a bubble, called passive investors zombies and parasites. Research firm Sanford Bernstein in a now-infamous paper called Indexing is worse than Marxism. At a conference in 1990, a speaker said that Jack Bogle was "worse than a communist, and more like a Bolshevik". Even the titans of the investing word like Bill Ackman, Howard Marks, Carl Ichan, Paul Singer among others have been saying silly things about index funds:

Most recently, it was the turn of Micheal Burry, who was immortalized in the book The Big Short by Micheal Lewis and also in the movie of the same name.

In the last five years or so, people have been blaming index funds for everything from the increased valuations, poor investor behaviour to changes in market structure. They have also been prognosticating that index funds and ETFs will be the cause for the next great recession. I wouldn't be surprised if people started blaming index funds for wars, hunger, and other conflicts.

What better compliment than all these people spending endless hours attacking Jack Bogle's creation? :)

I would have loved to meet Jack or to have written to him, but sadly he is no longer with us. Think about it, even in India, the expense ratios of some of the Index funds are as cheap as the US. For example, the expense ratio of Nippon Niftybees is just 0.05% and the UTI Nifty 50 Index Fund (Direct) costs just 0.10%. This wouldn't have been possible without Jack and all Indian index fund investor owe a tremendous debt of gratitude to Jack goddamn Bogle!

Jack, if you are looking down on me at this moment, thank you for teaching me to put the interests of investors first, above all else. And thank you for creating the index fund and giving millions of ordinary folk around the world like me a simple way to build wealth to fulfil our goals. We owe you so much, you are a real goddamn treasure, and I love you.

This post is also a tribute to Jack from the entire Indexheads team for all that Jack has done for the aam investor. We are incredibly proud of spreading the low-cost indexing gospel of saint Jack.

Finally, coming back to the podcast that inspired this post, here's Jack Bogle on EconTalk.

Here's an amazing webcast of Jack answering queries from investors on a webcast celebrating his 65 years in the industry.

Here's another amazing podcast of Jack with Barry Ritholtz.

We'd also highly recommend reading these 2 books by Jack Bogle:

You can also read some of Jack's most legendary speeches here.

🙏 Thank you for reading our tribute to Jack. You can keep the conversation going on the Indexheads Facebook group.

The goal of Indexheads is to spread the virtues of low-cost investing. We publish this newsletter just to create awareness about the merits of index funds. If you liked reading this issue, do you think it’s worth sharing? If yes, click 👇 the share button.