Passivefool here:

Damn, what a week it has been. The global markets were hobbling around and bam! All of a sudden, they just had the worst week since 2008 on the back of fears over the impact of the Corona Virus. The correction was swift, sharp, and brutal. Here’s a 5-day chart of the major Nifty indices and S&P 500.

Given that we haven’t had this sharp a fall for a while now, it gives us an opportunity to bust some myths. One of the most prevalent myths out there is that active funds provide downside protection during market crashes. This canard comes up when comparing active funds against index funds. Salesmen often use this as a selling point to discourage people from investing in low-cost index funds.

This sudden market crash has given us a chance to see if this hold true. Here’s how the top large-cap funds (regular plans) have performed vs the Nifty 100 index represented here by the Axis Nifty 100 index fund. I’ve sorted them based on the one-month returns and removed a couple of the smaller AMCs. We’ll do a detailed analysis of this topic in one of our future issues, but this quick and dirty look should give you an idea if this myth holds true.

The 5 large schemes by HDFC, Nippon, ICICI, Franklin, and SBI which underperformed the Nifty 100 account for 55%% of the combined large-cap category AUM for context.

While salesman and so-called advisors pooh-pooh that active funds offer downside protection in volatile markets, the reality is that not all active funds are created the same. Some funds offer downside protection, and some don’t. And like we’ve been saying from day 1 of this newsletter, the odds of you picking a good fund with decent downside protection are wayyy worse than a coin toss.

Why do some funds offer downside protection and some don’t?

Well, you could do a lot of fancy analysis. But the bottom line is it’s the because of a mix of performance and cash holding in a fund. Active funds, in general, tend to hold cash of between 5-10%. But few funds do have higher cash levels of even over 20%. Now, there could be any number of reasons why a fund may hold cash. It could be to meet redemption requests, or if a fund sees a sudden inflow of cash or if the manager has taken a cash call anticipating future opportunities. If the market falls when a fund has high cash levels, it tends to do better but cash holding is a double-edged sword. If the market rises, on the other hand, the fund will do worse than the benchmark because of the cash drag. Higher the cash levels, higher the drag on performance in up markets.

Index funds, on the other hand, hold very small amounts of cash to meet redemptions. Meaning, they are fully invested at all times, and they’ll track the benchmarks closely.

Look at the approximate cash holdings of the top 5 and the bottom 5 losers. In general, funds that fell the least tend to have higher cash holdings, but not always.

And managing cash levels in a fund is a very hard thing. If the manager gets it right, he’ll be hailed as a genius. If a manager gets it wrong, well, let’s just say he’ll be using his personal email ID to send out his resume while waiting to have a long chat with the CEO come bonus time. Here’s an example of why taking cash calls is tough. Here are the cash levels in the Quantum Long Term Equity Value Fund (QTLV) which historically hasn’t shied away from taking large cash calls.

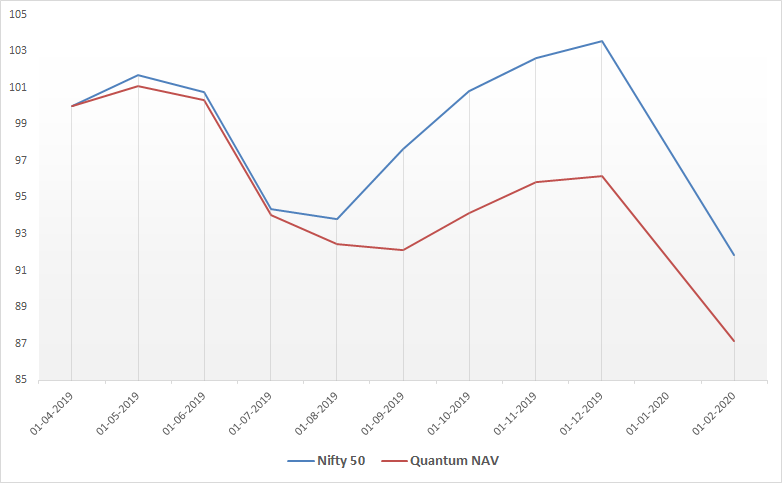

And here’s a normalized performance chart of the fund vs Nifty 50. Notice the performance drag during periods of high cash levels.

And just when the fund cuts the cash levels, the Corona crash. Quantum Long Term Value has had cash levels as high as 30% in 2015 when the index PE was at 23. Then the fund got an opportunity to invest in 2016 at when the PE was around 20 and the cash levels went down. The PE of the Nifty 50 is currently at 28 and relatively speaking, QLTV cash levels were low. Or by their own standards, they were optimistic. In the last 2 months, the market has gone down by 11% and QLTV by 9.38%. In the last two days, however, QTLV is down by 3.88% and Nifty 50 by 3.55%.

To be fair, high cash levels is not the only reason for the poor performance of the fund. This is a value oriented fund and value has been having a horrid time for about a decade now. But add to that, the high cash levels didn’t help either.

Are you saying downside protection is pointless?

Wait, hold on! I didn’t say that. Yes, downside protection is important. Behavioural literature has shown that we tend to experience falls more sharply than gains. Now, I am not denying that there aren’t any fund managers out there capable enough to capture the full upside while protecting some downside. But the odds of you picking such managers are stacked against you, it’s worse than a coin toss, and it’s not worth the bother!

What you should instead is to build a diversified portfolio and get your asset allocation right which will provide downside protection during turbulent times.

It’s not hard to preserve capital on the downside while participating in market gains. Literally any portfolio strategy that doesn’t put 100% in stocks will do this, providing the non-stock investments have less risk. The overall portfolio will preserve on the downside while…you know the drill. There’s nothing radical or revolutionary about asset class diversification. - Rick Ferri

For example, let’s compare an equity fund vs a balanced fund, which has a mix of equity and debt. Here’s how the Axis Nifty 100 fund has fared against ICICI Balanced Advantage fund (BAF).

Since Jan 1, 2020, Axis Nifty 100 has returned -7.71% vs ICICI BAF, which has returned -3.25%. The reason why ICICI BAF has fallen lesser is because it has a mix of stocks and bonds.

Also read: Anish had written a post about the importance of asset allocation and the beautiful simplicity of a balanced fund. We’ll cover the importance of asset allocation in-depth in future issues.

So, bottom line, why pay the manager to hold cash? You can do that on your own!

So, the next time someone sings the canard of “active funds provide downside protection”, just cough and say 👇

Suggested reading:

Having your cake and eating it — the myth of downside protection

🙏🙏 Thank you for reading this issue of Indexheads. You can keep the conversation going on the Indexheads Facebook group.

The goal of Indexheads is to spread the virtues of low-cost investing. We publish this newsletter just to create awareness about the merits of index funds. If you liked reading this issue, can we ask you to share this around? If yes, please do share this amongst your tribe.

We’d also love to hear your thoughts ideas and suggestion on what more we could write and do to spread the world about index investing in India. Please leave a comment below. It’s your loyal readership that keeps this newsletter going. And we’d like to say 👇