Mailbag

Issue 1

Issue 1: Let’s start from scratch, shall we?

Questions

Here are few interesting questions and thought I’d answer them

Answers:

Are AMC sites poorly designed?

I agree with you. Most of the investing experiences are horrendous. You could answer this in 2 ways:

a. What difference does it make, as long as you are able to invest?

b. I don’t have the numbers but AMCs sites don’t contribute much to the AUM. Also, AMCs can’t overtly promote direct because of the fear of pissing off the distributors. Remember just 18% of the individual AUM is in direct plans.

Reasons & implications of poor liquidity of ETFs

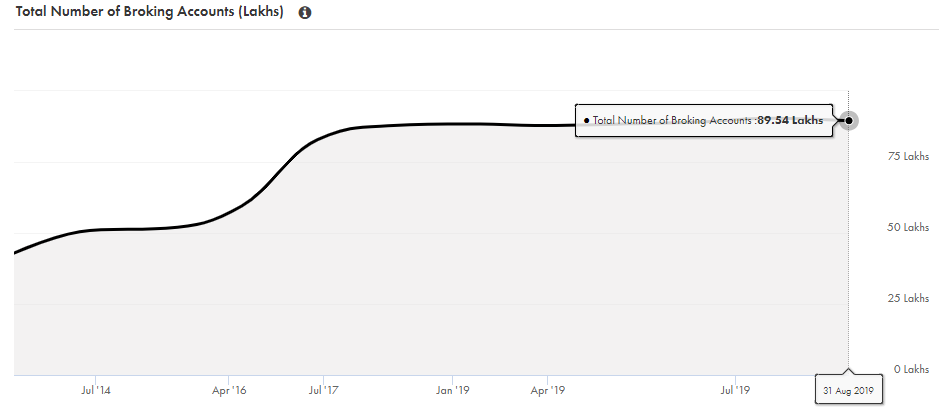

It’s still early days for passive and by extension ETFs in India. Just about 5% of the total AUM is in passive funds, out of which a lion’s share of the AUM is EPFO money. More importantly, we have crores of demat accounts but just 89.5 lakh active demat accounts. By active I mean, someone who has traded at least once in the last year.

Outside a few Nifty 50, Nifty Next 50, and Sensex ETFs, there’s hardly any trading activity. ETFs are the future, no doubt, but ETFs require demat a/c’s and it takes a lot of education to get people to open accounts. The story of ETFs in India is the story of the rise of retail participation.

True. Wrote about this in the main newsletter

The Employees' Provident Fund Organisation (EPFO) in 2015 had decided in to invest 5% of its incremental inflows in equities. It later increased the limit to 15% in 2018. EPFO, according to Value Research, EPFO sees about Rs 1.2 crore of inflows every year. 15% of annual flows, about Rs 18,000 crores are now flowing into equities.

EPFO has chosen the passive route to invest in equities through Nifty 50 and Sensex ETFs.

SBI Nifty 50 ETF, UTI Nifty ETF, and SBI Sensex ETFs are some of the biggest ETFs by AUM in India, purely because of EPFO inflows. In fact, SBI Nifty 50 ETF with 55,934 crore in AUM is the biggest mutual fund in India.

This question is why we started this newsletter. The job of an index fund is to match the returns of the index, plain and simple. Not to outperform it. If an index fund is outperforming an index then that a red flag because it implies poor fund management. Gross of expenses, an index fund’s returns and the return of the index should almost be the same. But the returns of an index fund will be slightly lesser because you need to pay an expense and also, the fund holds a little cash to meet redemptions etc. Here’s an illustration.