Lessons from Indexing ka Baap

Issue #15

Fool here

Sorry for the long pause after the last issue. I blame everybody else except me for that.

Jack Bogle launched the first index fund in 1976, and with that, he started the indexing revolution. We had written about the legend of Jack Bogle and the first index fund in a very special previous issue. But not many people know about the story of indexing in India. It all started when Sanjiv Shah founded Benchmark AMC in 2001 with a focus only index funds.

When Benchmark launched, there were seven index funds with Rs 316 crore in assets. Sanjiv shunned the mutual fund wrapper and exclusively focused on the exchange traded fund (ETF) wrapper to avoid paying commissions to distributors to push the product and keep the costs low. If you step back and think about it now in hindsight, it would’ve taken an enormous amount of guts, chutzpah, some misguided foolishness and then some to launch ETFs, let alone passive ones in 2001 when there probably were 23 Indians who knew what a mutual fund was, let alone an ETF.

Sanjiv and Benchmark were trailblazers in the mutual fund space. They were responsible for several firsts in the Indian mutual fund industry. They were the first to launch a Nifty equity ETF (NiftyBeES), a gold ETF (GoldBeES), a liquid ETF (LiquidBeES), Bank Nifty ETF (BankBeES) among others. At that time the liquid and gold ETFs were nothing short of pathbreaking given the complexity involved in running them.

In a lot of ways, Sanjiv and the Benchmark guys were innovators and visionaries way ahead of their time. They saw the evidence that active mutual funds as a whole don’t add any value to investors; in fact, they subtract value, way ahead of time. They were a decade early given that the active vs passive debate in India has just really started in the last five odd years. They also saw the advantages and the potential of the ETF wrapper when an ETF didn’t even exist in India.

Sanjiv is nothing short of India’s Bogle and without him and Benchmark the Indexing scene in India would’ve been probably very very different. Today you can invest in NiftyBeES for 0.05%, that’s basically free, and this wouldn’t be possible without Sanjiv and the Benchmark guys introducing index ETFs in India. If you are investing in an index fund or an ETF today, then you and I owe a huge debt of gratitude to Sanjiv and Benchmark guys.

When we started the newsletter, we wanted to get Sanjiv to write something for us, and then we decided to launch a podcast. We wanted Sanjiv to be the first guest, but then we were a bunch of noobs stumbling around in the dark, and we wanted to get our bearings before we had him on. Finally, Anish recorded and spoke to Sanjiv at length last week, and it was an absolute delight and full of incredible insights.

In this conversation, Sanjiv talks to Anish about:

The AHA moment that led the start of Benchmark AMC

The evidence about active vs passive even as far back as the 2000s

Challenges they faced in spreading awareness about ETFs

The evolution of the Indian mutual fund industry

Active vs passive

Why active managers fail to beat benchmarks

Smart-beta/factor investing

Allocating to gold and a whole lot more

I could write a mini booklet on all the things that were discussed in this conversation but no spoilers. You gotta listen to this episode, it’s the best 1 hour you’ll spend.

Some musings

This podcast was chock full of insights, and some of the things discussed got me thinking, and I thought I’d write a little about them.

ETFs are the future

Sanjiv saw the potential of the ETF structure even before we had ETFs in India, and I agree with him. In the grand scheme of things, Indian markets are still tiny. Although the Indian mutual fund industry has grown by leaps and bounds, it’s only as big as Vanguard’s second-biggest mutual fund. Yep, that’s how tiny and that’s also a sign of the growth potential.

ETFs have a lot of advantages over mutual funds - they have no commissions. Hence they have lower costs compared to mutual funds, they are fully invested compared to mutual funds, and in the case of fixed income, they are structurally superior at reflecting the true value of the underlying illiquid instruments. ETFs are like torn skinny jeans - the hot new thing while mutual funds are like lungis - classic.

Doesn’t mean mutual funds are bad but eventually and inevitably, ETFs will grow in popularity, but today, ETFs in India are orphan products. Except for Nippon and to an extent ICICI Pru, no other AMC seems to be committed to ETFs. This is because of a few reasons:

All ETFs are exclusively index products. Not that you cannot offer an actively managed ETF but nobody wants to. Even in the US, ETFs are almost all passive. We don’t have too many AMCs with a passive only focus in India because they don’t earn as much as an active fund. NiftyBeEs charges only 0.05% while you can make 1-1.5% on an active large-cap fund.

Since AMCs can’t charge too much with passive products, they can’t pay enough commissions to push index mutual funds because, at the end of the day, mutual funds are still push products.

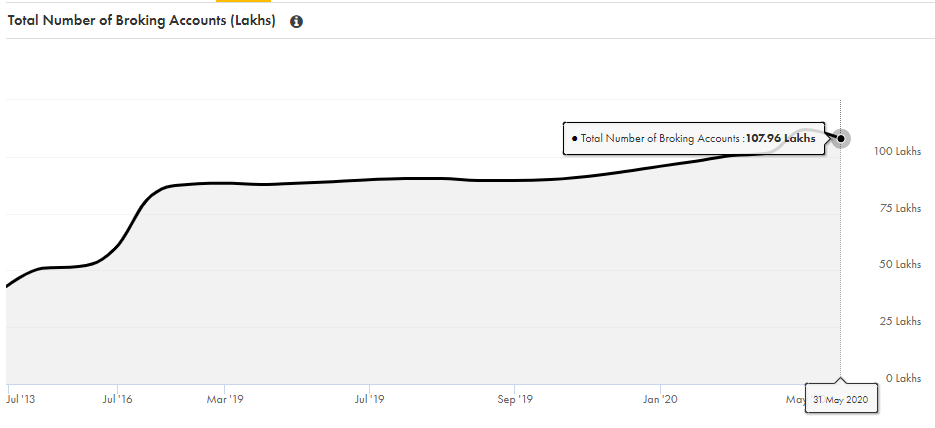

In the case of ETFs, the challenges are multi-fold. One: you cannot pay distributors commissions to push your ETFs. Two: you need a demat account to buy ETFs, and demat account usage is a tiny blip. Although you’ll see bigger numbers on the sites of NSDL and CDSL, this image shows the number of demats that have seen at least one transaction in a year. There are just 1.8 crore lakh Indians who’ve used a demat in a given year, and this is the non-duplicate data. If I had two demats and I made, transactions in both, this data counts both. Conservatively, you can reduce this number by 30%, 40%+.

Source: Tijori/NSE

So, it’s a bit of a chicken and egg problem, if there are very few active investors, ETFs won’t see adoption and volumes/liquidity, and if there’s no liquidity, investors won’t buy ETFs. But make no mistake, ETFs will see increased adoption with time.

Bargain basement fees on Index funds and ETFs

In the conversation, Sanjiv talks about how his only regret is that expense ratios have fallen by too much, too fast in India, and I agree. Don’t get me wrong, it’s an amazing deal for you and me as investors but a negative for the industry and I’ll explain why. Today NiftyBeEs ETF is available for 0.05% and so is the Tata Nifty Mutual Fund. 5bps is nothing considering the fact that it takes between 0.07-0.10% to run a fund according to AMC guys.

And the only reason why this is possible ironically is that active funds are subsiding index funds. Benchmark was the only AMC which had an indexing only focus and it’s now part of Nippon MF, which is an active giant. Other AMCs that offer decent index funds such as Motilal and ICICI are also active giants.

One perverse outcome of this situation is that it makes it that much harder for a new AMC to have an indexing only focus. Because if a new AMC has to compete with this bargain basement expense ratios, it either needs to have deep pockets or it needs to be subsidized by costlier funds or some other business. An AMC can only survive at this expense ratios if it gathers humongous assets, I’m talking 10,000cr+ levels to start with.

Today, the total AUM of the index funds is just 11,168 crores. Yes, true, ETFs have 175,340 crores in assets out of which SBI and UTI Nifty and Sensex ETFs are 1,18,430 crores, and this is almost entirely EPFO money. Without the EPFO, flows they probably would’ve had AUMs under Rs 5000 crs. For comparison, NiftyBeEs, which is 20 years old, has just 2,705 crores in AUM.

We are already at a point where the US mutual fund industry is in terms of expense ratios:

Source: ICI Factbook 2020

For context, the first index fund in the US was launched 43 years ago in 1976. Today, index funds have over $4 trillion in assets - that’s almost two times the Indian GDP. NiftyBeEs was launched in 2000, and we are already where the US is in terms of expense ratios in half the time and pretty much nothing in assets.

Inevitably, cost pressures will seep in the AMCs, and they may end up increasing expense ratios. Because on the active mutual fund side, there has been an inexorable downward pressure on expense ratios. How long can AMCs continue subsidizing make less to no money on index products? And it seems to be happening. Both UTI and ICICI increased the expense ratios of their Nifty Next 50 funds recently. So, don’t take those low expense ratios as your god-given right, they can and will change if I were to bet on it.

Smart beta

There are plenty of disasters in asset management, but none bigger than the term smart beta. This term just like the word Egydncsfbhfsfjfd, it means nothing. It’s an utterly and totally stupid word. It was coined by the investment consulting firm Towers Watson. In the industry parlance, it means anything that is not market-cap weighted. But the most common usage of the term is when referring to factor strategies.

If you are hearing about this so-called factor investing for the first time, worry not for we have thou covered. I’d suggest you check out this edition of the newsletter by Anish. Here’s what a factor means:

Factor is a numerical characteristic or set of characteristics common across a broad set of securities e.g. cheap valuation, small size of company, high ROE and profitability, high returns over a lookback period, less volatile than other stocks, etc.

With a factor strategy, you try to exploit a persistent source of return. For example, Value is the granddaddy of all factors, in value investing you are trying to capture the premium of cheap stocks over expensive ones over a period of time. In the podcast, there’s a particularly interesting conversation around smart beta and I highly recommend you listen to it twice.

Smart beta and or factor investing in the past decade or so has emerged as one of the biggest trends in asset management.

Factor investing isn’t without its controversies. Just like index investing, it has its fair share of critiques, venomous ones even. Even Jack Bogle dismisses them:

But to me, the topic of smart beta is interesting for so many reasons. Let’s unpack them a bit in brief, and maybe we’ll have a detailed issue sometime. From here on, I’m going to stop using smart beta, unless necessary. Factor investing has been around for a while now. In fact, Warren Buffett was one of the earliest factor investor. He figured out factors like value, low volatility, and quality way before the academics did. Here’s an excerpt from this AQR paper which looked at where Buffett’s returns came from:

In essence, we find that the secret to Buffett’s success is his preference for cheap, safe, high-quality stocks combined with his consistent use of leverage to magnify returns while surviving the inevitable large absolute and relative drawdowns this entails. Indeed, we find that stocks with the characteristics favored by Buffett have done well in general, that Buffett applies about 1.6-to-1 leverage financed partly using insurance float with a low financing rate, and that leveraging safe stocks can largely explain Buffett’s performance.

Later Eugene Fama, the father of finance and Ken French developed a 3-factor model, which later became a five-factor model, namely - market risk, size, value, profitability, and investment factor.

Anyway, institutional investors have been implementing factor models since the 90s itself but were out of reach for the retail investors. But a confluence of factors ranging from cheap computing power to the rise of ETFs has made factor investing mainstream, evident by the sharp rise in AUM. Since the early 2000s, there was a steady shift toward passive investing in the US, but this became an unstoppable force after the 2008 crisis when investors realized that active investing wasn’t delivering any value. And then the dam broke, and there was over a $2 trillion shift from active to index funds.

Now the thing about the US markets is that unlike the Indian markets, advisors are influential. And when I say advisors, I mean both RIAs and the US equivalent of distributors. For context - large firms called wirehouses like Morgan Stanley, Merrill Lynch, UBS, etc manage over $7 trillion in assets three times the Indian GDP and then there are independent RIAs, broker dealers etc.

Today, the vast majority of US independent advisors (RIAs) use index funds as the core allocation. Anyways, now given that active management wasn’t delivering the promised alpha advisors needed a replacement for the alpha component in client portfolios. Enter factor ETFs - these products became incredibly popular in the last five odd years, and advisors started tilting portfolios using factors funds. By tilts, I mean allocating a part of a portfolio in a factor or factors to eke out some extra return or alpha over an index fund. Say you put 80 bucks in an index fund and 20 in a value fund and tilt toward value out of your total equity exposure. There are true believers in factors so even have 100% of equity allocation to multiple factors too.

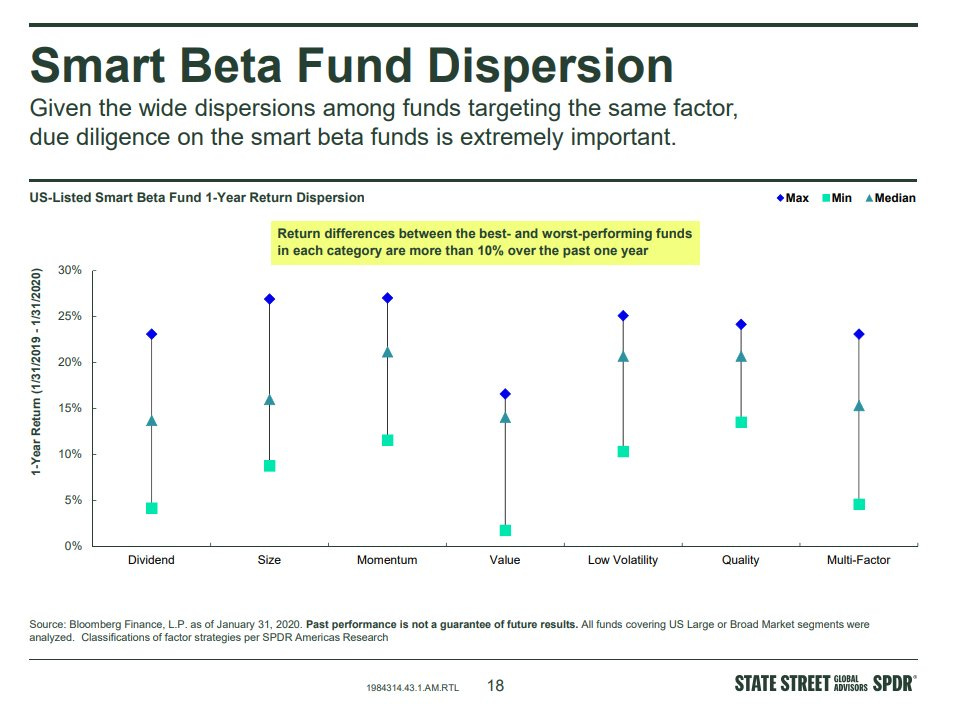

But the thing about factors is that they lie in the eyes of the beholder. Value can be defined by 10s of different metrics like P/B, FCF/EV, and so on. Momentum can be implemented in multiple ways. Definitions and techniques have evolved as more data became available. If you take a value ETF and talk about it to a hardcore value investor, you’ll get laughed out of the room, partly because value investors tend to be a little snobbish :p This is evident from the fact that these smart beta funds have huge dispersion. So two different value ETFs can have two starkly different returns.

Now, remember that advisors are dominant in the US? Well, career risk is a fact of life among fund managers and advisors. One of the reasons why active managers fail to deliver value is that they refuse to take a career risk. Meaning, if they stray too far from the benchmark, they’ll likely bleed assets, lose their bonuses or worse yet their jobs. So they tend to stalk benchmarks at close proximity. The same goes for advisors, and if they invest in an active fund and it underperforms the S&P 500 by 5%, they’ll have hard conversations with clients. Similarly, if they allocate to factors and they underperform an index fund, clients will leave.

Given that 80%-90% of all ETF flows are driven by advisors asset managers started launching factor ETFs that were diluted - in other words, their performance wasn’t too starkly different from the S&P 500 for example. And the flows followed, here’s a Bloomberg analysis on how flows have largely gone into ETFs with watered-down factor exposures. This is one of the reasons why smart beta gets a bad rap.

But there are firms that don’t play the asset gathering game but instead offer funds with pure and high octane factor exposures. Alpha Architect in the US is one such firm that I am huge fan of.

The next reason is the rampant data mining to uncover new factors which don’t survive the real-world tests. Today anybody with some cursory programming knowledge and slice and dice data to uncover something very shiny in a backtest which wouldn’t survive if it’s implemented.

And there’s also a raging debate over crowding in factors given that billions have flowed into ETFs that use quantitative factor metrics. I don’t think these debates will be settled anytime soon.

But just like index investing, denying the robust academic evidence of factor investing is foolishness. The reason why I wrote so much on smart beta (ugh 🤢🤮) is that I think these funds can be a replacement for discretionary active funds that do nothing and are largely closet indexers. These funds can be used to seek that extra returns over and above the market-cap benchmarks. The other advantage of these funds is that they are cheaper compared to traditional active funds and are rules based and hence transparent. You know what you are getting unlike an active fund where you are at the mercy of the fund manager’s whims and fancies.

Like anything in investing, factor funds come with risks - namely, they can underperform for long periods of time. For example, value has underperformed growth for over ten years now. That’s an eternity in the mind of investors.

Just to give you a snapshot of how the various Nifty factor indices have performed over the past five years.

We are seeing the first wave of factor ETFs and funds in India. We have factor ETFs from ICICI and Nippon which have relatively okayish volumes. DSP, Tata, and Reliance have quant funds which are nothing but multi-factor funds that combine multiple factors. I think this trend will only continue as fund houses look to greener pastures to maintain their margins or arrest the decline in margins.

Please don’t treat this as a recommendation of factor funds. Do your own diligence rather than going by past returns even though they look good. The idea here is you give you a hint about the possibilities.