Hello, all you doomed humans, Fool here. Hope all of you and your people are well. This stupid virus is on a rampage, so please don’t take it for granted and try to live!

Things have been really good for investors. Market crashes and bear markets have been banned, and the Federal Reserve has ordered the markets to only go up. Since the bottom in Mar-April 2020, pretty much everything has gone up in a straight line.

In fact, this has been a market in which even active fund managers have started beating their benchmarks. This shows how easy it has been to make money. What has been hard in the past year has been to lose money. Not just coffee cans, even garbage can portfolios have gone up.

Perhaps, the best description of the market phase we are going through was the phrase Upside-Down Markets coined by Jesse Livermore of OSAM in a piece with the same title. The fact that the markets are so bullish on humanity ending makes no sense. But that’s the job of the markets, to confuse the shit out of us.

And good times in the markets are a magnet for newbies. Just look at the growth in demat accounts and active users. I’ve highlighted the growth in 2020, and it’s stunning.

And we’ve reached the neighboring aunties asking Dogecoin tips stage of the bull market. Look, I’m not going to call tops, I’m a coward, and I don’t have the guts to call one. I think calling a top or a bottom is just about the bravest thing you can do in the markets.

The reason I wanted to write this post is that the questions I’m getting from my friends are scaring me. When times are good in the markets, It’s easy to let go of your common sense and go crazy. This is a market in which 16-year-olds have become trading mentors and coaches. That should give you pause.

But, it’s important to realize that just like bad times don’t always last in the markets, good times don’t either. Everything, including your kidney stones, will pass, and this too shall pass.

I was listening to this podcast of Stanely Druckenmiller, and the quote “don’t confuse brains with a bull market” stood out for me.

It’s so true, isn’t it? In a market where anything you do works out, it’s hard not to feel like a genius. But it’s important to realize that we mostly have no clue what the markets are going to do, and we’re mostly not really that smart.

But we’re in a market phase where if people sort funds based on 1-year returns, they’ll see this. In fact, as of writing this post, there were 39 funds with 1-year returns over 100%. And I see plenty of new people investing with the expectation of the same returns going ahead.

And more worryingly, we’re in a market where people keep telling me to shove index funds up my 🍑 because they can make 10-years’ worth of Nifty returns in a few months in crypto. They tell me that Nifty 50 looks like a liquid fund compared to Dogecoin😐

If you think this whole crypto-mania is only outside India, you’re wrong. From Jan to March 21, WazirX, one of the popular Indian crypto platforms, doubled its userbase. CoinDCX, another platform, went from 1.5 lakh users to 4 lakh users in 15 months. CoinSwitchKuber, also an Indian crypto platform, claims to have added 3 million users in 1-year 🤯😲😭

And Individual investors have entered the markets in droves. Retail investors account for 43% of the equity volumes today. They’re no longer minnows, they’re the big daddies, and much of that surge has come post-pandemic.

Forget the crypto nonsense, the growth of individual investors is a really good thing. Oh, before some crypto groupies hatch a murder plot, you can take all your dogcoins and your shitcoins, wrap them in 5 layers of aluminum foil shaped like a flowerpot, and sit on it. Except for Bitcoin & Ethereum and maybe some of the De-Fi stuff, 99% of crypto is an outright SCAM!! There, I said it!

But Nothing works like greed and mis-selling to attract new users. People who think investor education and awareness work are living in fantasyland. But the problem is that a lot of these equity and mutual fund investors expect 👇

And where there are greedy retail investors, there are snake-oil salesman and AMCs with a bucket full of shitty NFOs. Just browse through Twitter and it feels like everybody is an options trainer off late. As for the AMCs, In the last year, here are a few NFOs that have raised some mind-boggling sums of money. If you take away the fancy names, these funds are as useful as a torn underwear in winter. And that’s not even the worst part. These NFOs were launched at a time when the industry was seeing 8+ months of consecutive equity outflows.

If you are wondering, how did they raise so much money, look at the common denominator. Most of these funds are from bank-owned AMCs. And having spoken to several industry insiders, the AMCs apparently made sure the banks pushed these funds in any way possible. So the bank RMs sold these absolutely shitty funds to anyone they could find, even retirees 😖

These AMCs and their disgusting shenanigans. It’s surprising how myopic these AMCs are. Always ready to sell garbage to rip-off dumb investors instead of building long-term relationships with investors and help them build wealth.

But…

As Kangana Ranaut wisdomously said:

This too shall pass. It may pass like a kidney stone, but it shall pass.

Just as bear markets aren’t forever, bull markets aren’t either. In March-April 2020, a lot of wise men foretold that the bad market phase would pass. In May 2021, I, the wisest of all fools, am telling you that these good times today will pass too. I don’t know when. Only the people on CNBC do. But they will pass, like a swift fart.

It’s very easy to be tempted by all the good returns and lose control and do dumb shit like 100% equities, borrowing money to invest or trade, put your retirement money in shitcoins, and so on. But this will end badly. Good returns in the present are most often than not, a sign of low returns in the future. Since the Nifty 50 index started in April 1996, it has returned 11-12%. But going forward, I personally think that the returns are going to be much, much lower. So, if you’re expecting 20-100% returns, I have a seminar to sell you.

And no, I’m not going to give you reasons like the Fed money printing, deflation, and all those things. I don’t know. It’s just that I think we’re heading into a low returns environment and I could be a 169% wrong. And when you expect low future returns, there’s isn’t any magical secret to generate high returns. For most common people, the only solution is to save more to make up for the low returns.

Whether you agree or not, this tweet sums it up:

For all the simple investors like you and me, the only high probability way to reach our goals is to:

Invest as much as possible if you can

Have an asset allocation that you can live with

Keep costs low. Avoid 99% of active managers like the plague

Not do dumb shit

Pray and hope the markets go up #IndiaGrowthStory😂

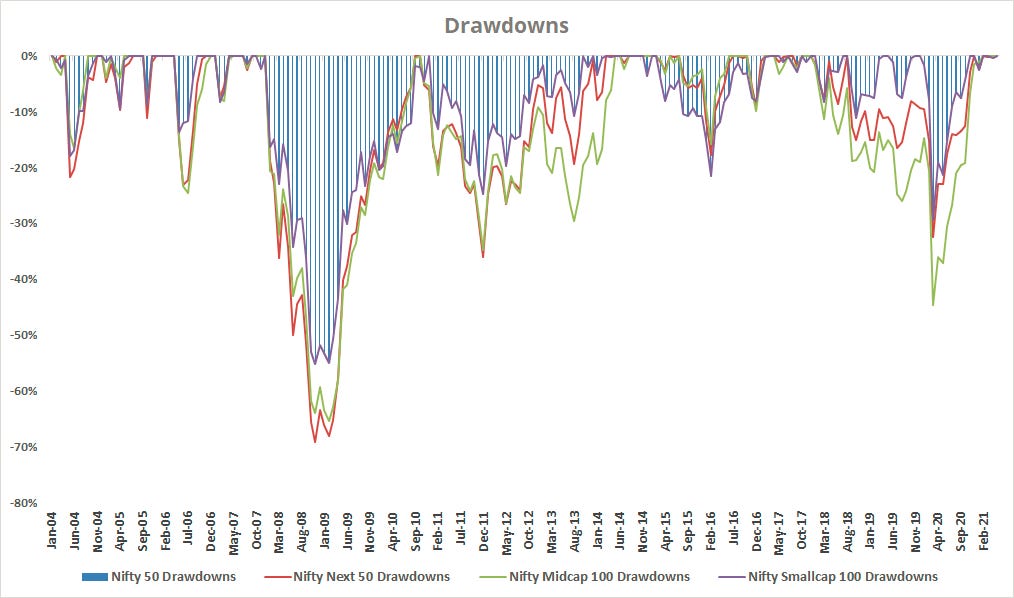

And today, it might seem unbelievable, but markets do crash. Here are the drawdowns of the Nifty 50, Nifty Next 50, Nifty Midcap 100, and Nifty Smallcap 100 indices. In 2008, they were down between 50-70%. That means if you had invested Rs 100, it would’ve been cut in half.

In an easy market regime like this, it’s tempting to chase hot stocks, hot funds, and useless shit coins. And the other thing about bull markets is that idiots who don’t know the right side of an underwear become gurus, mentors, and coaches. But remember, bull markets are fertile breeding grounds for bullshitters, quacks, and snake oil salesman. They’ll line up to sell you products and ideas that promise double the market returns with half the volatility. But It’s all bullshit! It ain’t real!

The S&P 500 has been compounding at 14% per year over the last ten years. That rate of return, which was not expected by anyone and should not be expected going forward, turns $100,000 into $370,000 if left alone. There have been people doing their best to talk you out of taking stock market risk, or convincing you that you could hedge it away while still earning the same (or better) returns. This is now and has always been a fantasy – risk-free reward is the domain of the charlatans. It only exists on Twitter, not in real life.

Stock market returns took your savings from ten years ago, nine years ago, eight years ago and kept them competitive with the prices in today’s economy. They allowed your dollars from 2011, 2012, 2013 to keep their purchasing power. In a moment like this, that’s meaningful. You should be able to pay this year’s living and traveling and eating and entertainment expenses without much aggravation so long as you’ve been invested all this time.

But the thing is, a secure retirement is probably the biggest goal we all save for. If the idea of being broke and living under a flyover sounds romantic to you, by all means, go crazy and invest your EPF money in Dogecoin. If not, keep things uncomplicated and do the basics right and hope for the best because the markets don’t owe you jackshit.

Having said that…

But I know it’s hard not to let loose a little. I’m not going to be a sanctimonious prick and tell you what to do and what not. It’s your money and you’re free to do whatever you please. Even if means a 5X levered position in ASS COIN.

Having said that, one of the best free pieces of advice I’ve ever received is to have a “dumb things account” with about 3-5% of your investments. In this account, you can trade options, buy shitcoins, buy blue-chips like Suzlon and Yes Bank and go crazy. Put a small amount of money in this account, small enough that it doesn’t hurt your goals and doesn’t hurt if you lose it. And then you can go crazy and play with whatever lastest fancy bullshit product a bull market has to offer. I do this; I recently started dabbling with crypto. YES, I BOUGHT SOME $DOGE!

But if you go crazy with your long-term money, remember, being broke and homeless living on the back of Maruti Omni wearing a Gucci branded garbage cover is a real possibility.

And

Great Stuff !!

Nice write up... As always... Thank a lot...