In 2005 Nobel Laureate, the late Paul Samuelson said, “ The creation of the first index fund by John Bogle was the equivalent of the invention of the wheel, the alphabet, wine and cheese”. The index fund he was referring to was the index fund which is weighted by the market capitalization of the companies in the index.

The higher the market cap of a stock, the higher the weight. For example, the S&P 500 index has stocks like Mega Caps like Apple, Microsoft followed by FB, Google, etc., Apple and Microsoft will have much higher weights than FB, Google, and so on. In India, the Nifty 50 is weighed based on the free-float market capitalization and so Reliance Industries has the largest weightage, followed by HDFC Bank, Infosys, HDFC, and ICICI.

Then some smart person decided why not give equal weightage to all stocks in the index and call it - An Equal Weighted Index and dub thee Smart Beta. The benefit, they say, is that it has an “automatic profit booking feature.“ Say it starts in Jan 2021 and gives equal weight to HDFC Bank, ICICI Bank, Yes Bank, and IndusInd Bank. Now as prices move, weights will not remain static. Come rebalancing time at the end of the quarter, and the stock which has performed the best will have a higher weightage than the one which has underperformed.

So let’s say if we had a 4 stock fund above with 25% weights and HDFC Bank out performs and its weightage goes to 30%, ICICI performs a bit better and its weightage goes to 27%, Yes Bank underperforms and drops to 22% weightage while IndusInd drops to 21%. Now, this EW fund at the time of rebalancing will sell some portion of HDFC Bank and ICICI Bank and buy more of Yes Bank and IndusInd bank to reset the weights back to 25% each. Ricardo who said, cut your losses and let your winners run, would be rolling in his grave.

Now there are second-order effects of Equal Weighting a Cap Weighted (CW) Index. As Yes Bank and IndusInd underperform, their relative valuation becomes more attractive and they also are relatively smaller than HDFC Bank and ICICI Bank now. This gives the EW fund exposure to the value factor (a portfolio of cheaper companies outperforms a portfolio of relatively expensive companies) and the size factor (a portfolio of small companies outperforms a portfolio of large companies). This makes an EW Index fund relatively more riskier and volatile than a CW Index.

However, in its infinite wisdom, this is what a leading financial daily published in their analysis of an Equal Weighted (EW) Index Fund.

“For risk-averse investors, equal weight index strategy is a suitable investment. Of course, these funds can witness higher turnover but there would be no higher impact costs given their large-cap portfolios. Investors looking for balanced diversification and anti-momentum ways to play equity index funds can consider buying units of equal weight index funds tracking Nifty 50 and Nifty 100 for their core portfolio. You get the same set of top-quality stocks that the blue chip baskets have, but with an important twist — equal weight for all.

More weight to the historical winner stocks exposes a portfolio to higher risks because stocks/sectors regularly go through rotation and when the largest market-cap stocks in a portfolio underperform, they have an outsized impact on the overall performance. In contrast, smart beta products based on equal weight indices offer an anti-momentum, forced buy-low-sell-high mode of investing that clearly comes with lower stock and sector concentration risks.”

Smaller companies have in the past given returns as much as large-cap companies with higher volatility. Value over the last ten years has seen the same. Lower returns with higher risk. And if one wants exposure to value and size, why not take it directly through a value or size factor fund. Why go through an obtuse way to get it ? Genuinely asking for myself. Not for a friend.

We look at returns for the last ten years and see that EW has underperformed significantly by 1.6% per annum annually. 10.5% p.a. for CW vs 8.9% p.a. for EW.

3 year monthly rolling metrics

However, point-to-point returns can be misleading at times, so we look at rolling returns. We look at 3 years monthly rolling returns. What stands out is in the period from 2002 leading up to 2005, EW had outperformed Cap Weighted significantly (post dot com bust when old economy value stocks rebounded).

However, post that for fifteen years EW has underperformed CW along with higher volatility. EW saw a huge spike in volatility post-2008 and has had higher volatility over CW to date. In recent times, post the pandemic, volatility and returns have spiked in EW.

Does it work globally?

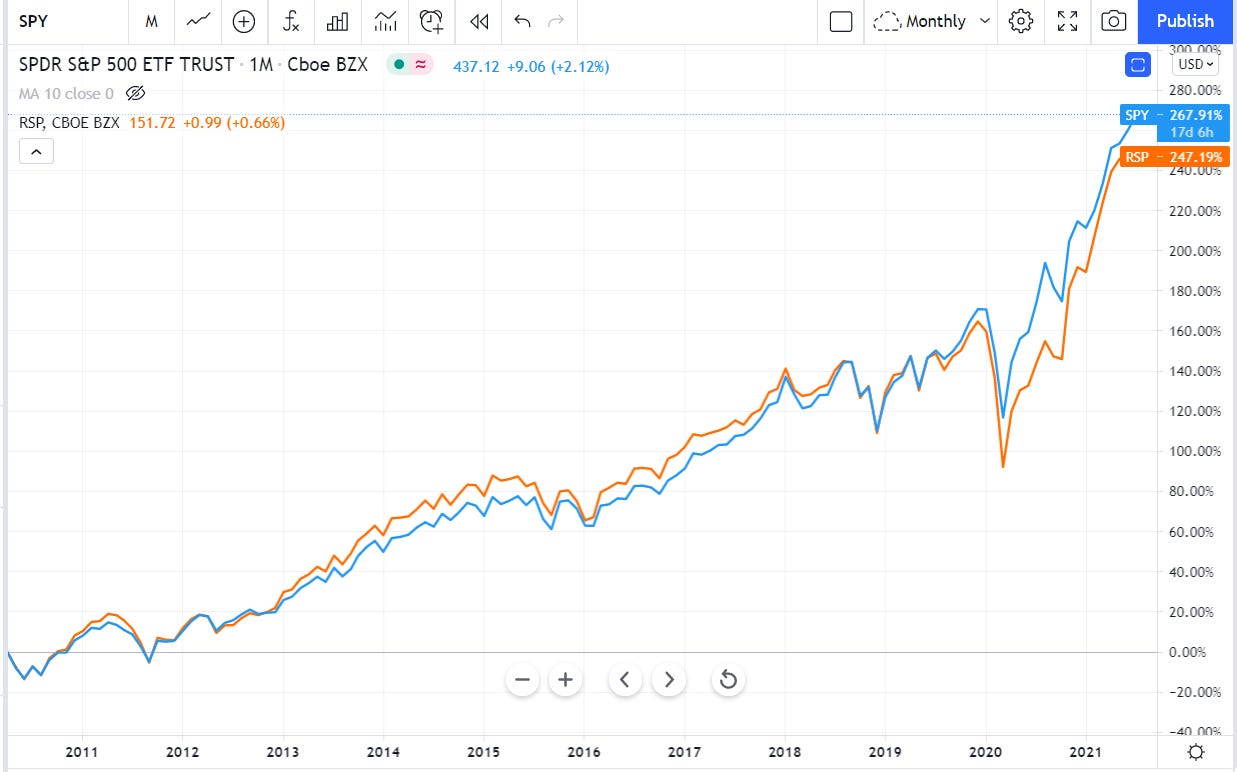

The global experience is somewhat similar. EW does provide marginal higher returns in some time periods but with higher risk i.e volatility. In the last 10 years, however, the cap-weighted S&P 500 index has done much better than the equal-weighted S&P 500.

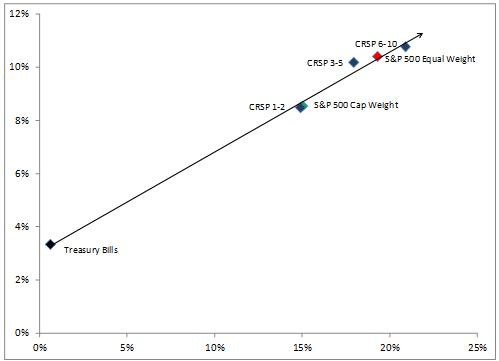

Rick Ferri writes in No Free Lunch From Equal Weight S&P 500 that in the period 1990-99, EW underperformed CW (S&P 500) as well mid cap stock indices (which were cap weighted). In the next period 2003-12, S&P 500 EW annualized return outperformed the S&P 500 CW Index but not the CW mid-cap index. The equal weight index also delivered higher risk-adjusted returns than the S&P 500 over this particular 10-year period.

As the figure above shows “Most asset classes fall very close to the CML over the long-term. The S&P 500 EWI returns fell exactly on the CML over the past 23 years. The equal-weighted index earned no more and no less than what was expected based on its risk” concludes Ferri.

The last 10 years

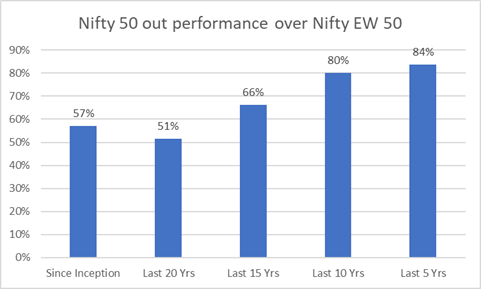

Coming back to Nifty 50, EW hasn’t exactly covered itself in glory post-2008 with 2018 being a particularly tough period. Returns for EW saw a trough in 2020, before catching up recently. Odds however, do not favor EW when it comes to choosing between EW and CW.

In fact as the table below shows, in the last 5 and 10 years, CW has outperformed EW over 80% of the time in 3 year monthly rolling periods.

Even since inception is number is 57%.

Cost Matters Hypothesis

EW funds for some reason are dubbed smart beta or factor fund and expense ratios in India for these funds range from 81 bps to 96 bps. CW funds on the other hand are available at 20-30 bps. The mind is boggled that one pays higher for more risk and lower expected returns.

So, unless one has a very strong rationale, other than being masochistic or being charitable and paying higher fees to expose the portfolio to more volatility without getting higher returns, there seems to be no logical reason to go for EW over CW. If you want a value and size tilt in the portfolio, do it directly.

Can you shed some more insight on the CML graph on risk vs the return expectations.

Please suggest a CW index fund for mid-cap and small-cap stocks. Your posts are great and have me raving about index funds. Thank you