When I was growing up, all I heard from my parents and the all-seeing and all-knowing “grown-ups” was that there’s no easy money. For most of my life, these people kept repeating that you had to work your ass off to earn money. Now that I've mostly grown up, I’m smart enough to realize that my parents and these supposedly wise grown-ups are bloody idiots, they know nothing!

Making money is probably the easiest thing you can do in life. Making money is actually easier than properly applying soap under your armpits and not putting two legs in the same hole of your underwear.

All you need to know to make money is to understand a few fundamental truths about human nature. Before you are intimidated by that sentence, don’t be. Even a person who has failed the 5th Standard can figure this out.

The most important fundamental truths about human nature:

Most people are stupid, there’s nothing wrong with that. In fact, several people have told me that my extraordinary and world-class stupidity belongs in The Guinness Book of Records. But the problem is, most stupid people don’t know they’re stupid.

Most people are lazy, and they’ll always take the easy way out.

Most people are greedy. Greed is probably the most destructive emotion compared to all the others because it murders common sense and critical thinking.

Most people prefer to be told what to do than to take responsibility and do something because they’ll have someone to blame if things go wrong.

Most people prefer to have babies in 3 months rather than wait for 9 months.

At this point, you have my permission to wonder and marvel at just how smart, wise, and profound I am. Go ahead, I will pause.

But you might be wondering how you can make money with these fundamental truths of human nature.

Remember, people are stupid, lazy, and greedy. Most people will believe anything, so you just have to appeal to that.

How do you do that?

One of the easiest ways to become rich quickly in life is to sell greed through stock tips, futures and options trading seminars. Here are a few examples 👇

The best part about this is that stock market knowledge is optional. You still don’t believe me? Recently, a certain extraordinary genius posted the tweet below. He was happy that he had made enough money for a Maldives trip. But it turns out, he had edited the P&L but not the quantity. It was higher than the NSE order limit.

The best part is that this individual allegedly earned 16 crores from stock market training.

This isn’t just one random instance. Let me give you more evidence. These tipsters had collected 3.1 crores and 6.1 crores respectively by peddling selling stock and F&O tips.

Crores!

How?

Sell greed.

There’s more.

The first biological organism had made so much money from selling options that he has the costliest house in Chennai, a house in Dubai, a Mercedes-Benz, a Jaguar (the car, not the animal), and is now shopping for a Rolls-Royce. Whenever he goes to Dubai, he tweets that he is in Dubai. Why? It’s very important for his followers to know that he is in Dubai. Did I mention he’s in Dubai? Oh, and remember, he likes Dubai.

The second specimen doesn’t know how to stop making money. Check out the proof here if you don’t want to believe me. For him, making 20–30% in a day is like eating Magahi Paan.

Oh, and he also holds tiger balls.

Oh and he teaches you how to make money while dancing. #LEGEND!

The third biological organism is better than Jim Simmons. In fact, Jim Simmons is an idiot compared to the said biological organism. The organism makes lakhs every day—the organism doesn’t know the meaning of thousands. So let’s take a very conservative estimate of Rs 5 lakhs a week, even though the organism makes more. The organism earns at the very least Rs 2.6 crores per year. Don’t let the small P&L screenshots fool you. This organism deleted most of the screenshots last week after the SEBI enforcement orders asked unauthorized tippers to refund the money they had collected.

But the problem is that because of inflation, even if you make Rs 2.6 crores, you are below the poverty line. So, in order to make a living, the said biological organism offers F&O tips through a Telegram channel. My sources tell me the pricing is between Rs 5,000 and Rs 25,000, and there are thousands of subscribers. Even at a conservative estimate, if the organism in question charges Rs 5,000 a year and there are 5000 subscribers, that’s another Rs 1 crore.

What kind of tips does the organism give?

Well, do you remember this Mak Oil advertisement?

Exactly like that!

As I said, stock market knowledge is optional. Before you accuse me of being a certain body organ below the abdomen and defend the said organism and say that the organism makes real money, there are more tricks in the book. For example, showing a small gain on a large account Making Rs 2 lakhs on Rs 1 crore of capital is nothing.

Why would the organism have so many crores? Remember rule 3: people are greedy. The moment you start posting these screenshots, you will have the rich and poor alike begging you to take their money and manage it. I mean, even other tipsters will rush to throw money at your face! Click on the tweet below for one such real-life example.

If you make the mistake of thinking that you are an actual trader instead of just editing screenshots, trade with real money, and lose, you can always do as the creature in the tweet below does. Where there's a will, there's a way.

If you're still not convinced that making money is this easy, here's more proof 👇

Do you still need more proof?

Bernie Madoff is a role model for all aspiring fraudsters and scammers—he's among the greatest ever. He ran a $65 billion Ponzi scheme. Madoff promised a 10–20% annual return, similar to that of the S&P 500, without any of the volatility. Despite that scammy pitch, some of the smartest people on the planet fell for his pitch. If the best institutions can be gullible, just imagine how gullible individual retail investors will be.

The supply of gullible idiots is endless.

To summarize, here are the steps to make money:

Start posting random gyan about trading and charts like this fellow on Twitter, YouTube, etc. You don't need to know anything about trading. In fact, the emptier your head, the better, because you can bullshit with more creativity.

Slowly start posting some trades. You don't have to take real trades—edit the screenshots.

People will flock to you like bhakts to a baba.

Along with charts, start posting random quotes from WhatsApp. At this stage, you need to graduate from being just another trader to being a wise trader.

Open a free telegram channel and post the same stuff. The tagline of the channel should be "helping 1 million Indians become millionaires."

Now, this is a crucial step in the journey. If you're a guy, the only way to make money quickly is to pretend to be a girl. So choose a profile picture of a good-looking girl very carefully. Don't copy from Google; people can search and figure it out. In fact, you can use AI to generate an image. Here's one I generated:

The second crucial step of the journey is to decide whether to just give tips or run seminars and webinars. If you're arrogant and overestimate your "trading skillz" and start giving tips, over time, even the dumbest will figure you're an idiot.

But on the other hand, if you only conduct options trading seminars, you can copy some basic trading gyan from books and pretend to be a trading genius. Remember this saying: Those who can, do; those who can't, teach. — George Bernard Shaw.

Knowing what you can't do is important.

Become rich.

Some of you might be thinking, isn't this a fraud or scam? "Fraud" and "scam" are such unsophisticated words, I prefer the term "income redistribution."

But anyway, do you want to worry about being called a scammer, or do you want to make money?

The two most common elements in the universe are hydrogen and stupidity.

— Harlan Ellison

How to become rich: Method 2

If you find the first method difficult, try this one. After all, doing all that work to scam people and become rich is a little demanding. But luckily for you, there's an easier and much better way. The best part about this method is that you need to have negative knowledge of the stock market. All you need to know is to frame sentences that other humans can understand.

Then make random videos with clickbait titles like these👇

You don't even have to make sense in the videos. I've watched them, and I came out being more stupid than I was before, and I was already blessed with world-class stupidity to begin with.

As long as you can confidently say something and appeal to the greed in people, there's an endless supply of idiots willing to watch you.

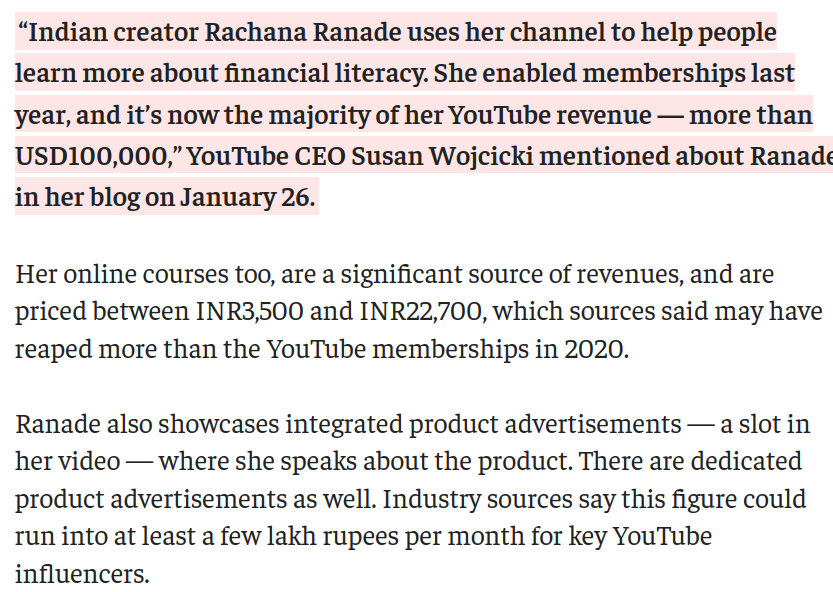

If you still don't believe me that you don't need to know anything, let me prove it. Below are some of the stock recommendations of CA Rachana Phadke Ranade, a popular "finfluencer" with over 4 million subscribers. Well, to be fair to her, she didn't directly recommend them. She hedges her words by saying things like "stocks I am buying" or "top stocks," etc. But we all know this shtick. If it looks like a stock tip and walks like a stock tip, it is a stock tip.

Now, you'd imagine being a CA and having 4 million subscribers, she must be a star stock picker. The reality is… how do I put it? She's bad. Like terrible at picking stocks.

Kora had analyzed all the stocks this lady had recommended till June 2022 and compared them to NiftyBeEs (Nifty 50 ETF). I used the same data and extended it to December 2nd, 2022. As you can see, she's bad, like really bad.

But it doesn't matter, she's printing money!

If you're worried you're stupid and that someone will notice your stupidity, some people are far stupider—stupider enough to make you look like a genius. The supply of such people is endless, and you can continue milking them.

To be fair, it's not just her; there are plenty of geniuses with a negative IQ. Also, you might find it hard to believe that people will do any random thing you say. But I have proof. Last year, all these people promoted the crypto platform Vauld. One of the geniuses even promoted it, saying, "You can make stock market-like returns of 14% on Vauld, and it is guaranteed."

Vauld became bankrupt 😂😂😂😂😂

Yet, people continue watching the guy, and he's making lakhs and crores from YouTube ads on his channel and through sponsorships.

If you still think you need brains to make money, watch these videos of this evolutionary marvel. This fellow has 6 million subscribers, and at the bare minimum, he must be making a few lakhs just from the ad revenue on YouTube. The revenue from sponsorships and affiliates is extra.

Do you still think you need brains to make money?

Hell no!

To summarize, here are the steps to make money on YouTube:

Start posting random videos on YouTube, etc. You don't need to know anything about trading. In fact, the emptier your head, the better, because you can bullshit creatively.

Make things clickbait. Your videos should have titles like "how to become rich in 8.3 seconds", and "how to pledge your left kidney to make 2% a week in options trading."

People will flock to you like bhakts to a baba.

Along with finance, start gyan videos. Make videos about how to live a good life, have a happy marriage, solve climate change, and what the PM and FM should do.

Start monetizing your channel through ads. You can also run memberships, sell sponsorships, and offer courses.

Once you have enough subscribers, people will start approaching you for sponsorships. Make more money.

Become galeej rich.

On a serious note

Scammers in financial markets aren't a bug, they're a feature. As long as human greed exists, there will always be someone trying to exploit it.

Frauds and swindlers have been around since day 1 of the financial markets, going back over 400 years. One historical example that's quite similar to today's markets that comes to mind is the popularity of bucket shops (Dabba trading) in the US during the 1800s. Bucket shops allowed people to bet on the direction of stock prices for small amounts. They were illegal, and they attracted people by offering insane leverage—as high as 100:1. By the late 1800s, they had seven times the volume of the New York Stock Exchange, and they were rife with fraud. From outright swindling of people to pump and dumps

Tipsters and influencers are also nothing new, they've been around in some shape or form for centuries. But what's different this time is the internet. The internet was supposed to make us smart, and kind and liberate us. I don't know if it has done that, but what it has done is democratize the ability to scam and defraud anyone anywhere in the world. An ambitious and aspiring kid from Indore can scam someone in Bangalore, Mumbai, New York, or Tajikistan while sitting in his mom's basement.

The internet gave everyone a voice. Now, the good thing is that everyone has a voice, but the bad thing is that every moron now has a voice. Any loudmouth can say anything, and he'll find an audience.

I know calling these tipsters and influencers disgusting is harsh. But if you even knew half the stories I've heard over the years, you'd call these people worse. There are some bottom-feeding cockroaches peddling tips, seminars, mentorship programs, and memberships that prey on people who don't know any better. Before someone gets offended, not all of these people are scammers. There are perfectly good and smart people who are registered as research analysts (RA) or investment advisers (RIA), offering financial advice and stock portfolios for a fee.

Over the years, the term "influencer" has become a dirty word. But an influencer doesn't just mean all these idiots on YouTube, Instagram, and Twitter saying stupid things. An influencer is anyone who people listen to. I consider myself to be one of the world's biggest idiots, but because you're reading this newsletter, I'm also an influencer. Lucky for you, I don't have anything horrible to sell. I just have my cheap index funds 😂

There are some insanely smart and well-intentioned people, or "influencers," who constantly share their knowledge to educate people. Check out the end of this post for a list of such people from whom I've learned pretty much everything I know. The only way markets will ever grow is with more of these people.

But for every sensible person, there are a hundred other morons spewing dangerous nonsense. Sadly, there's an endless supply of people who are willing to pay for and listen to this dangerous nonsense with their time and money.

These scams are too simple. They don't work!

I wish that was the case. Take a look at the number of subscribers on these Telegram groups. There's an endless supply of suckers. If I were an options seminar startup, this would the opening slide of my pitch deck:

India has 125 million people, and I can make a lot of money even if I only attract 0.0005% of the population to my scam.

This passage from Reminiscences of a Stock Operator sums it up better than I ever could:

But the average man doesn't wish to be told that it is a bull or a bear market. What he desires is to be told specifically which particular stock to buy or sell. He wants to get something for nothing. He does not wish to work. He doesn't even wish to have to think. It is too much bother to have to count the money that he picks up from the ground.

― Edwin Lefèvre, Reminiscences of a Stock Operator

We can all waste our time trying to teach and educate people, but nobody gives a shit. The only question the vast majority of traders and investors have is, tell me what to buy.

One of my all-time favorite quotes and one that's burned into my brain is this one from quantitative investing pioneer James O'Shaughnessy.

This is essentially why people will always keep falling for scams. Even if we get artificial intelligence, flying cars, and sentient robots, humans will still keep asking random people on the internet, iska target kya he?

Robert Cialdini is a giant in the field of behavioral science. He's written the definitive book on persuasion and influence. Here are some quotes of his that perfectly apply to the stock market and explain why people keep falling for the same old scams:

"There is no expedient to which a man will not resort to avoid the real labor of thinking."

"people don't care how much you know until they know how much you care."

"Research has shown that we automatically assign to good-looking individuals such favorable traits as talent, kindness, honesty, and intelligence"

This is why stock tipster account with female profiles have far higher followers than men even if they are fake!

"First, we seem to assume that if a lot of people are doing the same thing, they must know something we don't."

"Social scientists have determined that we accept inner responsibility for a behavior when we think we have chosen to perform it in the absence of strong outside pressures."

"Without question, when people are uncertain, they are more likely to use others' actions to decide how they themselves should act."

"our typical reaction to scarcity hinders our ability to think."

"Social scientists have determined that we accept inner responsibility for a behavior when we think we have chosen to perform it in the absence of strong outside pressures."

It's remarkably easy to fool people.

Never bet against human nature.

Two percent of the people think; three percent of the people think they think; and ninety-five percent of the people would rather die than think.

-George Bernard Shaw

I beg you. Stop trusting these frauds

I just said that attempting to teach and educate people is a waste of time. It is, but despite the odds, let me try. Even if I can discourage one person from falling for these scammers, I'd consider this post a worthwhile investment of time.

Michael Mauboussin is one of the best minds in investing. His books and papers are a must-read for all investors. In one of his guest lectures, a student asked him about one framework he would learn if he could go back in time. Michael Mauboussin said base rates, I would say the same thing.

Base rate is a fancy word for probabilities or odds. Some of the brightest minds in the world, like Daniel Kahneman and Charlie Munger, have spoken about the importance of base rates. Here are some excerpts from How to Decide by Annie Duke that explain the concept:

A base rate gives you a place to start when you are trying to estimate the likelihood of any outcome (or the upside and downside potential). It is not that your estimate should always be identical to the base rate. As should be clear by now, the particulars of your situation, the inside view, do matter. "But if you're thinking of starting a restaurant and you estimate the probability of success at 90%, knowing that only 40% of new restaurants make it past the first year is going to help discipline your overconfidence.

Whatever your forecast of the future is, it needs to be in the orbit of the base rate. A base rate gives you a center of gravity.

When you learn that you're planning on doing something that the base rates tell you is difficult, a realistic view of what the future might have in store for you will encourage you to identify the obstacles that stand in the way for most people. That advance warning gives you the opportunity to develop ways of avoiding or surmounting those obstacles so you can increase your chances of success.

I think when it comes to investing, thinking in terms of base rates can help you avoid a lot of grief and save you a lot of money.

When you decide to listen to a stock tipper or an influencer, you are betting on their ability to pick stocks and predict the market's direction. Now, what are the odds of them being really good? Let's look at some statistics.

In any given year around the world, over 60% of all fund managers fail to beat their chosen benchmarks. As if that wasn't enough, there's no persistence in performance. So this year's outperforming fund manager will likely go on to underperform in the future. These are fund managers with all the resources in the world, the best tools, an army of analysts, and millions in research budgets.

The CXO advisory group analyzed 6582 market forecasts by 68 experts from 2005 through 2012. The average accuracy was just 46.9%. A coin toss is better!

Larry Swedroe, the prolific investment writer and author, has been tracking financial predictions in the media every year since 2010. Since he started the analysis, the accuracy has been just 35%.

Bloomberg analyzed 3200 country-level economic forecasts of the IMF. They found: "In 6.1 percent of cases, the IMF was within a 0.1 percentage-point margin of error. The rest of the time, its forecasts underestimated GDP growth in 56 percent of cases and overestimated it in 44 percent."

Philip Tetlock, psychology professor and the author of Superforecasting, looked at 82,361 economic and political forecasts by 284 experts between 1987 and 2003. These experts made a living “analyzing” and pontificating on political and economic developments. He concluded that chimpanzees throwing darts at a board full of predictions would be more accurate than these "experts."

Along with hosting Mad Money, Jim Cramer also runs a subscription investment advisory service. That portfolio hasn't beaten a simple index fund since its inception.

You can apply the same base rates to people peddling stock tips. You might wonder, "What about futures and options?" There could be people making more money there.

Of all the ways to make money, trading futures and options (F&O) has to be the hardest. I haven't read Nassim Taleb's books, but someone once told me an anecdote from his book The Black Swan. I think it perfectly sums up retail investors trying to make money from F&O:

"Consider a turkey that is fed every day," Taleb writes. "Every single feeding will firm up the bird's belief that it is the general rule of life to be fed every day by friendly members of the human race 'looking out for its best interests,' as a politician would say. On the afternoon of the Wednesday before Thanksgiving, something unexpected will happen to the turkey. It will incur a revision of belief."

I'm not going to quote Warren Buffett about how F&O is a weapon of mass destruction, etc. Much like everything else in the markets, futures and options (F&O) are a tool. Ultimately, whether a tool is good or bad depends on the person using it. A skilled person will make good use of it, while an idiot will blow himself up. Unfortunately, most retail investors who trade F&O tend to be idiots who are just gambling recklessly in the hopes of making quick money.

I will never forget this tweet:

But anyways, let's look at how many people make money in F&O

In India, we don't have any regulations requiring brokers and exchanges to disclose client profitability. But luckily, some of the securities regulators around the world do. In 2018, the European Securities and Markets Authority (ESMA) told all brokers offering binary options and contracts for differences (CFD) to disclose the percentage of clients making a loss on their websites.

CFDs and binary options are leveraged derivative instruments that have a lot of similarities with F&O contracts in India. The trading behavior of retail traders in CFDs and binary options is the same.

The press release had the following data:

NCAs' analyses on CFD trading across different EU jurisdictions shows that 74-89% of retail accounts typically lose money on their investments, with average losses per client ranging from €1,600 to €29,000. NCAs' analyses for binary options also found consistent losses on retail clients' accounts.

If you go to the website of any European CFD broker, you'll see statistics like the ones below, stating the percentage of clients who lose money. On average, it's well above 70%.

In 2019, the Australian Securities and Investments Commission (ASIC) wanted to tighten the regulations of brokers offering binary options and CFDs. As part of the regulatory process, it looked at the profitability of CFD and binary options traders across the world. The results are stunning:

We estimate that retail client losses from trading binary options were at least $490 million in 2018. (In Australia)

The UK Financial Conduct Authority (FCA) found that: (i) in 2016, between 81% and 85% of client accounts lost money and, on average, clients made a loss of between £400 and £1,200; (ii) many of these clients appeared to make a profit from trading but made a loss when taking into account the impact of transaction fees;

the Cyprus Securities and Exchange Commission (CySEC) found that from 1 January 2017 to 31 August 2017, on average, 87% of client accounts made a loss of around €480; (c)

The Polish Komisja Nadzoru Finansowego (KNF) found that in 2016 86.3% of clients lost money trading binary options and in 2017 86.4% lost money; and (d

The Italian Commissione Nazionale per le Società e la Borsa (CONSOB) found that in 2016 up to 74% of Italian retail clients made losses, with an average loss of approximately €590.

In another regulatory report, ASIC disclosed detailed numbers that tell us what we all know—60%-70% of people lose money. In case you skipped your math class, those odds suck! They suck more than active fund managers.

ASIC CFD product intervention order

During that volatile five-week period in March and April 2020, the retail clients of the sample of 13 CFD issuers made a net loss of more than $774 million. During this period:

You can safely assume the numbers in India will be far worse.

This reminds me of a passage from The Man Who Solved the Market: How Jim Simons Launched the Quant Revolution:

The Renaissance team was curious by nature, as were many of its investors. They couldn't help wonder what the heck was going on. If Medallion was emerging as a big winner in most of its trades, who was on the other side suffering steady losses? Over time, Simons came to the conclusion that the losers probably weren't those who trade infrequently, such as buy-and-hold individual investors, or even the "treasurer of a multinational corporation," who adjusts her portfolio of foreign currencies every once in a while to suit her company's needs, as Simons told his investors. Instead, it seemed Renaissance was exploiting the foibles and faults of fellow speculators, both big and small. "The manager of a global hedge fund who is guessing on a frequent basis the direction of the French bond market may be a more exploitable participant," Simons said.

Laufer had a slightly different explanation for their heady returns. When Patterson came to him, curious about the source of the money they were raking in, Laufer pointed to a different set of traders infamous for both their excessive trading and overconfidence when it came to predicting the direction of the market. "It's a lot of dentists," Laufer said.

The description perfectly matches most retail traders and investors. They'll always be the pigs and the ostriches—they will end up as food for others.

Set aside the fact that the people on YouTube offering advice and spouting random nonsense are unregistered. Set aside the fact that they are violating Research Analysts (RA) or Investment Advisers (RIA) guidelines. The numbers above are the base rates for people making money in futures and options. If you come across someone on Twitter or Telegram claiming a 70% success rate and promising to make you rich, what are the odds that the person is full of shit?

Pretty damn high!

I still follow a handle on Twitter that posts profit screenshots of at least a few lakhs every day. For a long time, the profits used to be well above Rs 10 lakhs, but most of those screenshots were deleted in the last few weeks. If these screenshots were true, the person was easily earning well over 5 crores per year. In a few years, this person would have a trading capital of 10-20 crores. On such a large capital base, even small profits will be huge.

But this person also sells some courses and Telegram memberships for Rs 5,000–25,000. Why would a person making crores every year sell courses? It's like Warren Buffett and Jim Simmons starting Telegram groups. You could argue that these people in the Telegram group are passionate about educating people and making them rich. If you believe that, I know the owner of the American White House and the Taj Mahal. He wants to sell them for Rs 12 crores each. Send me a message if you are interested.

"Bulls make money, bears make money, but pigs get slaughtered"

— Some guy

So what should you do?

Before I tell you my perspective on what most investors should do, I think it's worth looking at why people fall for these tipsters, influencers, scammers, frauds, and other bottom-feeding cockroaches.

Greed

In most cases, greed is the best explanation. Ever since the first human started rubbing two rocks together, humans have been searching for the quickest way to get something with the least amount of effort.

Galaxy sized egos

We all think we're the masters of the universe and God's gift to humanity. In our minds, Warren Buffett is a 99-year-old dead guy walking around who is an idiot, and Jim Simmons is editing his P&L screenshots. But, we, on the other hand, are Einstein reincarnate.

The gap between what we think we know and what we know is the root cause of most troubles in life. Understanding that we are far more stupid than we realize and investing according to our realistic abilities doesn't come naturally. That's because we rarely pause and engage in self-reflection.

Shortcuts

In my limited experience, most people understand that they should save and invest. They might not fully understand things like beating inflation and asset allocation, but they get the general principle of saving and investing to have a secure retirement. The problem is they get scared when it comes to how to save and invest.

I don't know about you, but I was intimidated when I think back to the first time I heard about the stock market—most of my friends were as well. At this stage, some people decide to do some homework and try to learn the basics of the markets, but most take shortcuts. It's human nature to look for the easy way out. Like most people, I ended up taking advice from a few relatives who I thought knew something.

When they Google "how to invest," they'll end up discovering these scammy influencers and tippers because they tend to have the most views and followers on social media. People underestimate the power of first impressions. The ideas and concepts you learn first at the beginning of your investing journey tend to stick and are very hard to get rid of. Humans aren't known for being rational and updating their beliefs quickly. In the face of conflicting evidence, we often search for supporting facts rather than change our minds.

Since investors don't know any better, they'll see these screenshots of massive returns and get rich quick stories when they start Googling.

If they're popular, they must be smart

This is perhaps one of the most damaging beliefs among investors. People equate views, likes, and retweets with smarts. If some investing "guru" or "expert" has lakhs of views on his videos, then they must be really smart. But popularity isn't an indication of ability. In fact, you can safely assume that almost all the investing and trading influencers on YouTube are idiots.

I don't mean to say there aren't exceptions, but to figure out who's sensible and who's an idiot takes a basic understanding of money and markets. If you are a beginner, start by reading a good book. I know we live in an age where people would rather watch a 60-second TikTok video on how to invest than read a 200-page book, but common sense is uncommon. If you want to read some investing books, here's a great list:

This quote sums it best:

Question everything. Learn something. Answer nothing.

—Euripides

There will always be someone trying to convince you—both overtly and covertly—that they can make you rich quickly. All you have to do is pay Rs. 20,000 for some useless seminar. But you can safely assume that most people are full of shit.

Fear of mistakes

According to one study, losing money activates the same parts of the brain as physical pain. So losing money feels like getting punched in the face.

Current research has shown that monetary loss shares common neural bases with pain. We found that monetary loss and pain, whether physical pain or social pain, engaged overlapping neural regions. Although monetary loss and physical pain coactivated the right AI and dorsal anterior cingulate, monetary loss and social pain coactivated the left AI, inferior occipital gyrus, and lingual gyrus. Furthermore, the neural representation of monetary loss was more similar to social pain than to physical pain. All these results provided persuasive evidence of common neural correlates of monetary loss and pain.

— Tan H, Duan Q, Liu Y, Qiao X, Luo S. Does losing money truly hurt?

We're evolutionarily hardwired to avoid pain and discomfort. When you try to learn something for the first time, it sucks. The human tendency to avoid discomfort is what stops us from learning new things. We'll do anything to avoid the tedious process of putting in the time and effort to learn and, most importantly, the pain of making mistakes.

But nothing ever comes easy in life. A little time spent learning about money today will result in a secure retirement 40–50 years later. Imagine spending your retirement doing what you love. That's possible just by spending a couple of weeks learning how not fuck up your money today.

I can think of very few things in life where such a small effort today can lead to such an outsized benefit in the future.

Now, after what seems like a few thousand words, let me quickly get to the point 😂

What should you do?

Be skeptical, very skeptical

Bob Seawright's The Better Letter is one of my favourite newsletters. Yesterday, he published a brilliant post on gaslighting by hedge funds.

Definition: Gaslighting

Manipulate (someone) using psychological methods into questioning their own sanity or powers of reasoning.

Here are two telling excerpts:

As Chris Brightman of Research Affiliates likes to say, echoing Groucho Marx, "The hedge funds that produce [great] results will never manage your money." And, as Nobel laureate Eugene Fama noted: "If you want to invest in something where they steal your money and don't tell you what they're doing, be my guest." Rex Sinquefield, co-founder of Dimensional Fund Advisors, went even further, calling hedge funds "mutual funds for rich idiots." These testimonies and the data that supports them should seal the deal: there is very little reason or necessity for most investors to rely on hedge funds.

Indeed, the hedge fund industry retained in fees 84 percent of the total dollar profits generated from invested capital, leaving just 16 percent for investors. Including fees charged by fund-of-funds like Protégé Partners (to whom nearly half of hedge fund investors delegate fund selection and portfolio construction), the share "enjoyed" by investors fell to just 2 percent.

This is largely true of the investment management industry as well. It's become cliché to say that the investment management industry is useless, exploitative, shady, and rent-seeking. But clichés are often clichés for a reason—because they are true.

Everybody in the finance ecosystem, with very few exceptions, is incentivized to do one thing and one thing only—take as much as they can and give as little as possible in return. So, first and foremost, be skeptical of everything and everyone in finance. It's the only thing that will ever stop you from getting ripped off.

Everything is hard

Contrary to cute and folksy sayings about investing being easy and simple, nothing about investing is easy. One awesome study that demonstrates this fact was conducted by Hendrik Bessembinder, professor of finance at Arizona State University. Here's a summary of the study:

Bessembinder also found that the 86 top-performing stocks, less than one-third of 1 percent of the total, collectively accounted for more than half the wealth creation. And the 1,000 top-performing stocks, less than 4 percent of the total, accounted for all the wealth creation. The other 96 percent of stocks just matched the return of riskless one-month Treasury bills! The implication is striking: While a large equity risk premium has been available to investors, a large majority of stocks have negative risk premiums. This finding demonstrates just how great the uncompensated risk is that investors who buy individual stocks (or a small number of them) accept—risks that may be diversified away without reducing expected returns. Bessembinder concluded that his results help explain why active strategies, which tend to be poorly diversified, most often lead to underperformance.

Anish looked at the data and found the same thing in India:

I'm not using this data to say that picking stocks is impossible. My point is that investing is notoriously hard—It's a blood sport.

When you come across someone who claims otherwise, run.

I'm also not telling you to avoid picking stocks, you never know, you could be a genius. But the odds tell me, you most likely won't be. But play around with a small part of your portfolio and figure it out for yourself—don't listen to a moron like me.

Do the sensible thing

Look, there will always be a small minority of skilled traders and investors in the markets. But most people like me aren't skilled. Now, realizing you aren't skilled is a whole other thing—most people live under the delusion that they are. But for people who realize they aren't skilled, investing through diversified mutual funds is the highest probability way to build over the long term.

Notice the emphasis on the highest probability. There are no guarantees in the markets, they are perfectly capable of doing nothing over long periods. Since we don't have a long enough history for Indian markets, here's a chart of the S&P 500 from 1965. Lost decades aren’t uncommon. Imagine a market that generates 0% over 10 years.

The basics

As I mentioned, for most people like me, mutual funds are the best way to have a realistic shot at building wealth over the long term.

But what mutual funds?

If you are new to investing, please read this post to understand the types of mutual funds. Once you read the post, you'll know that there are active mutual funds and index funds.

Most actively managed mutual funds suck. 60% to 70%+ of actively managed mutual funds underperform their benchmarks. In plain English, they charge too much and are useless.

This means low-cost index mutual funds are your best friends.

Ironically, index funds have also become a jungle, but let's unpack this.

Equity

Nifty 50 and Nifty Next 50 index funds should be the core of your portfolio. Pick index funds with the lowest tracking error—they should track the underlying index as closely as possible. The combination of Nifty 50 and Nifty Next 50 gives you exposure to the 100 largest companies in India and is as good as owning 72% of the Indian stock market. The combination of both also outperforms the vast majority of actively managed mutual funds.

But owning just index funds gives you market returns, and we humans are never satisfied with just market returns. We want more, we want to be exceptional, without realizing that 60–70% of all actively managed mutual funds don't even match the unexceptional.

But anyway, as I mentioned, market cap weighted low-cost index funds like Nifty 50 and Nifty Next 50 should be the core part of your portfolio. If you want to try and generate some additional returns over and above the market returns, you can consider some good actively managed mutual funds if you can pick them. You can also add some factor funds or smart beta funds to the satellite part of your portfolio. But add them only and only if you understand how they work, the evidence underpinning factors, and that they can underperform simple market capweighted funds for long periods.

How to allocate?

Asset allocation plays a crucial role in how you invest. There's no one perfect way to allocate assets. Asset allocation is less about backtesting, and optimization and more about your temperament, behavior, and unique life circumstances. However, a core-satellite framework is one intuitive strategy for allocating assets. Anish has written a post explaining it here.

Debt

The role of debt in your portfolio is to help you reduce volatility when you are accumulating and to generate income when you start spending down your portfolio in your retirement. Debt isn't to generate high returns—that's what equity is for. Stick to very safe debt funds that only hold or have a majority of their portfolio in government bonds (G-Secs), state development loans (SDLs), and AAA-rated bonds. If you want to uncomplicate things further, you can invest only in short-maturity funds and reduce interest rate risk. When it comes to debt, having a basic understanding of debt concepts is a must.

As long as you get these basics right, you have a reasonable probability of doing well. I saw this image in a Motilal Oswal presentation. It shows the calendar year performance of two portfolios with the following asset allocations:

Aggressive (AG): Nifty 500 (50%), Nifty 5 Yr G-Sec Benchmark (20%), S&P 500 Index (INR) (20%), Gold (10%).

Conservative (CN): Nifty 500 – (30%), Nifty 5 Yr G-Sec Benchmark (50%), S&P 500 Index (INR) (10%), Gold (10%). THIS IS NOT A RECOMMENDATION IN ANY FORM!

Even such simple diversified portfolios have done well. What else do you want in life?

Behave

"The best way to measure your investing success is not by whether you're beating the market but by whether you've put in place a financial plan and a behavioral discipline that are likely to get you where you want to go."

—Benjamin Graham

You can pick the best funds and the best managers, but if you don't behave well, it's all pointless. Picking funds is the easy part; being disciplined both in bull markets when everything is going up and in bear markets when everything is going down is the hard part. To be successful in reaching your goals:

You must be well aware of your circumstances, goals, and the amount of risk you can bear realistically.

Ensure you have adequate protection in the form of life insurance, health insurance, and emergency savings.

You need to invest regularly and increase your investments regularly.

Rebalance regularly to keep your risk in check.

Keep holding, no matter what.

Avoiding diworsification by not adding the flavor of the moment funds and products.

Avoid trying to time the market without the ability to time the market.

Avoid constantly tinkering with the portfolio.

Not listening to the advice of some random moron on the internet like me. Having the wisdom to learn and the ability to ignore the noise.

Doing something more productive in life, like watching funny videos of Kangana Ranaut while simultaneously getting high on the substance of your choice.

Having said all this, I know it will make zero difference. The guy with a green P&L screenshot will always win over an idiot like me asking people to invest in index funds. I do know that I’ve wasted time trying to educate people about the commonsense things about investing. But hey, what's life without trying?

There is a natural human tendency to dislike a person who brings us unpleasant information, even when that person did not cause the bad news. The simple association with it is enough to stimulate our dislike.

― Robert B. Cialdini, Influence: The Psychology of Persuasion

Sometimes people hold a core belief that is very strong. When they are presented with evidence that works against that belief, the new evidence cannot be accepted. It would create a feeling that is extremely uncomfortable, called cognitive dissonance. And because it is so important to protect the core belief, they will rationalize, ignore and even deny anything that doesn't fit in with the core belief.

— Frantz Fanon

We need to ensure that all the AI model fellows train their models on your tweets and articles. Your 'fullish' sagely caution will probably be the last thing standing between disgusting creatures and zombie apocalypse of retail investors.

Can't thank you enough for this book (yeah, in tiktok age, this article qualifies as a book :-D)

Articulate....Engaging.....Engrossing.....

Need more of your kind...

Keep up the tempo...