This is a bit of an uncharacteristic post for me but we are living through some terrifying times. The Corona Virus pandemic is sweeping the world, and global markets are seeing their sharpest correction since 2008.

The 2008 correction was about 400 odd days and Nifty 50 down nearly 60%. While the correction starting Feb 2020 has been just 40 odd days, and Nifty 50 is already down 30%.

I don’t know, nobody knows

Look, I don’t claim to have any real insight on this market fall. What’s more, I am a post-2008 baby, and I just popped my cherry with this market crash. But I’ll tell you three words that are unspeakable in the markets - I don’t know! Nobody knows, but you won’t hear anybody say this because, well, it’s not the sexiest of phrases. And you’ll never get a bazillion followers on Twitter, and an invite to CNBC TV18 if all you say is I don’t know.

But I don’t know, and nobody knows if this correction is just getting started if we’ve found a bottom, if this time is different or if India will become Japan and continue falling for 25 years.

We don’t even know if we’ll all be alive tomorrow. For all we know, the Corona Virus might mutate and just wipe out half the planet in the next few months.

If the markets correct so swiftly and sharply, there must be a reason, or maybe not and they are just dumb?

The easy thing to say is that this too shall pass, and historically it has. But there’s going to be a bloodbath between those two points. The easy thing to do when the markets are falling is quoting one-liners.

Nobody knows anything! Anybody who says otherwise is trying to tell you something or talking out of their ass.

Bear market wankfest

But what I do know is that when the markets are seriously up or down, a clown car full of characters descend on social media and business channels. People glibly and confident talking, predicting, and advising people to do really silly things. I can’t tell you what to do during this crash, but I can tell you what not to do. First thing, don’t listen to the so-called experts. I repeat, don’t listen to the so-called experts, no matter the circumstances. I’ve been following the gurus, the so-called experts, and the salesman since the correction started. And boy oh boy, is it a wankfest of terrible advice. Here are some gems:

Let’s start with the high profile names. Abhishek had shared highlights from Prashant Jain’s con call, and frankly, it’s a bit funny. We are at a time when companies are facing unprecedented disruption across the world. It is also not quite yet clear as to what the economic fallout from the Corona virus pandemic is going to be. Sure, the markets have crashed, and P/Es have fallen. But what good is that when you have no clarity about earnings? Look at the absurdity and certainty of the predictions here - algos linked to the fall? He might as well have blamed the weather because that would have been more credible. Two quarters of disruption and we’ll be alright, vaccine in 2-3 months, fundamentals are strong. I really want 👇

I wonder why fund managers keep saying "fundamentals are strong" even when things are a little shaky. Takes away the seriousness of the read for me. I understand SIP zaroori hai, but sahi advice zyada zaroori hai.

I wonder why fund managers keep saying "fundamentals are strong" even when things are a little shaky. Takes away the seriousness of the read for me. I understand SIP zaroori hai, but sahi advice zyada zaroori hai.

What the hell!The head of a money manager with a big following, at the beginning of March, had said it was time to start investing confidently! Since then, Nifty has fallen 20% more.

Another head of an AMC said, if you were investing when Nifty was at X, you should be investing if Nifty is Y. Since that post, the index is down 21%.

Another famous money manager said, using hyperbole that you should mortgage your house and invest. Nifty down 9% since.

Wait, there are more. Another head of an AMC said we don’t know, but you can buy our dynamic equity fund.

Why one, let’s go for broke and ask people to buy three funds, thought another head of an AMC. The advice was to invest in India, gold, and internationally simultaneously.

This is my personal favourite. The head of a small AMC went so far to say cancel all SIPs and invest in lumpsum. This is just utter stupidity! Who gives advice like that? Since that advice was published, Nifty is down 20% more.

The Achilles heel of this bear market is complacency. Once we break the FANG bottom fishers, then we bottom.I've been trading for 38 years and I have seen many cycles. This level of complacency and such confidence in buying the dip is what I have seen BEFORE several meltdowns and bear markets.

The Achilles heel of this bear market is complacency. Once we break the FANG bottom fishers, then we bottom.I've been trading for 38 years and I have seen many cycles. This level of complacency and such confidence in buying the dip is what I have seen BEFORE several meltdowns and bear markets. Mark Minervini @markminervini

Mark Minervini @markminerviniA Mr Goldilocks said Nifty X is a sacred level and with great emotion said if the markets were to change direction, it was that particular level. They didn’t!

Another trader said that he was putting his neck out and calling a bottom. Well, his neck was cut in one fell swoop, rather brutally and mercilessly.

And then there was usual “India growth story” crowd, the Warren Buffet and Charlie Munger quotes wala crowd. Be fearful when others are greedy, and be greedy only when others are fearful my ass!

It might seem like I am mocking these guys, well, I am a little, but that’s the not the point. These people have huge followings, and people invest REAL money saved over a lifetime based on their advice. Of course, people shouldn’t be listening to free gyan, but we live in an imperfect world, can’t do anything. Such blatant wankery amazes me! Look, investing based on other people’s advice or random tweets will almost never end well and will only cause regrets. So, don’t do it!

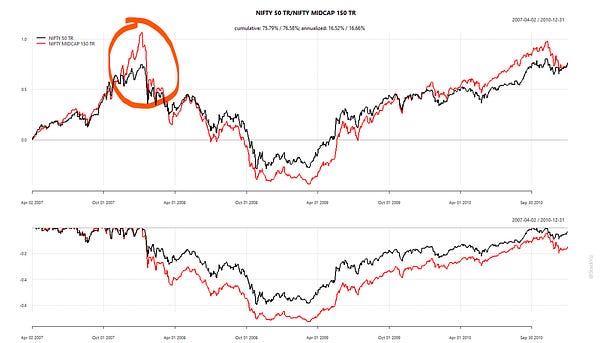

Perspective👇

I’m scared!

Having said that, I know you are scared. If you aren’t scared, then there’s something wrong with you, and you should run like hell to your nearest psychiatrist. If the market falls 30% in a month, I’d not only be scared; I’d carry around an extra pair of pants and adult diapers in the off chance that somebody talks about the markets in front of me and I might relieve myself.

And when were are scared, we tend to look for gyan. This is why we turn to the gods when something goes wrong in our lives. And this is when it all goes to hell. But remember, these 30% falls are what you signed up for!

Volatility is the price of admission

Think about it, there are no barriers to investing today. You can start investing instantly and for free. But you pay a different price - volatility. The phrase “price of admission” in the context of the markets has been stuck in my heard for a while. And the other day when I was listening to this podcast of Charlie Bilello with Howard Lindzon, Charlie uttered the same phrase but with the word volatility added, a lightbulb went off in my head and I started writing this post.

Look, equities are risky, that’s why you generally tend to get paid to take that risk. This is called the equity risk premium in fancy speak. Meaning, if you take the risk, you earn extra over say a fixed deposit or a government bond. Here’s how Niftybees has performed vs HDFC Liquid Fund which I’ve used as a proxy for a fixed deposit and the SBI Gilt Fund since 2000.

Although the line looks relatively smooth and upward sloping, it’s not going to be an easy ride. If you zoom in closer, you’ll wet your pants. Here’s a 3-year chart. As the saying goes:

No risk, no premium! You gotta pay the price of wetting your pants to that earn that good return!

But it’s not going to be easy. If you had made a lump sum investment in a large-cap fund 10-years ago, chances are you would have underperformed a liquid fund. How are we feeling now? 😂

And not to mention having to deal with the self-doubt and fear. When things are going up, you are calm. But when the markets fall, you’ll feel like selling, you’ll doubt your decision to invest, you feel like consulting an astrologer or some supposed investing expert on Twitter. You’ll feel like chanting Warren Buffet quotes while sweating, watching CNBC TV18. You know why? Because you are human! But the moment you give in to these fears, you’ll royally fuck up your goals, possibly an important one like your retirement. Escaping panic by selling or doing dumb shit in the short run is easy, but in the long run, you might be homeless!

Jim O'Shaughnessy is the Chairman and CEO of O'Shaughnessy Asset Management, and he’s pretty much seen all the nasty market crashes. Jim is one of the people I admire in the markets because he’s a practitioner and doesn’t bullshit around. I heard this on his podcast with Howard Lindzon, but he’s also written a blogpost on this.

I have long said that the four horsemen of the investment apocalypse are fear, greed, hope and ignorance. And note, that of the four, only one is not an emotion. These four things have wiped out more value in an investor’s portfolio than even the most vicious bear market.

Brilliant, isn’t it!

What should you do?

Just investing because there’s a dip is stupid and moreover, it doesn’t do any better than a simple SIP [1][2]. But, buying the dip does have the advantage of giving us an air of invincibility. It makes for a nice party story too because you can say "I was brave and courageous enough to buy when there was pandemonium on the street" 🙄 Plus, you can also feel good about your non-existent skills.

I can’t tell you what the markets will do or where they’ll bottom or if it’s a good time to invest or bad time to invest or what, where, and how to invest. If that’s your expectation, you might as well unsubscribe and join an options trading seminar. I hear those guys can double your money in 6 months.

But one of the most underrated investing advice of all time, in my view, is - automate whatever possible and get out of your own way. We, humans, are terrible when it comes to investing, we aren’t designed for it.

Create a rules-based system and put it on autopilot. It could be something as simple as a monthly SIP, or something a little complex like a moving average based system or a timing markets based on PE levels. For example, invest above 200 DMA and sell below it. Whatever the system may be, create one, test one, deploy, and stick to it like sweet death! But of course, if your system sucks, so will the outcome, that goes without saying.

Anish is a big proponent of rules-based investing, and he tweeted this recently which I had bookmarked. I kept reading the tweet over and over again because this is just brilliant advice from a practitioner:

Asset allocation

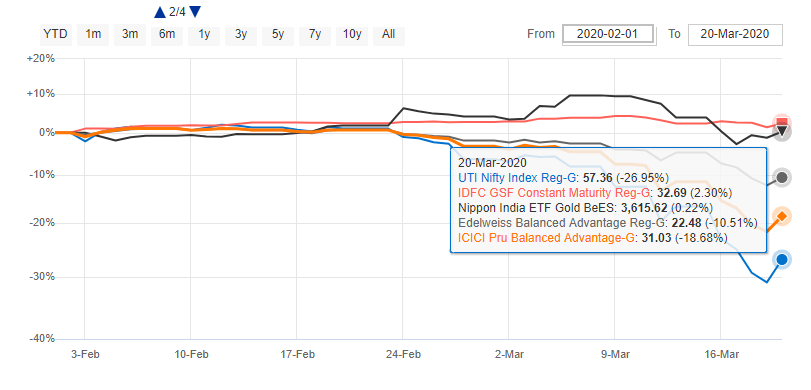

This is crucial. It’s in markets like this the importance of asset allocation becomes evident. Just to give you an ultra-simplistic view of why here’s how equity, debt, gold, and balanced funds which have a varying degree of stocks and bonds have performed so far in the market turmoil.

Anish had written about the importance of asset allocation in a previous issue:

Ben Graham said the first decision one must make when it comes to investing, is about asset allocation. How much should you allocate to stocks, bonds, real estate, gold, etc.? This is a very important strategic choice that every individual must make depending on the following two factors. In-fact this is true for institutional investors also. A landmark 1986 study confirmed Graham's view. The study found that asset allocation accounted for 94% of the differences in total returns achieved by institutionally managed funds.

In-fact Graham also talks about Asset Allocation in his 1949 classic, The Intelligent Investor:

“We have suggested as fundamental guiding rule that the investor should never have less than 25 per cent or more than 75 percent of his funds in common stocks, with a consequent inverse range of between 75 percent and 25 percent in bonds. There is an implication here that the standard division here should be an equal one, or 50-50, between the two major investment mediums.”

Furthermore, a truly conservative investor will be satisfied with the gains shown on half his portfolio in a rising market, while in a severe decline he may derive much solace (a la Rouchefoucald[1]) from reflecting how much better off he is than many of his venturesome friends.

Asset allocation is more art than science in my view, and I do subscribe to the view that the perfect asset allocation can only be known in retrospect.

Here’s Jack Bogle on asset allocation:

Man, you’re useless! No easy gyan but just depressing BS!

I’m sorry, investing is not an easy thing. If you want enjoyment or an adrenaline rush, I recommend Bungee Jumping or smoking up and watching Tik-Tok videos while throwing grapes into your neighbour’s window. Investing is a brutal bloodsport!

But I got something for you. I loved this excerpt from Anish’s letter to his clients.

Investing, is like being in the army, said someone. We have hours of boredom, punctuated by moments of terror. This is one of those “moments of terror”. But we do eventually get to the other side, safely, if we follow our processes and systems which we are trained to follow in times like these, and live to see another cycle. Please remember what you see on CNBC and read on social media is not representative of majority of the country. Optimism and pessimism overshoot on both sides, and boundaries of both can only be known in hindsight.

This is a short note, click here which I thought I should write to you all in this time when there is panic and mayhem in markets and confusion in our lives. We will send you our more detailed and longer investor letter in April 20’.

Please stay safe and take care of your families and loved ones. That is all that matters in the long run. It looks bad out there today. But we will, together, get through this.

I’m not going to say that this to shall pass. I’m not going to say that the “India growth story” will be back with a vengeance, or that everything will be alright. You need to figure that out for yourself. The goal of this post was to help you cut through the barrage of bullshit out there from people who have something to sell you. Have an investment plan, stick to it, and stay the course.

I’ll end the piece with this from Jack

The idea that a bell rings to signal when to get into or out of the stock market is simply not credible. After nearly fifty years in this business, I don’t know anybody who has done it successfully and consistently. I don’t even know anybody who knows anybody who has.

Investing is all about being in the unknown. That’s what makes it rewarding and terrifying at the same time. All you can do is control your costs and your behaviour.

Stay safe

While your financial freedom is important, it’s more important to stay alive to enjoy the fruits of your investing! The Corona epidemic is serious and please do not take it lightly like some of the idiots seem to be. Work from home, don’t go out unless absolutely necessary, wash your hands, don’t do dumb shit, and stay safe with your near and dear ones.

We’ll see you on the other side.

Further reading

Rick Ferri on asset allocation - 1 & 2

Shyam writes and tests out various asset allocation mixes and strategies. You can check out his blog archives for some insightful pieces on asset allocation.

Thank you for reading and do share this thing around, if it deserves to be :)